HOW COVID-19 WILL TRANSFORM THE FINANCIAL MARKETS |

| How does banking come back from this? |

| Loans: Crunch time for credit |

| Private equity bets on post-Covid survivors with hybrid capital |

| A stitch in time: can corporates follow bank resilience playbook? |

| Wealth managers find out who is with them |

| Life through a lens: bankers can do deals online, but can they win clients? |

| Home offices get a tech upgrade |

|

ALSO IN THIS STORY

|

As many countries start to reopen after lengthy Covid-19 lockdowns, the fear of bankruptcies and corporate restructuring leading to prolonged unemployment haunts the global economy.

Many of the consumers who have clung on to their jobs have had their hours reduced and their pay cut or deferred. Social distancing continues. That may be good for makers of face masks. It remains to be seen how happy people will be to return to shops, restaurants, hotels, airlines, mass transit and other businesses, even hospitals.

It could be many more years until economies return to the point they were at on February 28, 2020.

Sifting the likely corporate survivors from the doomed has only just begun and will intensify after second-quarter results. Travel companies face a particularly worrying time.

However, in late April, Expedia Group announced that it had privately placed $1.2 billion of perpetual preferred stock with Apollo Global Management and Silver Lake Partners in a deal that closed in May and saw the two investors take board seats.

The preferred stock pays an annual dividend of 9.5% for the first five years, rising after that, and so giving the issuer an incentive to redeem. Very early redemption, however, would require Expedia to pay a modest premium, starting at 105% after year one and declining from there to par after year five.

This is not quite the famous 20% internal rate of return private equity funds target when buying companies outright. But it is juicy enough if the company comes through the downturn and prospers; and it carries equity upside.

|

|

|

Sean Quinn, |

“Private equity fund managers have had a lot of proposals coming across their desks, and there is a hurdle rate they need to see to make it worth their time engaging,” says Sean Quinn, chief financial officer of mass customization business Cimpress, which was negotiating a separate deal with Apollo at the same time as Expedia.

And convertible preferred is not pure equity risk. The preferred stock ranks senior to common equity in dividend rights, and dividends may accrue. It also comes with the kicker of warrants attached to buy up to 6% of the company’s common equity.

At the same time, Expedia announced the sale through a private placement of a $2 billion five-year bond paying a 6.25% coupon and a $750 million five-year bond paying 7%, but which can be called from 2022. Apollo bought bonds as well.

Apollo, the private equity firm renowned for the capacity of its hybrid value distressed debt and credit funds to offer structured capital deals, had not previously invested in Expedia equity. Yet it knew the company well.

“We have a long history in the hospitality industry and, more recently, have been spending time in the online travel space, including building a relationship with the Expedia management team,” Reed Rayman, partner in private equity at Apollo Global Management, tells Euromoney.

We have moved into a time when cash is king, and many companies have tested the capacity of their debt facilities, like consumers maxing out their credit cards – Ashar Qureshi, Fried, Frank, Harris, Shriver & Jacobson

This is the way investment bankers traditionally talk. And Apollo has acted as a deal structurer and underwriter as well as principal investor.

Expedia had pressing liquidity needs. Although it had drawn down on its revolving credit facilities in March, it needed to refund hundreds of millions of dollars to customers who were cancelling bookings. New revenues coming in had collapsed. The company sought to negotiate amendments to its bank loan agreements, including a suspension of its maximum leverage ratio and elimination of the covenant setting a minimum ebitda-to-interest coverage ratio.

|

|

|

Reed Rayman, |

“Expedia needed to put a plan together in just two or three weeks,” says Rayman. “There was a window to go out to the capital markets; as part of this, Expedia sought capital from a credible partner with deep industry knowledge that might validate its financial outlook and could also move quickly.

“The whole package, including negotiations with bank lenders, had to work together; banks want to see a sufficient runway of liquidity for the company. We worked with Silver Lake, who took half of the preferred deal and served as anchor investors in the bond deal as well.”

