The launch of New Development Bank (NDB) cemented a sense that the new centre of gravity among multilateral lenders is Asia and, more specifically, China.

The formal beginning of operations at NDB in its Shanghai headquarters came just a month after the same landmark at the Asian Infrastructure Investment Bank (AIIB), which opened its doors in Beijing in January 2016. AIIB has got going rather faster: while NDB has five members, AIIB has 93.

But in truth the total lending to date by the two institutions is similar. NDB has $8.4 billion of approved loans to AIIB’s $7.5 billion, although AIIB’s spread is bigger. Its 35 projects to date are in 13 countries, ranging from power distribution in Bangladesh and slum upgrades in Indonesia to road improvements in Tajikistan and maritime infrastructure in Oman.

AIIB plans to invest between $3.5 billion and $4.5 billion in 2019, in 15 to 20 projects, according to the bank’s 2019 business plan and budget summary, released in December. Again, that is a similar ambition to NDB.

AIIB and NDB are new players in a field that for almost half a century was the preserve of Asia’s original multilateral, the Asian Development Bank (ADB), conceived at a 1963 UN conference and formally launched with a mandate to alleviate poverty and help with rural development in 1966, a time when Asia was still largely agricultural.

The ADB remains far larger than the new China-based upstarts. In 2017 its total commitments – which means loans, grants and investments – were $20.1 billion, well up from $13.3 billion the previous year, and well over double the amount NDB and AIIB between them expect to lend this year. Co-financing adds another $11.9 billion to the ADB figure.

Euromoney’s April 2017 edition included detailed interviews with AIIB’s chairman and president, Jin Liqun, and the ADB’s president, Takehiko Nakao. And it is relatively easy to summarize the differences between the old guard and the new.

For a start, the ADB’s mandate is in large part about poverty alleviation. The two newer institutions are purely about infrastructure development (also part of the ADB’s role), although they argue that this infrastructure is itself a tool of poverty reduction.

Both China-based institutions aim to be far faster than the ADB. The Manila-based ADB also wants to be more nimble, but insists that in order to conduct proper due diligence, ensure environmental safeguards and avoid corruption, things have to be done properly.

For all their speed, both the NDB and AIIB insist that environmental and governance concerns are paramount, and point out that the language of sustainability is written into their articles of association; when the ADB was launched, those terms didn’t exist.

Voting powers

Jin at AIIB is at pains to point out that the institution is not simply a bank for the Belt and Road Initiative, that it is not state-directed by China and indeed that China does not run the thing. China has current voting rights worth 26.78% of the total – enough to effect a veto today, since many big AIIB decisions require a 75% vote to go ahead – but plans to dilute itself to around 20% with expansion of the membership. This contrasts with, for example, the World Bank, where a US veto is protected in the articles of agreement.

It also contrasts somewhat with the ADB, where Japan, the largest shareholder, has provided every president since the institution’s foundation and where China’s representation is just 6.4%, which seems low given its modern influence in Asia and the world.

Nakao addressed this in our interview: “I think India and China want to have greater voting powers, or shares, but unless we increase capital, there is no opportunity to do that.”

We haven’t seen a major breakthrough in private-sector mobilization as yet – Jang Ping Thia, AIIB

China did gain more sway in the World Bank following a capital increase last year, but it is perhaps the inability of China to gain representation at the elder statesmen of multilateral funding that has led to the appearance of the AIIB and NDB.

What all institutions do agree on, however, is the need to get private-sector investment into infrastructure. In February 2017, the ADB published a study called ‘Meeting Asia’s infrastructure needs’, a document both daunting and ambitious and just a little apocalyptic.

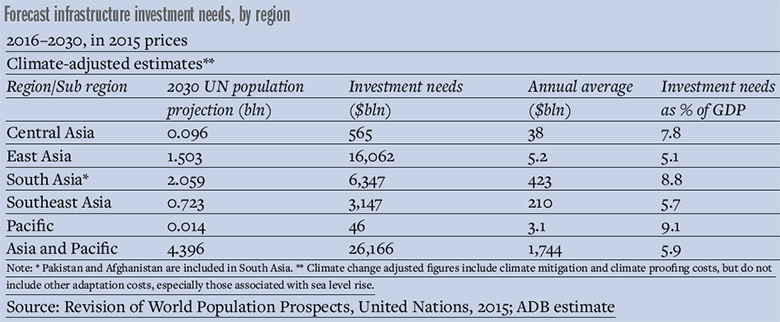

The study concluded that developing Asia would need to invest $26 trillion in the 15 years from 2016 to 2030, or $1.7 trillion a year, a more than doubling of the previous annual estimate in the ADB’s 2009 study. The principal reason for the increase was the inclusion of costs on climate mitigation and adaptation, but even if that were removed, the need would still be $1.5 trillion a year.

It concluded, as it has consistently done for decades now, that this cannot be achieved without mobilizing the private sector to make big investments in infrastructure and this is a large part of the raison d’etre of the NDB and AIIB.

The AIIB stated a strategy on mobilizing private capital for infrastructure in 2018 and followed it up with a benchmark study of its own in January this year. It was not especially positive.

“We haven’t seen a major breakthrough in private-sector mobilization as yet,” says Jang Ping Thia, the principal economist at the AIIB, who wrote the report. “In fact, some indicators are pointing towards a softening of private-sector financing for infrastructure in Asia. The reasons are not difficult to guess: macro volatility and rising interest rates.”

A heightened sense of populism and nationalism has not helped, he adds, “especially on cross-border infrastructure,” leading investors to perceive greater political risk. The cancellation of the BRI projects between Singapore and Malaysia, chiefly the high-speed rail link, is an example.

