Digital banking in South Korea is a tale of mixed fortunes. Two such banks have been operational for the last two years.

One has become, by some measures, the most successful digital bank in the world. The other has made barely any inroads and is in a desperate battle for new funding. It is a curious environment into which a further two banks may be ushered later this year.

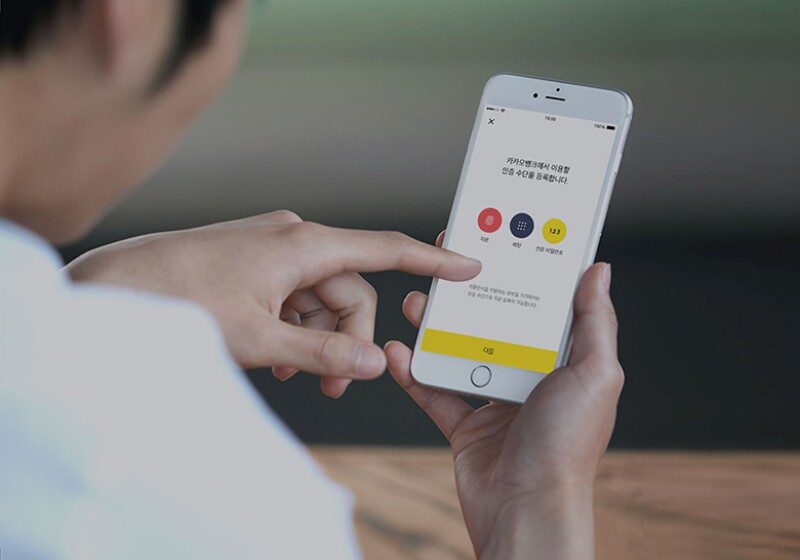

The story of these divergent outcomes starts in 2015, when the Financial Services Commission (FSC) of South Korea approved two new digital banks. One was kakaobank, owned by Korea Investment Holdings alongside Kakao Corp, KB Kookmin and Tencent; the other, K Bank, has shareholders including Woori Financial Group and KT Corp, the telecommunications leader, alongside China’s Ant Financial and the videogame developer Smilegate. There were big ambitions. At the time the FSC said it wanted the new banks to transform financial services in the country.

Both became operational within months of one another in 2017, but their experiences have been very different.

kakaobank crossed the 10 million customer mark at the remarkably precise moment of 10.25pm