Capital access

For the many other companies seeking injections of capital to bolster their balance sheets, ensure sufficient liquidity and reassure senior secured lenders – while some try to pay down debt and many more seek covenant waivers from their banks – the ranks of potential providers of new capital have thinned.

The primary high-yield market closed for several weeks in March and early April and, even with the Federal Reserve as the marginal buyer, no one knows how long it will remain open when the number of bankruptcies starts to climb.

The term loan B market remains shut at the time of writing in mid May. The public equity market has been open for common stock and convertible bonds, but remains tough to access on other than emergency terms.

In the UK, for example, there was a relaxation in April of pre-emptive rights that previously restricted quick equity placements to new investors to 10% of a company’s equity base.

Companies were allowed to issue up to 20% from April, and a string of new deals followed as stock markets recovered from their lows thanks to government and central bank support.

|

|

|

John Satory, Fried, |

“The bulk of these were smaller deals, with three or four larger ones as well, among companies fearing that debt might not be available to them and reasoning they should issue new equity when they could,” says John Satory, partner at law firm Fried, Frank, Harris, Shriver & Jacobson.

“But there has been a bit of a backlash, and boards may be cautious now about being seen to rush to the equity markets too soon and issue on terms that favour opportunistic new investors and not long-term holders. Selling equity to these investors is almost a last resort.”

Long-term shareholders hanging onto stock amid dividend cuts don’t want to be diluted and have new owners average in at much lower prices for new shares. Seeking to avoid dilution, Cimpress raised a second lien note with a 12% coupon and warrant for just under 4% of its shares instead.

“The equity capital markets have remained open for those that need capital, whether that need is urgent for liquidity or, in our situation, to create desired flexibility,” says Quinn. “For us, limiting dilution was very much in focus given the sharp move down in share prices, especially in those weeks of heightened uncertainty.”

In the panic to conserve cash in March and April, many companies immediately drew down their bank revolving credit facilities in full. That has consequences. Heightened leverage can breach financial maintenance covenants, raise the price of and restrict access to additional longer-term debt and bring the risk of ratings downgrades.

“We have moved into a time when cash is king and many companies have tested the capacity of their debt facilities, like consumers maxing out their credit cards,” says Ashar Qureshi, partner and head of EMEA global transactions at Fried, Frank, Harris, Shriver & Jacobson.

“Because banks came into this crisis in stronger shape than in 2008 and 2009, they can be more supportive,” Qureshi continues. “But they also had been able to hold the line on covenants more than is widely recognized. Over the next three to six months many of these companies will have to rebalance their capital structures.”

There are many hundreds of private equity funds together sitting on enormous amounts of dry powder. Of those, just two or three dozen are capable of doing exhaustive due diligence at speed without being distracted by the alarming volatility in pubic equity and debt markets – Anon

And CFOs face another challenge in attempting to raise new capital at the same time as negotiating with existing bank lenders while their earnings collapse.

Public capital markets transactions require plenty of disclosure. Equity deals, even accelerated book builds, can take several days to complete and require regulatory oversight of disclosures that must be based on audited historical financials.

Anything before March has become almost irrelevant. Investors now need to review and model companies’ forecasts for downturns of varying severity and duration.

If it becomes known that the success or failure of a new issue of equity or long-term debt is essential to a renegotiation with senior lenders, a company is exposed.

Those investors being asked for new capital – themselves struggling to price new commitments amid extraordinary volatility in secondary markets – have the whip hand on terms. Failure to complete a deal can trigger calamity.

“What all of that spells,” the chief financial officer of one US company tells Euromoney, “is that you go to the private markets for capital.”

Private capital deals can be negotiated in confidence with a single provider and then announced, with some fanfare, to other investors as evidence of faith in a company’s prospects, once capital has already been secured.

Banks may insist on capital raising as a condition of granting covenant waivers. Even if they don’t, they are mightily relieved if investors commit new funds below them in the capital structure and so may shift their attention away and onto more troubled borrowers.

