In early March, Lyft, the San Francisco-based ride sharing company that compares its market share in the US with that of Uber, filed an S-1 registration statement with the SEC that lead to the most closely watched IPO so far this year. After a quiet start, 2019 is shaping up to be a banner year for IPOs, with Uber also set to float.

Lyft, which operates a marketplace that connects car owners and riders, earning commissions from drivers, revealed some big numbers for a company that was valued at around $15 billion after its last Series I private funding round in June 2018.

It had already raised close to $5 billion from private sources in 19 funding rounds, according to Crunchbase. Lyft’s disclosures suggest the seven-year-old business has been growing fast in the last two years.

Revenue was $343.3 million in 2016, $1.1 billion in 2017 and $2.2 billion in 2018. But the company’s net loss has been growing too, rising sharply from $682.8 million in 2016 and $688.3 million in 2017, to $911.3 million last year. Building a community requires incentivizing drivers. The company bears the cost of insurance and heavy marketing spending. At the end of March, Lyft priced its IPO at $72, raising over $2.3 billion, with investors putting a value of $24 billion on the heavily loss-making company.

The genius of Uber was spotting an opportunity to consolidate local taxi businesses, using new technology such as GPS and PayPal to draw in more part-time drivers, resisting the notion that these were employees and so undercutting fares and drawing younger and poorer riders off the night bus.

But barriers to entry are low. And if the consolidators should now start to merge among themselves (Lyft recently acquired bike sharing platform, Motivate; Uber paid $3.1 billion for Middle East rival Careem), buyers of Lyft common stock should not expect a control premium. True, their common A shares do carry one vote. But the B shares have 20 votes each, retaining power in the hands of Lyft’s founders.

Public investors may be keen to get in on the growth in enterprise value of new technology companies, which now mostly concentrate wealth creation in private hands. But that transfer will no longer constitute much of a rite of passage in corporate governance, if such dual-class share structures become normal.

And, more worryingly, more of the value will already have been extracted.

Amazon floated three years into its life as a revolutionary new internet business. In the next 20 years it and the group of tech stocks with which it is often lumped, the so-called Faangs– Facebook, Apple, Netflix and Google (now Alphabet) – delivered hundreds of billions of dollars in value to public equity investors since their IPOs.

Today, you do have tech companies that stay private for longer. They do not want to be beholden to the public markets as the only source of growth capital – Mo Assomull, Morgan Stanley

Airbnb is still private 11 years after it was founded. It has raised $4.4 billion in funding and was already valued at $30 billion in 2017 at the time of its last capital raising round, its series F, which brought in $450 million.

When Softbank Vision Fund announced the investment of $2 billion in WeWork at the start of this year, the short-term office rental company, founded in 2010, was already valued at $42 billion: that’s $10 billion more than Ford Motor company. Is this a real estate company enjoying the valuation of a tech company?

Airbnb, Palantir, Pinterest, Slack, WeWork and the big one, Uber, all might go public in 2019, making this a highlight year for listings and a proof of the enduring primacy of the public stock markets for trading ownership interests in the world’s leading companies.

That’s the theory anyway.

But last year PitchBook, the private equity analysis platform, studied 10 US tech unicorns that were already valued at $1 billion when they floated between 2009 and 2014. By May 2018, only four of them were valued higher than on their stock market debuts, with Facebook the standout winner.

There was a lot of debate about Facebook’s valuation at the time of its float.

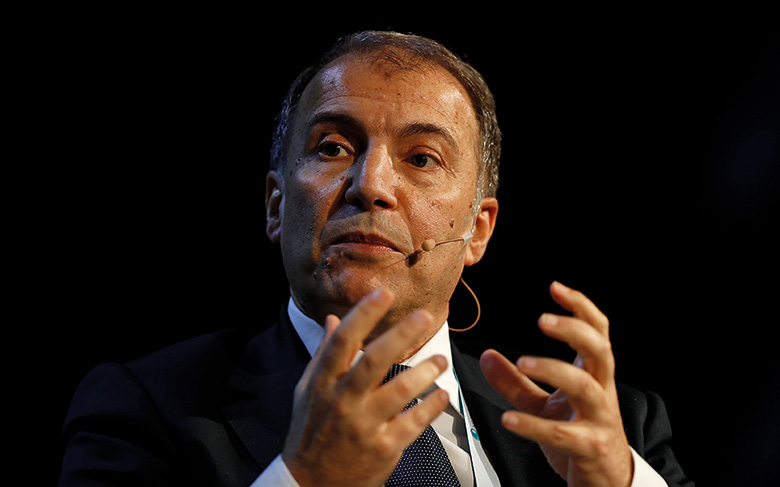

Mo Assomull, head of global capital markets at Morgan Stanley

“Many companies have successfully accessed the private and public markets,” says Mo Assomull, head of global capital markets at Morgan Stanley, a long-time leader in technology investment banking. “Facebook was valued at around $100 billion when we took it public in 2012, and seven years later its market cap is now close to $500 billion. And it’s not the only one. Salesforce had a market cap of just over $1 billion when it went public in 2004. Today it’s worth more than $120 billion.

