January

Jamie Dimon’s new year of contrition begins with another apology to the Chinese Communist Party. “As one chairman for life to another, I would just like to say to Xi Jinping: ‘Jeez buddy, lighten up, will you? Can’t you people take a joke?’” Dimon asks in a debate at the World Economic Forum meeting in Davos.

JPMorgan quickly issues a lengthy statement explaining that the phrase “you people” was not meant to disparage either China or its political leaders.

JPMorgan aides try to shift the narrative by pointing out that Dimon has been awarded environmental, social and governance (ESG) Holy Warrior status as head of the biggest bank to sign up to Mark Carney’s ‘Kumbaya Pledge’ for a greener future.

An article highlighting the number of private jets taking bankers to Davos undermines this effort and overshadows the main conference theme of tackling climate change.

Davos meeting founder Klaus Schwab denies that attendees are once again looking completely out of touch.

“It is only by gathering all members of what I call the Global Elite 4.0 in one place that we can have any hope of developing herd immunity against the concerns of the other 99.9%,” he says.

February

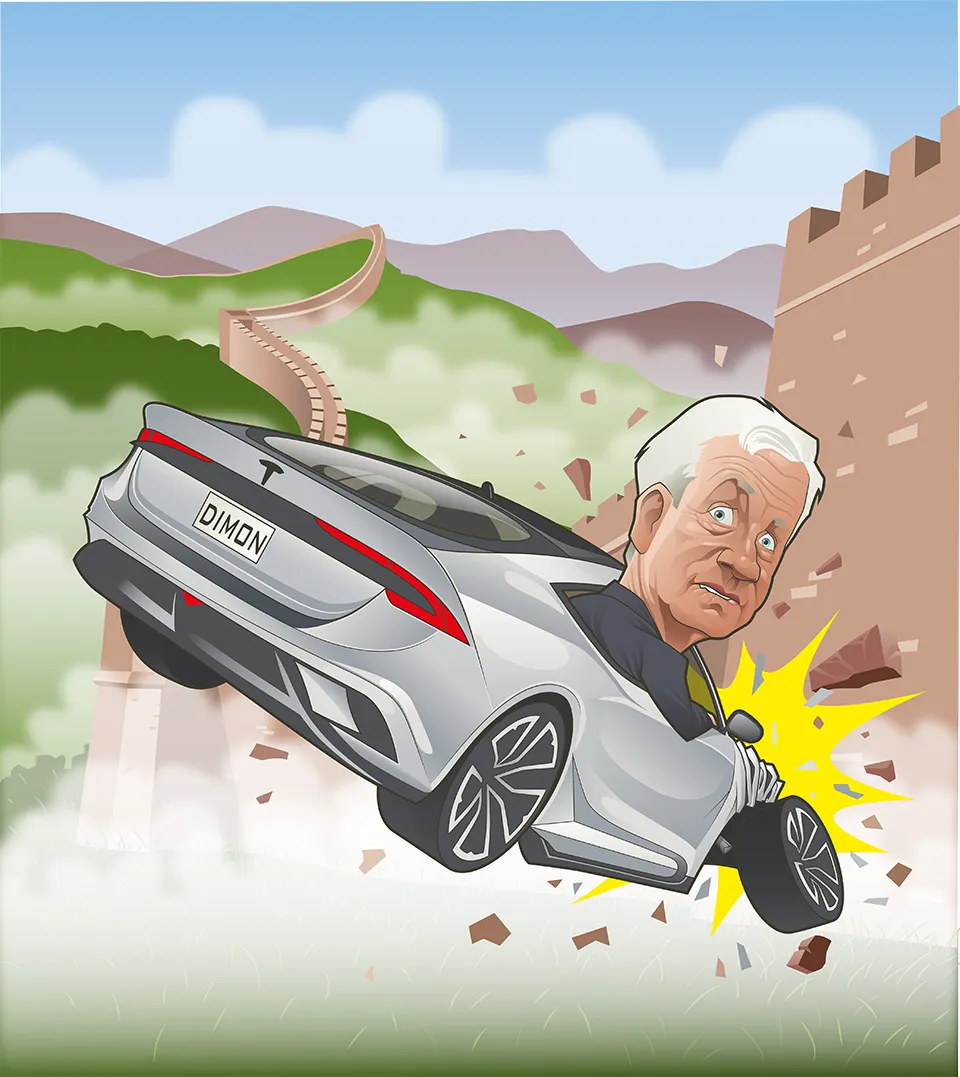

The feud between Elon Musk and Jamie Dimon intensifies as the Tesla founder mocks JPMorgan’s ‘Dimon Hands’ attempt to develop a viral marketing campaign for its online trading services.