It is dispiriting to learn that the trend for private-sector engagement, already wholly insufficient for the need at hand, is going in the wrong direction. So Thia used the report as “a call for financiers in the industry to really work together through this more challenging period.”

Jang Ping Thia, the principal economist at the AIIB

By this he means things like co-financing, with a multilateral doing the groundwork on project assessments and reducing political risk exposures for private-sector investors. This is nothing new and something that the ADB has been talking about for 20 years or so, but “a lot of work still needs to be done on co-financing and removing the risks,” Thia says.

That said, the ADB, which has a dedicated department for private-sector financing, the private sector operations department, does feel like it is making progress. Michael Barrow, who runs the division, says it had a record year in 2018 with 32 non-sovereign deals signed, involving $3.1 billion of ADB committed funds and $7.2 billion of co-financing. They are heavily focused on renewables and have recently included projects as diverse as solar in Mongolia, Samoa and Cambodia, and wind farms in Kazakhstan, all of them with private-sector involvement. At the time of our interview Barrow is expecting to sign the first private-sector renewable deal in Afghanistan.

Separate to that is the progress on green and climate bonds. The ADB has helped to underwrite, structure and certify issues for groups such as AC Energy, the power subsidiary of the Ayala group in the Philippines.

“There is a lot more issuance not just by banks but by corporates in Asia,” Barrow says. “It’s part of a new wave we are involved in.”

Coax

Buyers of green bonds vary. In Thailand, Barrow says, they tend to be placed locally, to Thai banks and investors. AC Energy was Singapore-listed, with large bank arrangers who placed the bonds widely in the institutional investor marketplace.

“If you look at the history of Asian infrastructure, it’s been very much a bank sponsored, bank-driven market, and still is to a large extent,” Barrow says. “But there is growing institutional appetite both for general corporate bonds and, increasingly, the dedicated project bond market.”

The ADB has found that the best way to coax private-sector money is to come in as a minority financier but with a bigger role on pulling the overall financing together.

“We have credit enhancement products to entice people into deals where they need a bit of encouragement, where we can take political risk or some longer-term risk off their books,” says Barrow.

“There is validation of having us on board. You know that the issuers have met our fairly rigorous standards and requirements, and that gives reassurance to the markets.”

Answering the issue of speed, he says that sense of validation makes the ADB’s pace worthwhile.

“We see that as an attraction, not an inconvenience. And in the private-sector part of the bank, we are used to working to private-sector timetables.”

He says that on the AC Energy deal, from initial discussions to signing took just six weeks.

Cooperation in finance is always going to be tough, for the reason that people are always motivated by profits – Jang Ping Thia

As for the New Development Bank, it also knows it cannot go it alone and that long-term success in infrastructure funding requires getting other lenders involved.

“Having put the building blocks in place, the biggest driver now is to shift away from projects with a sovereign guarantee and to get the private sector involved,” says NDB’s CFO Leslie Maasdorp.

He says that for multilaterals today about 70% of loans have a sovereign guarantee and 30% are private sector, but he expects that to shift to 50/50, with multilaterals as “hybrid institutions”.

He says crowding in private-sector capital “is going to be a big focus this year” and that some loans have already been issued without sovereign guarantees.

Clearly BRI is a vast engine for infrastructure development in the region, but as Euromoney has reported in detail, there is suspicion about the political intentions of the enterprise. Both AIIB and NDB have worked very hard to distance themselves from any sense of them being policy banks for BRI.

“AIIB is an international development institution. It’s different from the Silk Road fund, which is a Chinese fund,” Jin Liqun at AIIB told Euromoney in 2017. “It’s certainly different from China Development Bank and China Eximbank.

“So if lots of our projects are in the One Belt, One Road countries, which are our member countries, what’s wrong with that? Eventually it’s the sovereign government’s decision whether they should have a project that is defined as a One Belt, One Road programme or not.”

On the political sensitivity point, Thia argues that: “The multilateral approach is the way to allay some of these suspicions. High-quality projects, with high governance and social standards, high-quality implementation and mutual benefits, assessments on debt capacity of countries: these are all ingredients AIIB can bring to the table.”

The ADB in particular, given its scale as an issuer, has worked hard to develop local currency debt capital markets, partly (but not only) as a method of creating suitable infrastructure funding. But it is not an automatic solution. Thia points out that any current account deficit country, which is therefore by definition a capital importer, will have to borrow hard currency in the international markets.

“The fundamental solution lies in having the right framework and policy certainty to allow you to access the right mix of finances,” he says. “Local currency is good to have, but it does not solve the need of these countries that need to import capital. There is no free lunch.”

All are open to innovation to try to access private-sector funds; Thia points to the development of trust instruments to this effect, where India is an early adopter (it has to be since bank balance sheets are generally quite weak).

One other point that binds Asia’s multilaterals, old and new, is a willingness to work together. The leaders of all three institutions speak frequently and their positions on acceptable due diligence are not far apart. The bigger issue is getting private investors to work with multilaterals.

“Cooperation in finance is always going to be tough, for the reason that people are always motivated by profits,” says Thia. “Reduction of risk is all good, but the competitive nature does get in the way of sharing deals and reducing risks.”

A key moment, he says, will be “when market players start to realize they, by themselves, cannot overcome risk completely. They have a choice between walking away from the deal because they couldn’t bear the risk or sharing with someone else, like a multilateral, to get it done.

“I hope more people will come to the conclusion that sharing is a better outcome than walking away.”