“Today, you do have tech companies that stay private for longer,” says Assomull. “They do not want to be beholden to the public markets as the only source of growth capital. But nine out of 10 of them do intend to go public, even if it is at a later stage in their development when they are more mature.

“The list that intends to stay private is very short. After a relatively quiet start this year, we will see a pickup in big public deals through the course of 2019. And there are far more potential buyers for an IPO today than when I started 20 years ago, across a broad spectrum of investor type.”

But recent years have not been good for IPOs, even while volumes in debt capital markets have soared. Investment banks have had to adjust to intermediating private equity capital raising, instead of simply picking up companies from the venture capitalists and sponsoring their introductions to the leading stock exchanges.

Perhaps, that adjustment has not been too hard.

“From a banking point of view, we cover private capital raising much like we do public capital raising,” adds Assomull. “We have a fiduciary duty to issuers and investors to find a market-clearing level in both cases.”

He thinks back to a breakthrough deal, not for a tech or biotech company, rather for fashion designer Michael Kors at the start of the decade.

“Up to that point, we had been running a small private placement business as an adjunct to equity syndicate, doing raises of maybe $100 million or $200 million. Michael Kors came along and wasn’t sure whether an IPO in an uncertain equity market was the right way to raise capital for the company. A lot of the banks were saying a private placement would be very complicated and advising against it. We took the opposite point of view and arranged a $500 million private placement, which seemed extraordinarily large at the time. That paved the way for a $1.1 billion IPO five months later at a higher valuation.”

As the US has continued to add layer after layer of obligation, we have reached a point where companies increasingly question whether the benefits of public ownership are worth the burdens – Adena Friedman, Nasdaq

Maybe reports of the death of public equity have been exaggerated.

But who knows what Uber will be worth by the time it lists? Under private ownership, it has already raised $24 billion in multiple rounds of equity and debt placements, most recently paying up to 8% on a $2 billion high-yield bond placed privately last October. Its individual businesses are attracting bigger single investments than many IPOs. Softbank, already a big shareholder, is rumoured to be looking at a $1 billion investment in Uber’s self-driving unit.

Uber raised $600 million of capital in March 2018, when its valuation was judged at $62 billion. However, after Softbank took a $1.2 billion direct investment in the company at the end of 2017, Uber’s value appeared to have dropped to $48 billion, a marked decline from the $62 billion valuation first established when Saudi Arabia’s Public Investment Fund injected $3.5 billion in 2016.

Its share register, as far as that can be discerned, is a who’s who of global private capital.

With an IPO now imminent, bankers are privately talking about valuations of $100 billion to $120 billion or even higher. But the record shows that after so many rounds of private equity funding the traditionally smooth track to higher and higher valuations with each late-stage capital raise towards an eventual IPO has been disrupted.

And even while these now-large companies prepare to float on the stock markets, their ability to finance their growth so extensively from private sources of debt and equity raises profound questions about the future of public capital markets.

The declining number of publicly quoted companies in the biggest capital market of all, the US, is a long-established trend. It halved in 20 years from close to 8,000 in 1997 to under 4,000 by the end of 2017, partly thanks to a wave of debt-financed M&A, which saw public companies take over each other and big private equity sponsors take public companies private.

On the supply side, as new technology disrupts so many industries, venture capitalists now hold on to growth-stage tech companies for longer, up from roughly five years until they floated their successes in the 1990s to closer to nine years today, with more exits through sales to strategic buyers of companies that have already achieved scale in private ownership.

These are well-established trends that provoke periodic calls for a relaxation of some of the quarterly reporting and other disclosure requirements on public companies that are considered disincentives for owners to take them public.

Dealogic data showed 2016 was the third-slowest year for US initial public offerings on record, with just 98 new flotations, the fewest in any single year this decade and the lowest since 2009.

