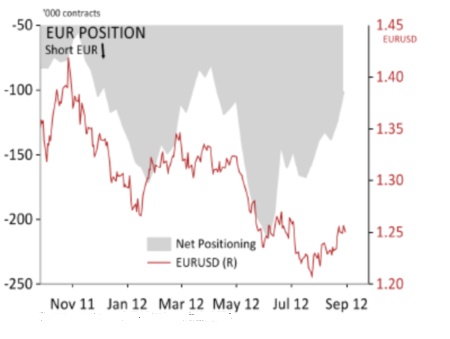

The latest Commitment of Traders report, issued by the Commodity Futures and Trading Commission, shows the value of the net short EUR position was cut by $3.4 billion to $16 billion in the week to August 28.

| IMM data shows speculative EUR shorts narrowing |

|

| Source: Scotiabank, CFTC |

Marc Chandler, head of FX strategy at Brown Brothers Harriman, says the reduction in short EUR positioning reflects hopes that the European Central Bank (ECB) policy meeting on Thursday could yield news on long-awaited plans from the central bank to begin a peripheral bond-buying programme in the eurozone in an effort to cap Spanish and Portuguese bond yields.

Meanwhile, some believe speculative short positions in USD are expected to grow as the FX market awaits US Fed plans to release more dollars through a further round of quantitative easing.

| Specs short USD for first time since Sept. 2011 |

|

| Source: Scotiabank, CFTC |

“It’s quite possible the speculative herd is right about a change of trend in EURUSD, but if the ECB fails to deliver next week, the preponderance of data suggests that positioning will not provide much of a speed bump to a hard reversal to the downside,” says Citi. Investors continue to build long exposure to CAD, pushing their long positions up to levels last seen in May. Neil Mellor, strategist at Bank of New York Mellon, says CAD could offer a safe haven against USD instability.

“Commodity currencies are getting a spillover effect from uncertainty in the EUR and the USD,” he says. “If you can see more liquidity getting thrown into the global system, it’s still going to help [reduce risk] especially in places such as Canada.”

“More than that, it’s the China view. If you wanted to play on any of the currencies, I’d buy the CAD over the AUD,” says Mellor.

According to Scotiabank, safe havens such as the AUD and JPY remain uncertain for FX speculators. The IMM data shows that the net long AUD position was scaled back last week to $8.1 billion and “remains vulnerable to further long squaring”, says the bank.

Mellor says: “Because of China, the AUD is seen as a yuan proxy. Whether that’s justified is another issue, but the fact is it has been propelled to parity and above because it benefits from China.

“The structure of growth in China is unsustainable and we’re now talking about a medium-term adjustment process. This will not help the AUD.”

The Reserve Bank of Australia is set to meet on Tuesday.