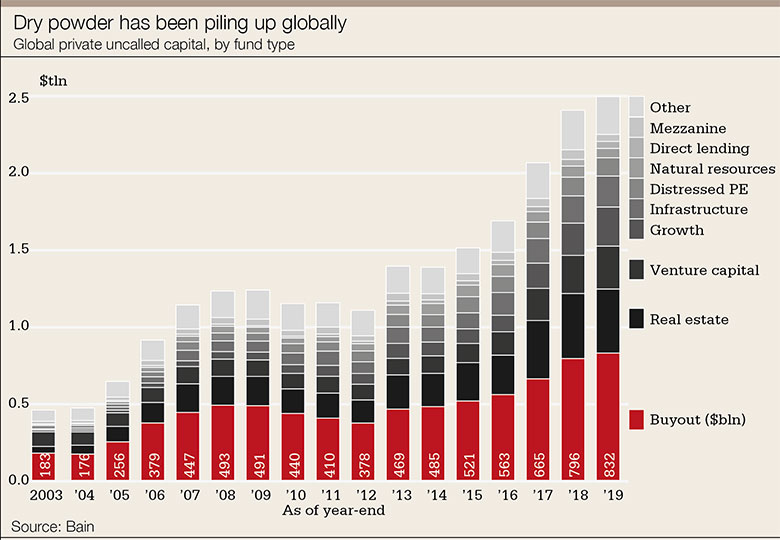

“There are many hundreds of private equity funds together sitting on enormous amounts of dry powder,” says a source at a leading consultancy. “Of those, just two or three dozen are capable of doing exhaustive due diligence at speed without being distracted by the alarming volatility in pubic equity and debt markets, evaluating the medium-term potential of a company beyond the prevailing economic disarray while also having the sophistication to structure custom-made and appropriately balanced transactions.”

|

|

|

Jake Elmhirst, UBS |

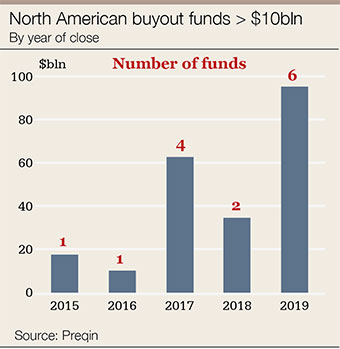

Jake Elmhirst, head of private market strategies at UBS Global Wealth Management, who manages limited partnership commitments to private equity funds, points out that when the Covid-19 pandemic emerged, we were already late in the credit cycle.

“As the cycle has matured, we start to hear general partners say there are many companies they would like to own, just not at today’s prices,” notes Elmhirst.

“Some have gone a step further and raised longer-term funds that target a lower-return/lower-risk profile of investment. Others have raised funds with a more flexible investment mandate, such as the ability to buy minority stakes or take structural protection, for example investing in preferred securities. These funds have been increasingly active.”

By mid May there had already been a string of large deals, such as that for Expedia, in which private equity firms have injected hybrid capital into public companies. Look at KKR investing $500 million in convertible preferred stock of US Foods; Clayton, Dubilier & Rice investing $250 million in perpetual convertible preferred stock of leading animal health company Covetrus; and Apollo Global Management again investing $300 million in Cimpress, a leader in printing marketing materials for small businesses.

If stock and bond prices collapse again and primary markets close once more, those deals may point the way for the months ahead.

Carve out

In May, leading beauty, cosmetics and fragrances business Coty, whose portfolio includes brands such as Marc Jacobs, Calvin Klein, Chloé, Gucci, Hugo Boss and Tiffany & Co, sold $750 million of convertible preferred shares to KKR.

Coty, which acquired P&G’s beauty business in 2016, is listed on the NYSE. Its biggest shareholder is JAB Holding Co, which manages the wealth of the German Reimann family.

Coty had already been restructuring itself in the lead up to the pandemic, while KKR had been working on a deal to buy its professional beauty and retail hair businesses. Negotiating that acquisition in the extraordinary circumstances of the pandemic led to a wider discussion on the holding company’s capital needs.

|

The new capital injection was revealed alongside the signing of a memorandum of understanding for Coty to carve out those businesses into a new division called Wella, in which KKR will take a 60% stake, with Coty retaining 40%.