Adena Friedman, chief executive of Nasdaq

In 2017, Adena Friedman, chief executive of Nasdaq, unveiled a blueprint to address what she described as fundamental structural concerns in the public equity markets, calling for new limits on frivolous shareholder litigation, on costly and burdensome disclosures and management of proxy processes, as well as on shareholder activism.

Friedman argued that “as the US has continued to add layer after layer of obligation, we have reached a point where companies increasingly question whether the benefits of public ownership are worth the burdens. If not addressed, this could ultimately represent an existential threat to our markets.”

In fact, the de-equitization trend was already well underway before the Sarbanes-Oxley reforms of 2002 added to the responsibilities of boards and executives of listed companies. The tax code’s favourable treatment of interest on already cheap debt, with rates kept low in the years after the 2001 terrorist attacks on the US and then after the 2008 financial crisis, has encouraged this for a generation.

Regulators are now making some efforts to encourage companies to list. In February, the US SEC proposed a reform of its so-called ‘testing-the-waters’ exemption designed to make it easier for emerging growth companies to engage with potential investors in an IPO prior to publication of a registration statement. That exemption was granted to those companies as part of the Jobs Act in 2012, in an attempt to make it easier for owners of fast-growing businesses to gauge the potential support for an IPO without publicly disclosing too much information to competitors.

Now the SEC wants to provide the same safe-harbour exemption to all companies, not just emerging growth companies.

But something more profound seems to have been happening to the formation of capital, the trading of securities and primary issuance.

In the 1970s, as post-war regulations trapping capital within national borders lifted and money flowed internationally once more, institutional management of capital increased and the integration of financial market clearing and settlement infrastructure began in the 1980s.

This was an era of democratization of finance through institutionalization. In the US, new equity issues used to be sold to wealthy individuals through the so-called wire houses in the 1960s and 1970s. In markets such as the UK, placing power rested with brokers to the landed families. Cazenove was the leader.

A number of Silicon Valley companies got to higher valuations in private rounds than they could have achieved in public markets, and not every unicorn that was a private market darling has performed so well after listing – Jim Amine, Credit Suisse

Now in the US mutual funds sprang up allowing less wealthy investors indirect access to markets and Erisa pension fund rules after 1974 pushed higher exposure to stocks as a means to meet long-term defined benefits.

By the late 1980s, global bonds had emerged, as had what looked like a global equity market. This thrived on privatization offerings of large countries’ state utilities, sometimes with dual or multiple listings in the US and Europe, and typically with discounts for retail buyers to win over taxpayers and electorates. These were an easy sell that could tap into competing demand from large asset managers all around the world.

The enhanced disclosures and scrutiny that came with listing on a stock market also eased the ability of quoted companies to raise finance in public bond markets, with progress from club loans and private placements of debt to large, liquid bond deals, mirroring the path from family ownership or venture capital towards the stock exchange for equity.

Along the way, something important changed that may have been far more important than market participants realized at the time.

Investors can of course take different views on the same fundamentals, but their ability to outperform on the basis of information asymmetry slowly began to evaporate.

Disclosure rules, ratcheted up in response to accounting and corporate scandals in the 1990s, set a level playing field for the dissemination of corporate information, while at the same time cheap computer power made this data easier to crunch.

After training as an accountant, James McMurdo began his career in the City of London shortly after the Big Bang in 1986 and then spent 15 years in Australia with Goldman Sachs, before returning to London and then moving to Deutsche Bank in Hong Kong, where he is now head of corporate and investment banking for Asia Pacific.

“If you think back to what equity research analysts used to do, they would visit the CFO of a company, glean some insights, which might be negative or positive, get a bit more of the company story, come back and write a report, which was delivered as a hard copy to portfolio managers the next day,” he says.

That’s not how it works anymore, as McMurdo points out.

“Today, there is a pretty even playing field, a CFO can’t tell an analyst anything that is not already disclosed on the investor relations portion of the website. The information asymmetry used to be massive both in content and timing. Today it has disappeared.”

One consequence has been the rise of passive investing in public equity markets and the rapid growth of exchange-traded funds from modest beginnings at the start of this century. End investors realized they had been paying excessive fees to intermediary fund managers for disguised index tracking; now they seek the cheapest capture of market beta.

Passive funds don’t buy the IPO story, although they may pick up stock soon after flotation to maintain index weights. Few vote on corporate actions, outsourcing this to proxy firms, leaving investor relations departments to engage with activists who may become influential on the basis of only modest shareholdings.

Stock pickers

Where do the stock pickers go? They may now start to look at smaller companies, either listed small and medium-sized enterprises that are little followed or private companies.

