As foreign exchange becomes a more competitive marketplace, banks are seeking to improve the cost-efficiency of their business models, investing vast amounts into the infrastructure of their e-trading operations. An important driver for the growth of e-trading in FX is the upcoming regulation, which treats e-trading as essential for meeting the tougher standards on transparency, execution and reporting.

New rules will dictate which formerly over-the-counter products must be traded on transparent exchanges and centrally cleared platforms, so mid-tier banks must decide whether to continue to use the single-dealer, scale-driven model or move towards a model offering a selective balance of products across several platforms.

For the leading flow providers, investment in e-trading will continue to play a crucial role, to drive higher volumes and make cost-efficiency savings.

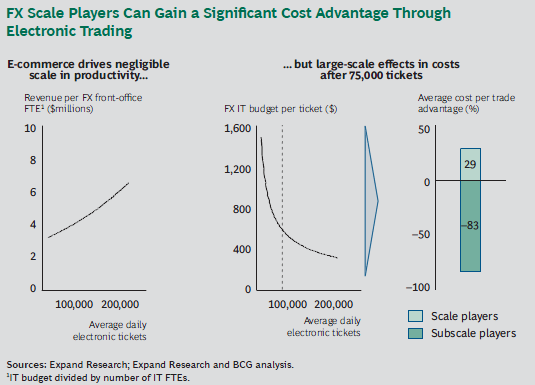

BCG estimates that scale players – the so-called “flow monsters†– can gain a cost-per-trade advantage of up to 29% over the average player.

Sub-scale players, by contrast, can expect an average cost-per-trade disadvantage of 83%, according to BCG.

The report goes on to say that while e-trading volume drives considerable scale in costs, the scale effects in terms of revenue per trade are negligible.

|

| Source: Boston Consulting Group |

The above chart of BCG’s analysis shows relatively modest improvement in productivity resulting from higher e-trading volumes. However, Paul Blank, e-trading solutions director at technology vendor Caplin Systems, says the consultancy might, in fact, be underestimating the scale in revenues achieved by the top players who have a lock-hold on the eFX market.

“For the top FX flow monsters, the sheer size of their e-trading volumes is what enables them to effectively internalize a great deal of their flow,†says Blank.

By internalizing flow, banks seek to match uncorrelated flows originating from clients, internal proprietary trading desks and market-making hedge positions. The ability to do this offers several revenue-boosting advantages to their FX businesses.

“This means that the flow they get from larger clients with tight spreads is provided back out again to smaller clients with wider spreads with minimal risk and leakage,†says Blank.

It also means less reliance on external liquidity pools, and deeper, consistent liquidity even in volatile market conditions.

“Because the biggest players see such a large portion of the flow, and are also able to consistently offer the best pricing, this attracts yet more flow, further improving their pricing ability – and hence boosting the revenue they receive from market making,†says Blank.

This leads to a virtuous circle for the biggest FX banks and, in the process, puts up barriers to entry to smaller players.

The void between the top players and everyone else might grow further as the importance of e-trading in FX grows.

“For the biggest banks to preserve their dominant position, continued investment in the electronic business will be crucial and will represent a high percentage of both run-the-bank and change-the-bank budgets,†says BCG.

Relationship experts and smaller banks, on the other hand, are likely to invest much less in their e-business strategy, potentially even decreasing their budgets.

Unable to compete with the large-scale players on complex in-house technology, the smaller players are likely to focus on areas such as connectivity, automated risk management, and servicing their clients with white labelling solutions and multi-dealer channels.