The carve out should deliver cash proceeds of $3 billion to Coty. Once that deal is signed, KKR will make an incremental $250 million convertible preferred investment in addition to the initial $750 million.

Coty also announced $700 million of cost cuts. Taken together, these transactions will deleverage the company’s balance sheet.

Pierre-André Terisse, chief financial officer at Coty, said when the deal was announced: “As part of a number of steps to continue Coty’s transformation, the strategic partnership with KKR is clearly the most game-changing.”

He added that the company could now start to plan through the pandemic and that the partnership with KKR “allows us to confirm our target to reach mid-teens operating margins by FY 2023.”

In April, KKR bought $500 million of convertible preferred stock in US Foods that carries a dividend of 7% and may be converted into 9.6% of the company’s pro forma common stock outstanding.

It had previously owned the company, listed it and sold down to a complete exit.

KKR knew US Foods well. That meant it could come back in when the company needed new capital and complete due diligence quickly.

“We are pleased to see KKR return as a shareholder of US Foods as we seek to further fortify our balance sheet during the current difficult environment,” said Pietro Satriano, chairman and chief executive of US Foods when announcing the deal. “KKR will be a valuable partner for us.”

These deals protect lenders, but they are also good for shareholders. They protect them too from being asked to provide fresh equity to save the company and keep its operating assets out of the hands of the banks – Anon

Private equity firms have a lot of capital and see an opportunity to deploy big chunks of it at good risk-adjusted returns.

They are taking informed bets that while certain companies’ reported earnings will be terrible for the second quarter of 2020 and perhaps several more quarters to follow, those companies will survive and may prosper.

Their funds don’t get controlling equity – which is what private equity lives for – and all the risk that comes with that, but they do get high coupons and equity upside.

The corporate issuers are making a judgement call too.

“You have to weigh up the cost of selling equity today at a discount to where your stock is now trading, likely already at a low multiple of historically low earnings,” says one CFO. “You set that discount against the cost of a convertible preferred. Say you are paying an 8% dividend on a preferred deal with two- or three-year call protection. That 16% to 24% dividend cost is probably right in line with the discount at which you would have to price new stock today.”

But the conversion premium investors have to pay to convert into common stock will usually come in at between 16% and 24% as well and maybe even higher. Some deals have conversion premiums closer to 40% above the low levels that prevailed in the initial panic in March and April.

Moreover, the fees and expenses on a private deal tend to be far lower than on pubic equity and, even more importantly, the issuer can maintain control of the whole process.

These deals are a way to get ample liquidity in quickly and give chief executives and CFOs the chance to lift their heads up in a year’s time, see where the economy is then and maybe start to plan issuing lower cost debt to redeem preferred.

The other intangible consideration involves messaging.

“You look like you are buying yourself some insurance,” the CFO says. “You don’t look like you’re acting out of desperation. These deals protect lenders, but they are also good for shareholders. They protect them too from being asked to provide fresh equity to save the company and keep its operating assets out of the hands of the banks. These deals are very well suited to the times.”

Debt competition

It’s not just minority equity and hybrid equity capital that private equity funds are now offering to companies hard hit by the pandemic. They are also providing forms of debt. High-yield investors and private equity funds are in competition.

Satory recounts one emergency call to Fried Frank.

“We were advising on a proposed private investment in a public equity convertible preferred transaction,” he says. “The time frame was tight as the deal was to be agreed and announced in connection with the company’s quarterly results in a few days. In the small hours of the first night, we were told to stand down as the company had found a way to do a conventional bond.”

Pressure works the other way too.

|

|

|

Ashar Qureshi, |

Qureshi at Fried Frank says: “We are aware of one high-profile issuer that was structuring a very large bond offering in late April and was approached by one of the alternative asset managers, who basically just walked in one morning and said: ‘Why are you going to the bond market? We can underwrite $1.2 billion for you, take down most of that ourselves, maybe distribute a portion to a couple of other funds and have it all done by the end of this afternoon.’”

Apollo Global Management diversified its investment approach several years ago when the private equity partners began to see a lot of deal flow that was not control investments.