In private markets, information asymmetry persists and what you know – often based on who you know – can still drive performance by enabling access to promising investment opportunities shown only to guardians of the money of a wealthy few.

|

|

|

Jim Amine, |

“The growth of private capital is a very pronounced trend,” says Jim Amine, chief executive of investment banking and capital markets at Credit Suisse. “It’s a phenomenon heavily focused on technology, a sector in which even highly valued companies prefer to drive growth further in private hands without worrying about explaining quarterly earnings.

“And because of the success of the original venture capital firms focused on tech, the increasing multiples and amounts of money they have to invest, there has been a surge in the quantum of capital that wants access to private companies, thus raising the amounts that can be raised privately. So now you see valuations of $1 billion series A rounds and $2 billion in series B and $4 billion in series C.”

He explains: “Those previous investors typically re-mark higher based on each round and that generates significant returns without going public.”

But something may be lost in the process.

“My concern,” says Amine, “is that because of that process, you don’t have public markets testing the valuations set in those rounds.”

He adds: “A number of Silicon Valley companies got to higher valuations in private rounds than they could have achieved in public markets, and not every unicorn that was a private market darling has performed so well after listing.”

Twitter floated in 2013 at $26, popped 72% on the first day, but had hit $14 three years later. At least today it stands back above its debut at $31.

Not so Snap, which was the hottest tech IPO of 2017. Investors piled into its shares at $17 and they popped 44% on the first day’s trading. Two years – and one damning comment from Kyle Jenner on an app upgrade – later they stand at $11.

If the idea takes hold that public markets are the dumb money that bails out the smart money after all the value has been sucked out in private, where does that leave us?

Should buyers simply remember to beware, or is this part of an unfolding crisis in capitalism that relates to malfunctioning markets caused by excessive central bank buying and unsustainably low rates eking out weak growth amid an excess of leverage.

“If you think back to the collapse of the Soviet Union in the early 1990s, an event which signalled the non-military victory of one political and economic model over another,” says Hans-Joerg Rudloff, co-founder of Marcuard Heritage, “the dogmatic approach of Margaret Thatcher and Ronald Reagan to deregulate, de-nationalize and liberate the forces of competition and innovation changed the world.”

It is not obvious how the exclusion of individual investors from capital formation may play out politically, partly because quantitative easing (QE) has inflated asset values and preserved investors’ wealth for now. You would be a fool not to borrow at 1%, if you can, and buy financial assets. But zero or negative rates make money essentially worthless and the problem is that savings produce nothing.

Now, 11 years after the crash, central banks are still pursuing a monetary policy that does not remunerate middle-class savings, but creates massive speculation and mis-pricings.

It is not a surprise that new populist politicians appear everywhere.

Powerful networks

Behind the open play of public markets, new networks of private capital are becoming increasingly powerful. These include but are not limited to: sovereign wealth funds; family offices of ultra-high net-worth individuals; and private equity sponsors – some, such as KKR are now operating like merchant banks, curating and taking investments themselves, while also syndicating to co-investees through their own capital markets units staffed by former investment bankers.

And they are doing that in debt as well as equity.

“We are in the distribution business and we do see a lot of private liquidity in debt markets,” says Sarang Gadkari, co-head of global capital markets at Bank of America Merrill Lynch. “It’s coming from specialist credit funds, among other areas. The private equity firms are also creating pockets of capital for debt and looking for opportunities in convertible bonds.”

Allegra Berman, co-head of securities services at HSBC and a veteran of debt capital markets, tells Euromoney the banks face a challenge: “There are more and more sources of liquidity and I definitely think that private capital is a threat to the banking industry. Issuers will still need banks for advice and portfolio construction, but they now have a far bigger pool of capital to go to.”

The overseers of these private pools are the new drivers of capital formation and capital markets activity, now pulling the conventional institutional managers of middle-class investments and pensions along in their wake.

That raises questions for policy makers.

“The good news is that a lot of capital is finding its way to the right places where it can increasingly support value creation, ultimately to the benefit of everyone,” says Vikram Pandit, who began his storied career in equities markets at Morgan Stanley in 1983, before going on to lead Citigroup through the aftermath of the financial crisis.

My observation is that private capital positions itself, effectively to be asked to invest, for maybe three years before one of these big private deals comes to market – James McMurdo, Deutsche Bank

Pandit now runs his own firm, the Orogen Group, investing in the digitization of finance.

