Are we finally seeing boutique investment banks become a fixture in the world’s largest M&A deals? In July, Japanese internet and telco group SoftBank announced the $32 billion buy-out of UK microprocessor design company ARM that saw boutique banks as the main advisers on the buy side. Advising SoftBank were The Raine Group and Robey Warshaw, as well as Mizuho Securities. Lazard and Goldman Sachs advised ARM.

This year has been full of similar surprises from boutique investment banks. In February Perella Weinberg Partners was retained by Deutsche Börse to advise on the potential $28 billion merger with London Stock Exchange Group. Robey Warshaw has been advising the LSE.

Qatalyst and Allen & Company are advising LinkedIn on its acquisition by Microsoft, while Ducera Partners is advising Monsanto on its discussions of a merger with Bayer alongside Morgan Stanley. On the sale of Syngenta to ChemChina, boutique firm Dyalco was appointed adviser to Syngenta alongside JPMorgan, Goldman Sachs and UBS.

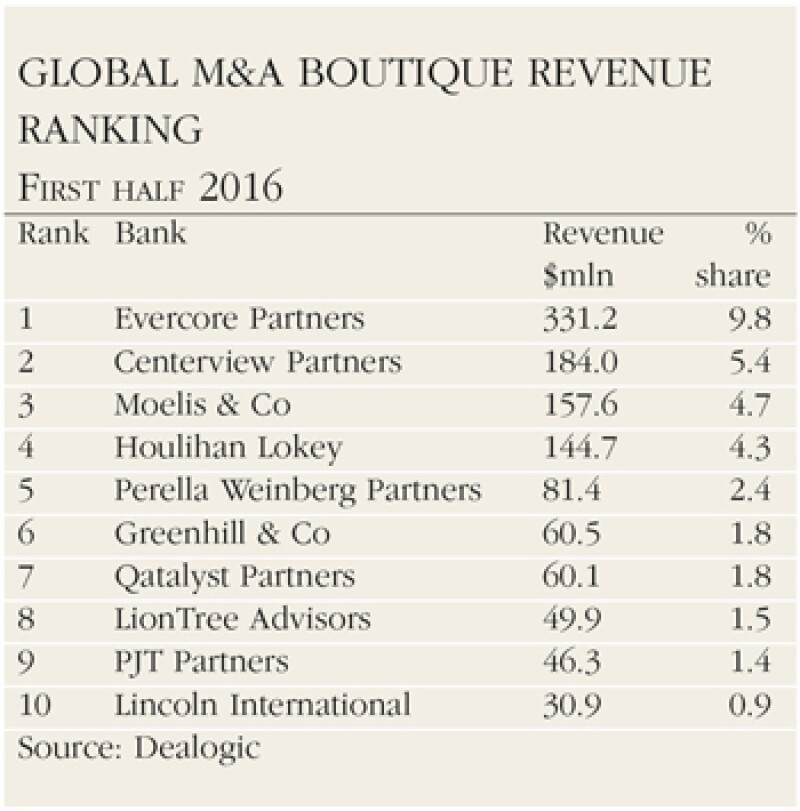

Indeed a glance at this year’s first-half league tables from Dealogic shows boutiques in the top 10 rankings in nearly every European country. Ducera, Centerview, Raine Group, Robey Warshaw, Perella Weinberg and Tyndall Group all feature in Europe. In Asia (ex Japan) Dyalco is ranked joint eighth. Moelis and Raine Group rank in the top 10 in Japan. In the US, Evercore and Centerview make it into the top 10 for M&A revenues at the end of June.

|

“These large deals that feature boutiques really just reflect how much momentum has been building over the past several years”Peter Nesvold, |

Peter Nesvold, managing director at investment bank Silver Lane Advisors, says the recent proliferation of boutique firms on larger deals is simply a development of a trend that began around the time of the financial crisis: “When some of the large institutions were breaking up or forced to change, we saw the rebirth of the boutique investment bank. The brain drain of talent leaving the large investment banks for boutiques was a trickle at first, but clearly it’s snowballed. These large deals that feature boutiques really just reflect how much momentum has been building over the past several years.”

Some of the talent that left started out on its own. Robey Warshaw was founded in 2013 by bankers from Morgan Stanley and UBS. Dyalco was set up last year by Gordon Dyal – the former head of Goldman’s mergers business and a former co-chairman of the firm’s investment bank.

In Singapore, boutique Rippledot Capital was set up by former head of Macquarie’s TMET group in Asia, Atin Kukreja. It was adviser to the private equity shareholders of Singapore engineering firm Interplex on its $461 million sale to Baring Private Equity in March and on Kirin’s $560 million takeover of Myanmar Brewery last August.

Just how much of a threat the boutiques are to the large investment banks is debatable. But Nesvold points out what has happened to the shared fee pool must be making some nervous. In the US, data from Dealogic shows boutique investment banks took 17% of US M&A revenue in the first half of 2016.

“M&A is the rocket fuel for investment banking earnings: it’s the least capital-intensive business in the industry and high margin revenue,” says Nesvold. “And because the value-add is rooted in a firm’s intellectual capital instead of its balance sheet, many boutiques can rightly argue that their offerings are as good as those from the bulge bracket.”

The brain drain is also a valid concern. Paul Webster is managing director and head of recruitment firm Page Executive in North America. He says the boutique banks are growing in popularity among candidates.

There are several factors at work. Since the crisis the appetite to enter large global investment banks has decreased. Younger candidates in particular prefer the idea of becoming more involved in deals earlier on – an opportunity more likely afforded by the boutiques.

Webster also points out that the talent drain is partly due to the salary increases witnessed at boutiques: “Historically the best-paid people were always at the large investment banks – but these days they are not. We are regularly meeting those at the managing-director level at boutique advisory firms that are earning in the seven-figure plus range now. That’s new.”

That is not surprising given the size of the fee pools involved. On the SoftBank/ARM deal Lazard, Raine Group and Robey Warshaw could end up walking away with between $15 million and $25 million each.

Nesvold also points out that job security may be better at a boutique. While the share price of boutique firms crashed directly after Britain’s exit from the EU was announced because of expectations that M&A activity would halt, Nesvold says that boutiques are less likely than large banks to cut heads.

“The earnings of boutiques are usually more highly geared to the M&A cycle, which carries some risk,” he says. “But boutiques are generally more likely to just pay people down in the event of a downturn, rather than gutting the department like many bigger organizations have done in the past. I believe that reflects the tighter culture of many boutique firms.”