“The private equity partners work closely with our hybrid value colleagues on these types of non-control deals, leveraging the Apollo platform to offer strategic capital solutions for companies,” says Rayman.

“We were set up well in advance for current conditions,” he adds. “The firm had raised $3.25 billion for our Hybrid Value Fund in March 2019. And, working closely with the private equity partners, that is the fund that supplied investments to Expedia and Cimpress, two companies with quite different needs: Expedia to bolster liquidity; Cimpress to address a covenant issue.

“In both cases, we were able to bring speed, certainty and credibility, and to provide bespoke financings with features they might not otherwise have been able to get in the public capital markets.”

Bankers who work with investors and issuers on these kinds of transactions point, for example, to reduced call protection on some high-dividend preferred stock investments, for which equity warrants or conversion features provide compensation to investors. They also have payment-in-kind options for issuers. And there are other refinements.

What we have not seen much of so far is deals where sponsors acquire ownership control – Jake Elmhirst, UBS Global Wealth Management

One banker highlights the $250 million of perpetual convertible preferred stock that Clayton, Dubilier & Rice bought from animal-health company Covetrus at the end of April. The company will use proceeds to bolster its liquidity and may pay down some debt.

“The fact that the deal has no fixed principal repayment is important, not least to other lenders,” the banker tells Euromoney. “The company had about four years left on its bank loan, so selling a five-year high-yield bond would have just bunched refinancing risk. Dividends are only 7.5% and can be paid in kind. Coupons on straight debt would probably have been higher.

“And the attraction for Clayton, Dubilier & Rice is that it fully expects to convert into common equity, albeit at a premium to the share price in April, bringing it a 25% economic interest in a business it knows well, having owned it prior to listing.

“CD&R clearly believes in the company but might have struggled to acquire a 25% interest in the open market for a thinly traded stock.”

The deal even includes a restriction on CD&R’s voting rights to 19.99% of the stock, although it will have the right to appoint two nominees to the Covetrus board.

Private equity funds have been busy during the first phase of the crisis and of the reopening, although not yet in securing control equity investments for their main funds.

If the high-yield debt capital markets and equity capital markets remain fully open for the rest of the year, the pace of these structured capital deals will slacken.

Distressed debt investing will be the next big thing.

Some companies are already in the firing line. Private equity owners have been injecting equity into some portfolio companies. But the only question is how big and how widespread the coming wave of defaults will be.

“What we have not seen much of so far is deals where sponsors acquire ownership control,” says Elmhirst. “That is likely because seller and buyer expectations remain quite far apart and probably will not converge until we have a little more certainty on post-lockdown trading conditions.

“If anything, we have been seeing some general partners trying to wriggle off the hook on agreements to buy assets or to renegotiate price.

“Some general partners may also be under pressure to show returns and hand capital back to investors in older funds and may be looking to sell assets, perhaps through secondary buyouts,” adds Elmhirst. “If they have achieved 2.2 times return on invested capital on paper, they might be willing to take that down to two times return to realize investments, especially if they are about to fund raise.”

Why do sponsors need to raise funds when they are already sitting on over $2 trillion in committed capital that they have yet to invest and there is a crying need for equity to restore over-leveraged corporate balance sheets?

Elmhirst explains it in simple words even Euromoney can understand: “In private equity, if you can’t fund raise, you’re not in business.”

Cimpress’s customized solution

Cimpress is a mass customization business based in Ireland but listed on Nasdaq and is a holding company for a number of brands. These mostly engage in the creation of customized marketing materials – leaflets, printed signs, packaging and staff T-shirts – for small businesses.

The company used to be called Vistaprint, which is still its leading brand, and serves 15 million small and micro-businesses. Other brands also include Tradeprint in the UK, Easyflyer in France, Build a Sign in Texas and several more.

Many of their small business customers were hit hard by the lockdowns. Large numbers of micro-businesses mothballed themselves and the larger ones that have stayed open have cut marketing spend.

“We have one small business in China and another business in northern Italy that proved a valuable asset because it gave us an early insight into what was coming,” says CFO Sean Quinn. “I remember getting a call in late February from our business in Italy that part of the country was about to go into lockdown. And we saw end-customer demand for many products start to drop in direct correlation with lockdowns.