“Time to ditch Montgomery Dimon?” Musk asks in a tweet with a link to a vintage ‘Simpsons’ episode.

Dimon returns to New York to find that a push on Reddit’s r/wallstreetbets forum for short sales of JPMorgan shares to fund Tesla call option purchases has developed momentum.

JPMorgan announces that it is abandoning a legal attempt to force Tesla to pay $162 million on an old options contract in the wake of a 20% fall in the bank’s stock price that erases $100 billion of shareholder value.

March

Goldman Sachs head David Solomon is rebuffed after pitching for Tesla business with a link to one of his DJ D-Sol ‘Work From The Office Weekend’ events for bank staff.

“We had a blast @100hoursindaoffice,” Solomon says in an Instagram post offering Goldman’s junior analysts the chance to take their annual bonuses in the form of financing for Tesla vehicle purchases.

Musk seems unimpressed, tweeting: “Have directed our Master of Coin to send all Tesla business to Bank of America. Never met anyone from there and don’t want to, but they sound like a bank. From America.”

Bank of America briefly overtakes JPMorgan as the biggest US bank by market capitalization.

April

JPMorgan regains its top spot among US banks by market value after announcing exceptional first quarter results.

“Our equity derivatives traders hit it out of the park during all that China BS and the Tesla options agita,” Jamie Dimon tells analysts on the bank’s earning call. “I personally think JPMorgan is worth more than all the other Wall Street banks put together, but what do I know? You want me to keep my big mouth shut just say the word and you’ll be stuck listening to our CFO ‘Dictionary Boy’ Jeremy Barnum on these calls. Read out the disclaimer Jeremy.”

JPMorgan discloses in a regulatory filing that Dimon was granted special retention share awards during the first quarter stock slump that are now worth over $100 million.

Communications staff at the bank provide background briefings that this arbitrage demonstrates that “Jamie has still got it,” and confirm that he will remain chief executive and chairman at least until his 70th birthday and possibly longer.

May

Bridgewater founder Ray Dalio releases a new 600-page online book and 62-part podcast entitled ‘Lessons from the Glorious February Winter Olympics in China’.

Dalio hails the contribution of Paramount Leader Xi Jinping to the success of the event. “At one point viewing figures for the Olympics were up to 10% of the total for the Super Bowl in the same week and close to 1% of the number for the last soccer World Cup final,” Dalio says.

“As a student of history this reminds me of the upset victory by the Carthaginian Elephants over the Napoleonic Globetrotters at the battle of Waterloo Bridge in 1066,” Dalio continues.

“The real lesson here is that investing opportunities in China should outweigh any other concerns for fund managers or indeed normal people. We must all heed the words of the old Chinese proverb: ‘Only through servility can we achieve prosperity.’ That for me says everything you need to know.”

June

Colm Kelleher announces a change of direction for UBS after taking over as chairman from Axel Weber.

“I think we are in danger of losing touch with some of the key investment banking values that helped UBS to perform so strongly during the biggest financial crises of the last half century,” says Kelleher.

“I’ll be handling key client engagement initiatives myself – including all lunches and major sporting events – and I’ve decided to give Rob ‘Killer’ Karofsky an expanded prop trading mandate and make him co-CEO alongside Ralph Hamers,” Kelleher adds.

“Ralph can still be head of IT support or digital future building if he insists and those two wealth management guys can carry on doing whatever it is that they do, but we need to get back to the basics of banking – like taking a private jet for a one hour visit to the client furthest away from your own office.”

July

SoftBank founder Masayoshi Son makes a surprise appearance at a groundbreaking ceremony for the new Saudi Arabian smart city Neom.

“At a cost of just $1 trillion, Neom represents the onset of the all-capitals 1,000-year urban singularity,” says Son. “On behalf of the many people who have taken money from the Saudis, I would like to thank Crown Prince MBS for his farsighted approach to investing – not just in my own Vision Fund but also in happiness for everyone. There is no doubt in my mind that Neom represents the future of urban living – it is literally on fire!”