“If you talk to the sovereign wealth funds, they now have analytic capability inside them equivalent to that of the investment banks and can have confidence that even if a company is not publicly traded they can still value it,” he says. “And you often hear that private companies want to delay going public because short-term earnings pressures might derail attempts to build out important long-term businesses.”

But what about the distribution of returns? Individual investors can allocate to private equity as limited partners in the leading sponsors’ funds, as long as they have a spare $25 million or so to play with.

“If you’re a sovereign wealth fund managing national surpluses and pensions, you might reason that you are already delivering returns to the population,” says Pandit. “However, the policy question becomes whether excess returns are increasingly falling to a small club of the already wealthy, freezing out access to the less well off. Is private capital a product just for the 0.1% or rather the 0.01%? In the end, the financial system has to find a way to take care of all the people, not just some of them.”

Intriguingly it is in Asia, where capital markets have grown fastest over the past 20 years, that the influence of private capital is most pronounced.

|

|

|

James McMurdo, |

McMurdo at Deutsche points first to the growth in public capital markets. In 1990, the Asia Pacific ex-Japan region accounted for 5% of global IPO volume and was home to none of the top 10 deals that year. In 2000, it accounted for 23% of IPO volume and was home to four of the top 10 deals, while in 2018, five of the top 10 IPOs came from the region, which accounted for 43% of activity.

“Think back three years, and the biggest IPO Vietnam had seen was for $160 million,” says McMurdo. “Last year we did one that raised $2.3 billion. This growth, which we expect to continue, has been driven largely by the rise of local funds. The influence of international investors that were once critical to the success of deals in Asia is not nearly the same.”

And he sees another big shift in capital raising in Asia.

“One of the defining features of this region around technology is that we have essentially three groups – Alibaba, SoftBank and Tencent – which have been hugely successful in tech investment. Almost every major tech company in China, India or southeast Asia will have one of these groups as a cornerstone investor. They now have enormous capital available to invest, deep industry knowledge and they are willing to invest in brand-new, truly disruptive technologies.”

Last June, Deutsche played a lead role in the $14 billion private placement of equity in Ant Financial, a leader in Chinese mobile payments and fintech. This was the largest-ever private funding round and was very heavily bid by both local and international investors.

GIC and Temasek, sovereign wealth funds from Singapore, took stakes, as did Malaysia’s Khasana Nasional. North American funds were also prominent investors, including Warburg Pincus, Silver Lake and the Carlyle Group, as well as funds and accounts advised by T Rowe Price and the Canada Pension Plan Investment Board, highlighting the growing appetite among pension plan sponsors to invest in private equity.

“Private equity may be more developed in markets like the US, but these large private rounds to multiple investors are now very much a feature of Apac capital markets,” says McMurdo. “While Ant was the largest, there have been plenty of other $1 billion-plus private raisings across the region; we expect this to continue.”

For the banks intermediating these deals – Citi, China International Capital Corp, Citic Securities, JPMorgan and Morgan Stanley also worked on the dual-tranche Ant Financial trade – the drill is not so different from conventional public deals. The issuers go through due diligence, package information into a memorandum and management teams present on roadshows to a small, targeted list of investors usually each capable of writing a cheque for $500 million to $1 billion.

But banks are no longer gatekeepers to these pools of capital, as they have traditionally been as de facto sponsors of public listings.

“The private capital chasing the large technology companies is very sophisticated and well informed,” says McMurdo. “Investors don’t simply wait for banks to bring a private round or an IPO and then read up for a couple of weeks. Private capital goes out looking for opportunities.”

We think de-risking from public equity will continue and even though pension funds require certain levels of liquidity they may have to allocate increasingly to specialists in emerging markets, in private equity and in private credit – Samir Assaf, HSBC

Deals come to the biggest private pools of capital that now have access to more opportunities than any single investment bank can bring them.

“My observation is that private capital positions itself, effectively to be asked to invest, for maybe three years before one of these big private deals comes to market,” says McMurdo. “In that time, investors will have visited and met management several times. As banks, we need to be working both with the companies and the large investors from an early stage so when they look to raise equity, we have a clear view on who has done the work, who will follow through and be aligned with the company’s business plan. In return for this homework, private capital will take on large positions and be a long-term shareholder.”

The downside is that there is little liquidity for these private investors to get out if something goes wrong. But then neither do they face any requirement to mark positions to market, which may be just as well.

“The quarterly performance for some of these early stage growth companies in developing countries can be quite volatile,” says McMurdo. “The attraction for these companies is that while they do have reporting obligations to private investors, the investors are sophisticated and they are private. When a company is at a dynamic stage of development, having no public disclosure, no scrutiny from broking analysts and no volatility in a public share price allows management to focus 100% on the business – it is a better ownership model.”