“In the last week of March and the first week of April, our consolidated bookings were down 65%,” he recalls. “In Italy, they were down more than that. Cimpress is a business with about $2.8 billion of revenue; at the time of maximum uncertainty, we had to start forecasting country by country for downturns of varying severity and duration.”

We wanted the flexibility to cope with various outcomes since the extent and duration of impact wasn’t known – Sean Quinn, Cimpress

In early March, it started cutting costs hard, perhaps ironically including marketing costs, mirroring its own customers. The company had drawn on its bank credit lines for certain organic investments and wanted to protect these. It did not have an urgent need for liquidity. And it did not want to dilute shareholders. With a large bank facility in place it didn’t lack liquidity, but further drawdowns would have brought pressures.

“We wanted the flexibility to cope with various outcomes since the extent and duration of impact wasn’t known,” says Quinn. “We reached out to JPMorgan, the administration agent on our bank group, a bank which we have known for a long time and which has taken a supportive approach. We were looking to suspend our covenants not just for the next couple of quarters but out to December 2021.”

Doing that required it to bring in new capital to reassure the banks. But any new capital provider also needed to know the banks would grant covenant waivers.

This is tricky stuff.

Package of measures

At the end of April, Cimpress announced a package of measures to get it through this downturn, including securing waivers on both total leverage and interest-cover-ratio covenants from its senior secured lenders until the end of next year.

It will have to pay a higher margin above Libor to its banks in return for these waivers, but it will also pay down a portion of those loans.

To do this, Cimpress announced it was raising $300 million from funds managed by Apollo Global Management in a private placement of five-year second-lien notes, paying a 12% coupon, up to 50% of which can be paid in kind.

The Apollo funds also receive warrants to buy 3.875% of Cimpress’s outstanding shares at $60 each. That represents a 17% premium to the 10-day, volume-weighted average price of the stock to April 28.

“Cimpress was clearly impacted by Covid-19,” says Reed Rayman, partner in private equity at Apollo. “Vistaprint, for example, primarily serves main-street businesses. Its customers are the local hardware store with business cards next to the cash register and the local gardening business.

“It is a great franchise and it will emerge strongly after this has passed. But it was in a delicate position and under time pressure, given the complexity of negotiations with its banks on covenant waivers, which were contingent on a partial paydown of its loans. Cimpress needed certainty on the funding for that.

“It may have had access to the high-yield market to do a conventional bond deal. But instead Cimpress chose to work with us, given our industry expertise and ability to structure a bespoke security in a tight timeframe.”

Quinn confirms that, as well as preventing dilution of shareholders and securing flexibility on covenants from its bank group, its other priorities were achieving a low cost of new capital, flexibility on the new instrument and certainty of completion at speed.

Cimpress initially approached a broad range of potential investors to get a sense of demand for various structures before narrowing down to a handful that had the greatest flexibility to invest up and down the capital structure.

At the start of this process, the high-yield markets were closed and the firm was far advanced in its strategy by the time the Fed announced in April that it would buy high-yield bonds and high-yield exchange-traded funds. The primary market magically reopened.

“If we were starting now [in mid May], we would probably look first at the high-yield market since that has been active,” says Quinn. “That wasn’t the case in early April, and as we narrowed in on terms, we were evaluating speed and certainty versus pivoting resources and the potential the high-yield market could shut again and leave us with nowhere to go.”

Cimpress did not like the potentially very substantial dilution from convertible preferreds.

It knew it would have to pay a hefty coupon on its second-lien note and provide warrants, although only for up to 3.85% of the stock.

“Apollo has other investments in our space,” says Quinn. “They took Shutterfly, which is more consumer focused than we are, private – and they know how this business works. They had done their research on us and knew where to focus.

“Flexibility was important to us. Most bonds are non-call two- or non-call three-years. This note is non-call one and can be redeemed at a 3% premium after year one and a 1% premium after year two. It’s expensive capital, but it is flexible; that made it work for both sides.”