The DXY index, whose futures contracts are traded on the IntercontinentalExchange, is a weighted index of six currencies comprising EUR, JPY, GBP, CAD, CHF and SEK. In 1973, when the index was created by JPMorgan, it represented 71.4% of the Federal Reserve’s broad USD index (USTWBROA), but since then it has steadily declined and now represents just 43.5%; and since 1990 has declined about 1% a year. The index has too high a weighting on European currencies and does not place enough weight on the Asian and emerging market currencies, according to Peter Redward, who prior to establishing Redward Associates last year, had been head of Emerging Markets Asia research at Barclays Capital.

With the inception of the euro, the index was rebalanced but the euro’s weighting in the DXY index of 57.6% is far greater than its share of the broad USD index of 16.36%. Indeed, European currencies make up just 23.5% of the broad USD index compared with 77.3% of the DXY and thus the index gives a biased indication of the US dollar’s strength from a global perspective.

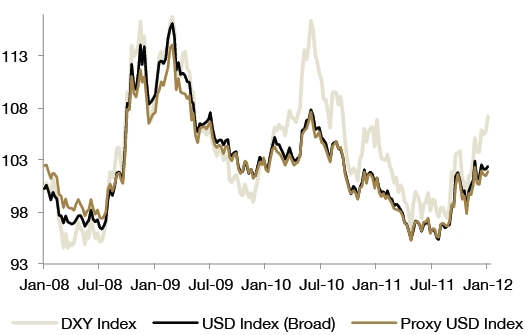

Since September 1, the DXY has risen 9.2%, while the broad USD index is up by only 6.2%.

The elevated weighting on the euro within the DXY has also introduced considerably more volatility into the perceived USD index than is the case and, particularly in the current climate, flatters the performance of the USD.

“The divergence between DXY and the broad USD index highlights the fact that current USD strength is illusory, more so reflecting EUR weakness,” says Redward.

This divergence is notable because the USTWBROA daily values are only published weekly, each Friday. As a more accurate gauge than the DXY, Redward suggests a simple five-country basket that has a higher weight on Asia, strong correlation to the broad USD index and similar levels of volatility. The index comprises CAD (19.23%), CNY (28.72%), EUR (23.78%), JPY (11.62%) and MXN (16.65%).

| DXY index overestimates US dollar strength |

|

| Source: Redward Associates |