Ken Jacobs, chief executive of Lazard, sees investors in both the public and private markets facing the same conundrum.

“You have very large pools of assets in pension funds, sovereign wealth funds and under all types and classes of managers, as well as in the hands of individuals, that have grown enormously,” he says. “But there are challenging return obligations attached to all that capital which have led to an increasing allocation to longer-dated, illiquid investments.”

Hopefully these will produce higher returns – although that remains to be tested across a couple of cycles – which don’t come with the same periodic revaluations.

Samir Assaf

Samir Assaf, chief executive of global banking and markets at HSBC, sees the same issue.

“Legacy pension funds need around 7% return to break even, and for years the question has been where to find it in public equity and fixed income markets,” he says. “We saw the dangers of using disguised leverage to seek yield enhancement. We think de-risking from public equity will continue and even though pension funds require certain levels of liquidity they may have to allocate increasingly to specialists in emerging markets, in private equity and in private credit.”

There are risks to this, of course. But they have to be faced, Assaf believes: “Private assets are not liquid and only partly transparent, but this trend will continue and private capital markets will continue to prosper.”

In a low-growth, low-rate world of secular stagnation and QE infinity, investors are desperate for yield and for growth. Technology stocks have become a byword for growth with the performance of the Faang stocks driving the S&P500 and investors eager to find the next such cohort.

It is likely that some of the pension funds and other investors that sniffed around the $14 billion Ant placement had missed out on the Alibaba IPO and so wanted in on its China fintech offshoot in the run up to Ant’s own eventual public listing.

If these early investors enjoy higher returns, in theory they must be taking higher risk than the public market investors now eager to follow on behind them. However, theory also holds that the more capital being devoted to an asset class – and late-stage pre-IPO tech companies have almost unlimited access as every investor chases the next unicorn – then returns should come down.

Liquidity provision

Distinctions are now blurring between public and private markets. Liquidity is increasing in private capital both for individuals and institutions.

The Jobs Act of 2012 raised the previous limit of 500 individual shareholders in a private company, beyond which it triggered public reporting requirements, to 2,000.

“Private companies have found creative ways to provide liquidity for shareholders such as by repurchasing private stock and re-issuing it to new approved holders,” says Amine at Credit Suisse.

This is mainly a provision to individuals attracted to work for these companies by grants of equity rather than annual pay, as well as to founders. It adds true secondary liquidity to the long-established capacity of investment banks and private wealth managers to write total return swaps for individuals with a lot of their wealth tied up in the equity of a single private company and looking to monetize it without selling.

For institutional investors in private equity the same search for liquidity is apparent. Lexington Partners, for example, now runs a $32 billion secondary fund to acquire global private equity interests through negotiated secondary market transactions. Ardian (formerly Axa Private Equity) runs a $14 billion secondary fund and there are plenty of other fund managers now running funds of private equity funds of $3 billion and above providing secondary liquidity.

Coming the other way, big asset managers, such as BlackRock and Fidelity, renowned for running mutual funds devoted to listed stocks, are coming into private equity. Some are setting up dedicated funds or funds of funds, while others are taking advantage of rules allowing up to 15% of a mutual fund to be invested in illiquid assets as a form of private equity pocket.

New technology may further blur the boundaries in future.

The opportunity set in the alternative investments space and specifically private capital, in my view, is much more flexible and compelling – Jeremy Isaacs

Back in 2015, in its first big feature on blockchain, Euromoney spoke to Mark Smith, a pioneer of electronic communication networks in the 1990s and founder of a fintech company called Symbiont.

Smith had been talking to investment banks about doing corporate bonds on the blockchain. But in August that year Symbiont started with something else, publishing several of its own private equity investments – including the founders’ shares and convertible notes in Symbiont itself – onto the bitcoin Blockchain, in a format trademarked as smart securities. It meant that those stakes will forever be part of that public record, allowing dividend payments or stock option conversions to happen automatically.

Others also cottoned on to the notion that while most of the equity in the world’s companies is private and therefore rarely traded, shared-ledger technology that immutably verifies a beneficial entity’s entitlement to claim ownership of equity stakes in private companies (and that records transfer of ownership in an uncontested register and automates actions such as conversion of equity-linked instruments into common stock) might just eliminate the distinction between private equity and public equity traded on an exchange.

