Partner content

From Vision to Ambition: Evolving ESG Strategies in GCC banking

Sponsored by Mashreq Bank

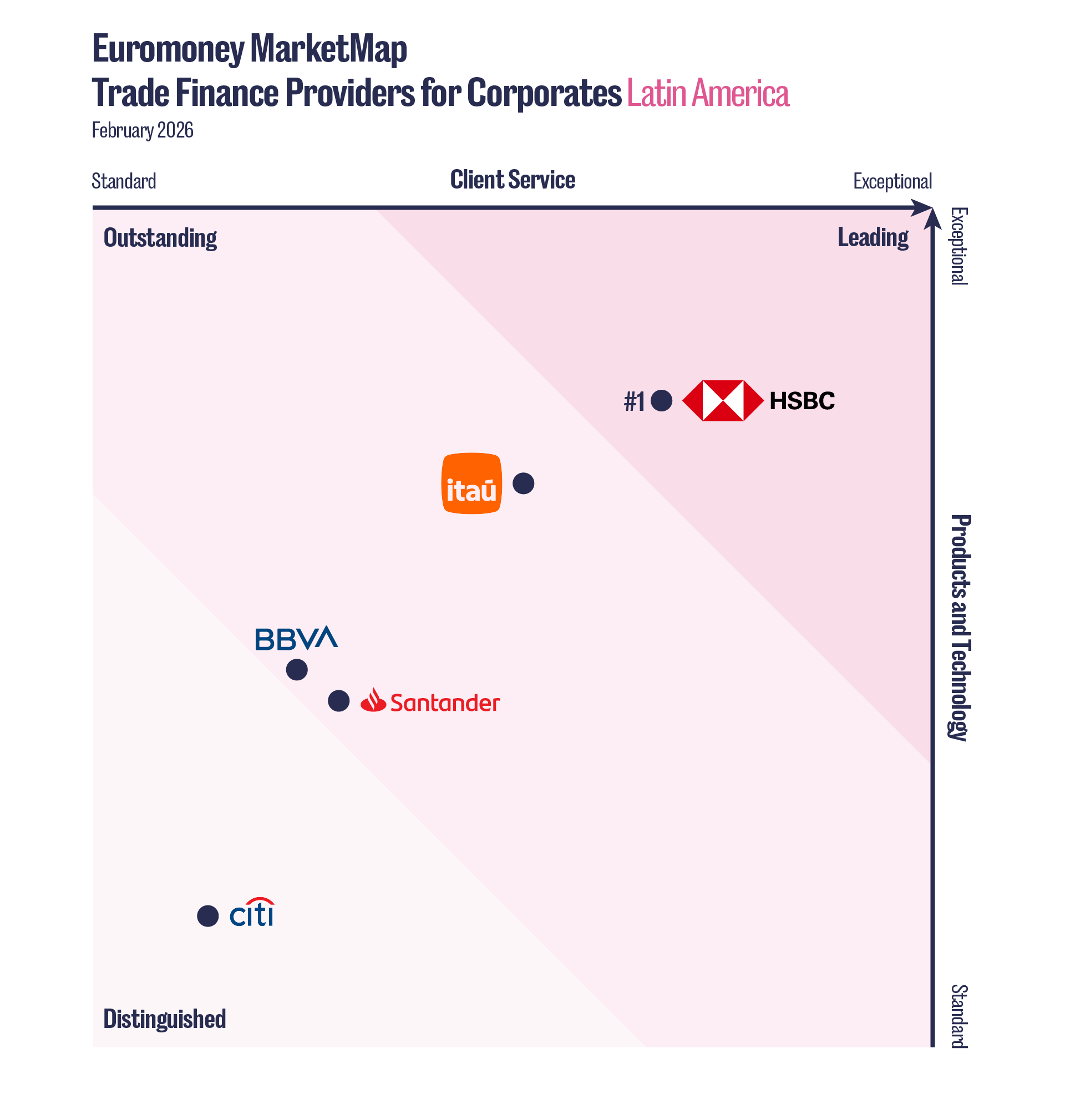

#1 trade finance provider for Latin American corporates in 2026: HSBC

Sponsored by HSBC

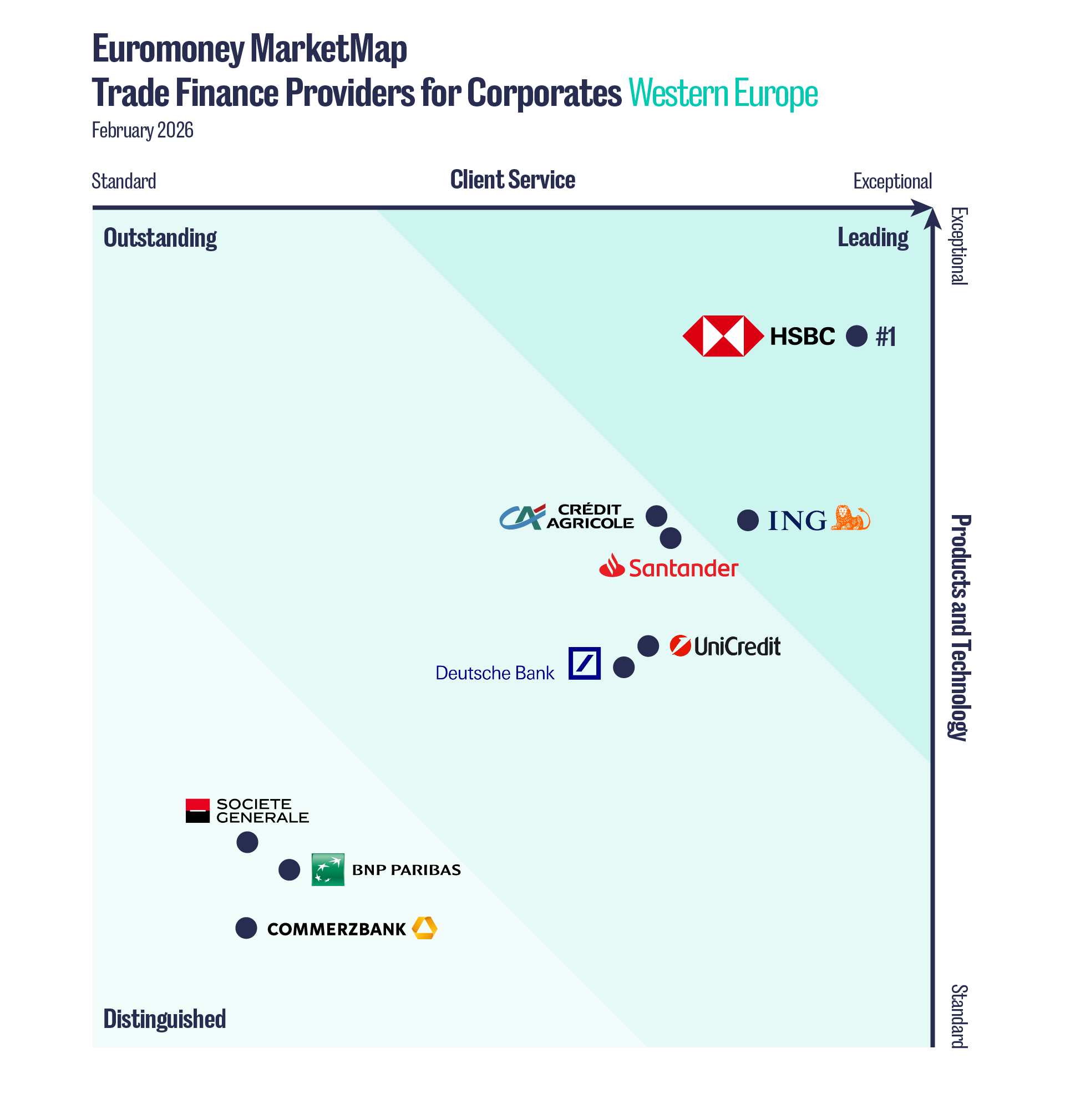

#1 trade finance provider for Western European corporates in 2026: HSBC

Sponsored by HSBC

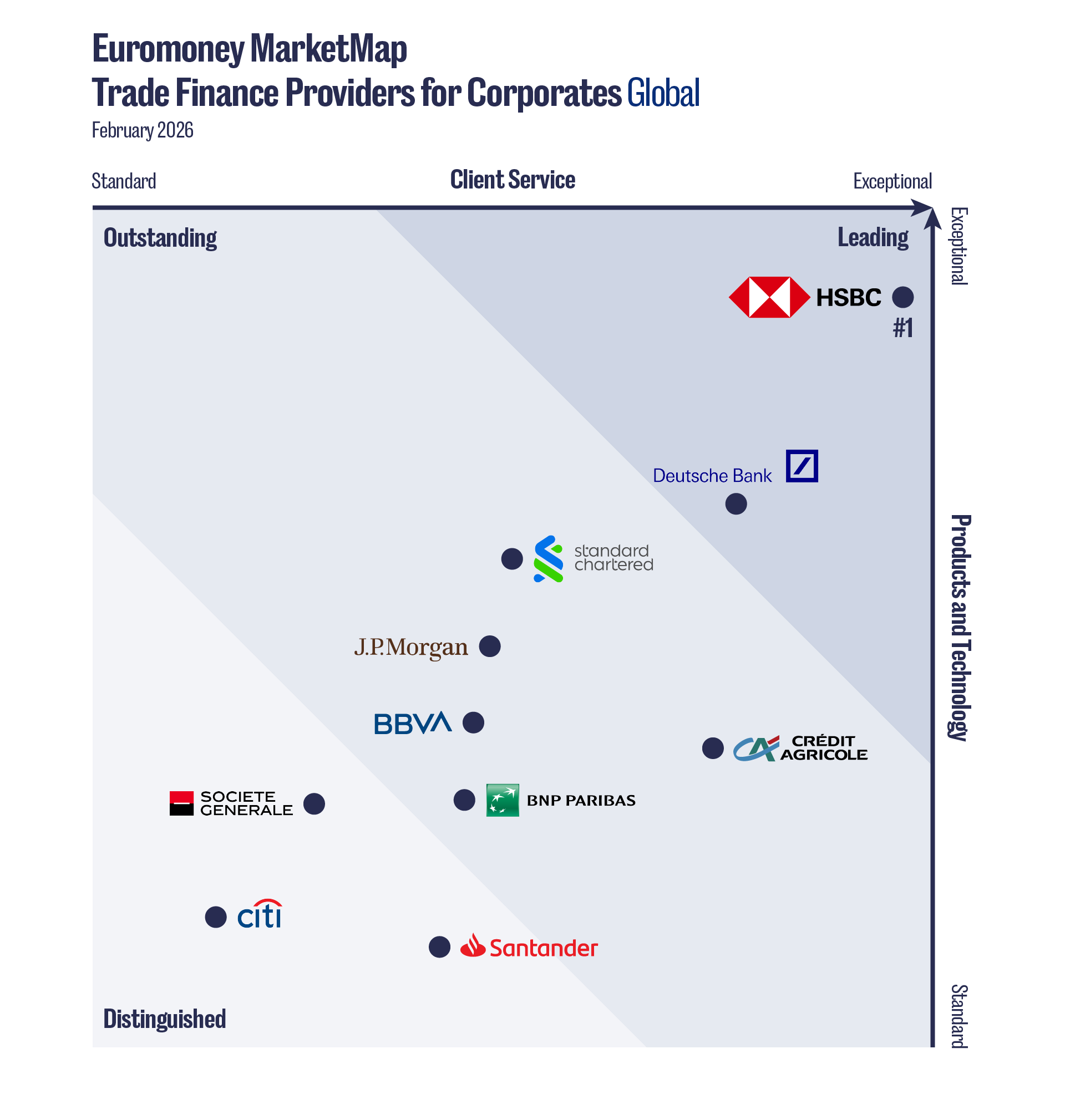

#1 trade finance provider for corporates globally in 2026: HSBC

Sponsored by HSBC

Tailor-made banking from high school to retirement

Sponsored by CaixaBank

Bank-backed stablecoins: a new chapter for payments in Europe?

Sponsored by CaixaBank

2026 Economic Outlook: Impact on Treasury

Sponsored by HSBC

How to capture opportunities in the fast-evolving payments landscape

Sponsored by DBS

Mongolia’s Khan Bank sets the pace for local green finance

Sponsored by Khan Bank

CTBC Bank: at the heart of Taiwan’s green and digital future

Sponsored by CTBC

Banreservas: Building bridges across borders

Sponsored by

AI Era: Designing the future of wealth management with customer alliance

Sponsored by Mirae Asset Securities

Bolstering SME finance amid interest rate headwinds

Sponsored by CIB