Satellite images indicating that a Saudi Aramco pipeline near the new smart city is burning are briefly available online, before Google Maps parent Alphabet announces that a hacking-related error has been corrected.

August

Green bond issuance for 2022 surpasses the $1 trillion total seen in 2021, with analysts predicting growth to $5 trillion by 2023.

Mark Carney gives special Kumbaya Project awards to the three biggest green bond issuers of the year: Aramco, Exxon and Shell.

“We have finally achieved the virtuous ESG circle in financing markets that was required to save the planet,” says Carney. “All the major asset managers and banks in the world have adopted my Kumbaya Principles, and most issuers have been able to cut their borrowing costs by exploiting the greenium involved in rebranding their bonds as ESG-compliant. Plus, we have created an entire new industry from scratch for supplying ESG ratings to new deals of all types. It is also completely digital, with zero related emissions, because nobody actually checks anything they are told by the issuers!”

September

Barclays announces that it has hired Marianne Lake and Jennifer Piepszak from JPMorgan to co-run a new US banking division.

“We want to show the markets that Barclays America is more than just a couple of ex-Lehman traders making massive bets in Tesla options,” says Barclays chief executive Venkat ‘C S’ Venkatakrishnan.

“I know Marianne and Jenn from our days together at JPMorgan, so it wasn’t hard to convince them that they have zero chance of actually taking over from Jamie Dimon – in fact they were on borrowed time as his heirs apparent. We’ve scooped up HSBC’s US branches and we are also offering a record-breaking credit line to the new Virgin Islands-based private equity firm launched by Jes Staley and Leon Black. What could possibly go wrong?”

October

The World Bank and IMF face controversy at their annual meeting over allegations that senior officials watered down the findings of a report on greenwashing in the financial markets. A whistleblower claims that World Bank president David Malpass and IMF head Kristalina Georgieva personally intervened to change the title of the report.

“We had headlined the report: ‘Greenwashing is rampant and has tacit approval at the highest levels’, but it went through extensive revision before publication,” a disgruntled staffer tells reporters.

“They eventually changed it to: ‘Greenwashing – nothing to see here, as you were’, which I really don’t think captures the essence of our study.”

Mark Carney tries to put the debate in context at a cocktail reception featuring drink ingredients specially flown in from the Amazon.

“The important thing is that there is an exceptional arbitrage opportunity from getting into the market now, while the greenium has been temporarily suppressed,” he tells VIP guests.

“As a former Goldman Sachs man who now works for a real estate firm, I think you will agree that my credentials for leading the green financing revolution are as impeccable as my suits.”

November

The US mid-term elections deliver a crushing defeat for the Democrats and president Biden. Former president Donald Trump confirms his intention to run for office again in 2024 and redoubles his funding efforts.

“My Spac is now up by 15,000% in the year since it was launched and I haven’t even started my very exciting Truthy TV yet. Sleepy Joe Biden has only been able to manage inflation of 15% for the entire US economy, which is pathetic,” Trump tells supporters at his Mar-a-Lago Seaworld Underwater Fun Ride (the former Mar-a-Lago resort and hotel.)

Trump’s son-in-law, Jared Kushner, announces that he has secured $10 billion in financing from Saudi Arabia’s Public Investment Fund for his new hedge fund.

“It took me a while to talk Crown Prince MBS round – maybe because I accidentally put my phone on mute – but he now agrees that this investment is a fantastic hedge, whatever that means,” says Kushner.

December

The football World Cup in Qatar provides welcome sporting relief after another volatile year. It is also the scene for a historic reconciliation, as Jamie Dimon and Elon Musk meet at a fully air-conditioned open-topped stadium to announce an end to their feud and the launch of a new business venture in partnership with the former Facebook.

“Tesla is thrilled to be a sponsor of Meta’s new Extraterrestrial Super League of soccer ball teams that will play each other via avatars every week in an endless season,” says Musk.

“JPMorgan is pleased to be providing the financing for this exciting project, which has been structured to avoid all that whining we heard from fans when we funded the European Super League,” adds Dimon.

“Whether you support Beijing United or Saudi Arabia’s very own Newcastle Rovers, there is something in this for everyone. There better be, because I can tell you I’ve really had it with all this contrition.”