Of course, listed stocks are meant to meet a higher due diligence bar. But exchanges have changed into for-profit companies. Their business now is selling data. On listing rules, they can be flexible: witness the UK’s Financial Conduct Authority shamelessly bending over to attract the listing of a small percentage of Saudi Aramco onto the London Stock Exchange and US exchanges’ acceptance of dual-class shares.

By enabling more efficient and secure transfer and trading in unlisted investments, the blockchain might encourage greater inflows of institutional capital into the ownership of private companies. The entities at risk of being disintermediated would not be the banks – although they face their own threats – but rather the stock exchanges and the central clearing counterparties.

Nasdaq quickly began working with shared-ledger technology in its private market division, mindful of the danger of being disrupted.

The launch of JPM Coin this year, as a digital currency pegged to the dollar, could bring us closer to the day when all types of tokenized securities might be exchanged for payment in tokenized currency on public, or more likely private, permissioned blockchains.

What of regulated disclosures and the famed corporate governance that are supposed to accompany public listing on a leading exchange?

Eric Dobkin, the retired partner at Goldman Sachs who pioneered modern equity capital markets in the 1970s and 1980s, still keeps a close eye on his former patch.

“Technology companies may be staying private for longer, but the same is not true for industrial companies and other sectors,” he says. “In fact, partly because equity markets have performed so well in recent years, a venture capitalist hoping to double the valuation on an investee company within five years might get there in three or four years and float sooner than in past cycles.

“Now, there may be some businesses that are better off remaining in private hands. Going public can be a painful process. But I have always been of the mind that the more information investors have about a company and the better their understanding of it, the better it will trade. Doing things that inhibit the availability of information, or mitigating the disclosure responsibilities to enable investors to have a proper understanding of a business, in the name of making it easier to become a public company, strikes me as possibly dangerous.”

Going public

Is going public, a public good? Maybe once it seemed so, but not everyone is convinced today.

Guy Hands is founder, chairman and chief investment officer at Terra Firma, one of Europe’s largest private equity funds. Probably his most famous deal remains buying Angel Trains, the largest of three UK passenger rolling stock leasing companies created in the privatization of the UK railways, while working in the Principal Finance Group at Nomura. Nobody gave the Japanese group much chance of winning the bid in 1996, until it paid £700 million for an asset that had been expected to fetch £550 million.

Guy Hands is founder, chairman and chief investment officer at Terra Firma

Hands changed management, cut operating expenses and turned the state-owned company into a commercial enterprise. He had been able to securitize the future state-guaranteed lease receivables to finance the acquisition and did a second securitization to take back the equity his group had put in, eventually selling the retained equity portion for another £400 million within a year.

The financial press that had derided Hands for overpaying now called it “the great train robbery”. Little recognized was the extent of due diligence behind the deal.

“We did so much work to understand the engineering that some people became convinced we wanted to get into the business of building trains,” Hands recalls. “We didn’t at all. We wanted to understand how difficult it would be to build new trains. That’s what people didn’t get: that even if train operators made the decision right away, it would take years to build and deliver new trains and so our old slam-door trains had at least one full leasing term still ahead of them. And then the credit risk on receivables wasn’t the trains, it was the British government, which was a pretty good credit risk back then.”

Financial innovation became a route into business ownership leading Hands to reflect on private versus public capital structures and governance models.

“In my time working in securitization, there were occasions when we would raise money for companies who would then go and invest it in businesses with poorer returns than they already had,” Hands says. “I wished that they could have applied the same technical skill to allocating the capital which they had to raising it.”

Hands talks about corporate governance, payments for failure and long-term capital.

“The public company model has broken down,” he says. Partly, he relates that to excessive compensation. “Large institutional investors take the view that if they pay these huge sums, they should have some control, especially if management starts taking a company in the wrong direction. But it is actually very hard to change boards and management teams who get paid enormous sums if they succeed but also get paid to leave if things go wrong.”

So, while policymakers worry that the regulatory burden of public ownership is now too heavy and may be preventing or delaying ordinary investors from gaining access to investment in growth companies, Hands sees exactly the opposite.

“I occasionally listen to executives of listed firms talking about how awful it is dealing with quarterly reporting and shareholder meetings and I think: ‘If I was you, I’d be much happier with that than if you had to answer to someone like me who can fire you and will drill you on everything.’ Because I really care about the businesses we’re invested in and I take time to understand every aspect of them.”

Terra Firma currently lists six portfolio investments. Hands understands the businesses. This model of governance is a world away from public ownership by a mix of passive index trackers and a few active funds whose portfolio managers and analysts may have scores and scores of companies to keep an eye on.

