The French bank’s monthly client survey questions a group of 90 accounts in Asia, Europe and the US, which comprises 45 real-money investors and 45 hedge funds. The results show a spectacular shift from a month ago, with 84.4% expressing a bullish bias for EM over the next two weeks, compared with just 41.8% in August, with real-money investors only marginally more bullish than hedge fund investors.

| Sentiment towards EM over 2 weeks - all investors |

|

| Source: SG Cross Asset Research |

However, there appears to be some doubt over the sustainability of the bull run in EM, with 72.2% of respondents bullish over a three-month time horizon. SocGén says that is not a normal state of affairs, as traditionally EM investors have been more bullish over the longer time period.

Again, real-money investors are marginally more bullish than hedge funds, with 75.6% expressing a bullish outlook on EM.

| Sentiment towards EM over 3 months - all investors |

|

| Source: SG Cross Asset Research |

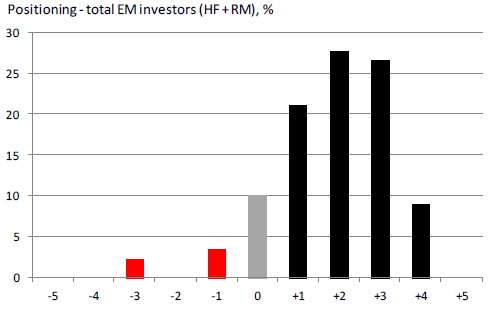

In terms of conviction level, the bank’s overall sentiment index, which can range from -5 to +5, has risen back into bullish territory over the two-week horizon, rising to 2.17 from 0.08 last month. The sentiment index stands at 1.51 for the three-month horizon.

SocGén’s EM positioning index, which again can range from -5 to +5, shows investors are running considerably more risk than a month ago. The index stands at 1.83, up from 0.65 in August, confirming the risk-on bias among investors.

| EM positioning - distribution of scores |

|

| Source: SG Cross Asset Research |

Benoit Anne, head of EM FX research at SocGén, says while the technical picture for EM has improved markedly, there are more investors that feel they are under-invested. That means, he says, their risk positions should be raised if they were to be aligned with their sentiment.

In particular, the positioning picture has turned quite positive for hedge fund investors, where 51.1% are now perceived to be under-invested, against 26.7% being over-invested.

“On this basis, one could argue there is potentially a positive driver for EM if, indeed, hedge funds investors are going to upgrade their risk positions in the period ahead, assuming they were going to align their positioning with their views,” says Anne.