“It might be better if there was greater feedback between investors in public companies and their boards and management teams, perhaps with more capacity for investors to set the agenda and vote on more decisions,” says Hands. “But that becomes very expensive to administer. And before you give too much power to independent boards as the guardians of investors’ interests, there is the issue of the quality of board members. Remember, no one pays any attention to these people until something goes wrong.”

To Hands this is becoming an almost existential crisis: “What keeps capitalism alive is the notion that we can all be investors in great companies. But I’m not sure the publicly listed company model is right for today. For example, any new investment for the future that requires capital raising today brings down earnings per share and that creates a big obstacle. But what is earnings accretive today and tomorrow may not be the right thing for the business to do over the long term.”

Turning around Angel Trains in one year was showing off a little and Hands presumably wishes he had held on to it a little longer and made even more money.

Today half the Terra Firm portfolio has been owned for between seven and 10 years, with is biggest position, Annington Homes, acquired from Nomura in 2012, being really a much older commitment. This is still the business Hands created to own, operate and invest in service family homes for the UK Ministry of Defence back in 1996. When he left Nomura, the Japanese firm retained ownership of Annington for a number of years, but Terra Firma operated it under a service contract.

How has the world of private equity changed since he started the Principal Finance Group in 1994?

“Back then, most people looked to get their money back in two or three years,” Hands says. “Today, private equity people talk about seven to 12 years. Meanwhile in the public markets, people increasingly are judged only on short-term results.”

Retreat of banks

One of Hands’ old contemporaries from Goldman Sachs, Jeremy Isaacs, who ran equity derivatives when Hands ran Eurobond trading in London in the 1980s, now also runs a private equity fund, JRJ Group, which he founded with Roger Nagioff and which concentrates on mid-sized financial services business in Europe.

|

|

|

Jeremy Isaacs |

“The environment for efficient capital allocation and value creation has changed post the global financial crisis,” says Isaacs. “The opportunity set in the alternative investments space and specifically private capital, in my view, is much more flexible and compelling. We decided our competitive advantage would be as patient investors and operators in financial services, a sector we know well and where we can attract the best human capital.”

The retreat of banks has also helped. Isaacs talks through a couple of portfolio companies operating in businesses banks once might have competed in.

“Firstly, Marex Spectron; it is a core part of the global commodity market infrastructure and a world leading commodity broker. In metals we are the number one by volume on the LME; in energy, a top three broker across our key products; and in agriculture we are a market leader in cocoa, coffee, grains and sugar,” he says. “With a global office network spanning Europe, Asia and North America, we provide an extensive number of services to our clients. It is the range of our clients and our technology that gives us the advantage.

“Marex has also benefitted because so many of the banks pulled out of commodities.”

As a private capital provider JRJ has helped finance this growth.

“We have supported the firm over the best part of a decade as it has expanded geographically and made acquisitions, most recently acquiring RCG in Chicago and investing significantly in technology,” says Isaacs.

“The second example is Demica; it’s a rapidly growing SAAS [software-as-a-service] platform, managing working capital programmes for large corporates financed by global financial institutions. We facilitate funding of $110 billion of invoices per year with $11.7 billion of financing.”

But this is not the go-go 1990s or noughties. Businesses need to grow with retained profits and that takes time. Marex has been a 10-year build. That is why private capital needs to be patient.

Why not copy the Berkshire Hathaway model? Buy businesses with a defensible competitive advantage, back or bring in good operators, run them, harvest the profits, reallocate excess retained earnings and don’t bother about ever selling good businesses.

“The money is not all ours,” says Isaacs. “Our partners provide patient capital, not permanent capital. However, I do see the attractions of that permanent capital model and like it very much, I sit on the board of two SPACs [special purpose acquisition companies].”

In the public markets, capital is increasingly impatient.

It’s not just passive index tracking funds that have changed the public equity markets, of course. So too has high-frequency trading (HFT). Trading turnover has picked up, with large proportions of volume in US stocks now comprising HFTs buying on one market and selling on another, and their so-called holding periods are averaging down to maybe 11 seconds. That’s trading of course, not investing.

In 2016, Ned Davis Research (which is owned by Euromoney) produced a long-term study of the average holding period for investors in NYSE stocks, which has been shortening since the early 1960s when it was above seven years. In the early 1970s, the average holding period was still over five years, but by 1989 it was down to just over two years. By the end of 2016, it was just over 8 months.

“It might be better if our pension funds invested more directly in private companies,” suggests Hands.