Bitcoin fell on Thursday as Russia invaded Ukraine, further undermining the case that it works as a hedge against inflation or market turbulence. Gold prices spiked to almost $2,000 an ounce, fulfilling the precious metal’s traditional role as a safe haven in crisis. But bitcoin fell roughly 9% and ether dipped faster, leaving cryptocurrencies in their recent pattern of high correlation to equity indices, especially the S&P500.

There are also signs that cryptocurrencies are losing some of their appeal as financial instruments that can be sheltered from government regulation.

Western nations took a few days to apply meaningful sanctions on Russia for its invasion of Ukraine, but limits on the use of the Swift messaging system and freezing of central bank assets had an effect on Monday, with the rouble falling by more than 30% against the dollar, before recovering some ground later in the day.

London-listed shares of Russian energy firms Gazprom and Rosneft also fell by more than 40%.

If wealthy Russians feel the bite of sanctions, and try to evade them with cryptocurrency use, they will find it difficult to do at scale

The prospect of further sanctions has prompted speculation that cryptocurrencies might be used to evade moves to restrict international banking services for Russians.

Cryptocurrencies do not move through traditional financial intermediaries, and decentralized finance exchanges are not designed to verify customer details on behalf of governments.

Evangelists often tout the potential of cryptocurrencies to help citizens in oppressive regimes to conduct financial transactions without government oversight.

Myanmar’s opposition-in-exile, the National Unity Government, has already adopted the use of tether, a US dollar-linked digital coin, and is considering approving bitcoin as part of its attempt to raise funds outside the control of the country’s military dictatorship, for example.

But if wealthy Russians feel the bite of sanctions, and try to evade them with cryptocurrency use, they will find it difficult to do at scale.

One reason for this is the attempt by the heads of the biggest cryptocurrency exchanges to ingratiate themselves with regulators, especially supervisors in the US, who have the greatest global impact.

Playing by the rules

The crypto bros who devote themselves to marketing digital get-rich-quick schemes love a flashy symbol of success. But while some of the Lamborghini cars on display at crypto conferences may be rented, the business founders who try to play by the rules are accumulating tangible rewards in old-fashioned fiat currencies.

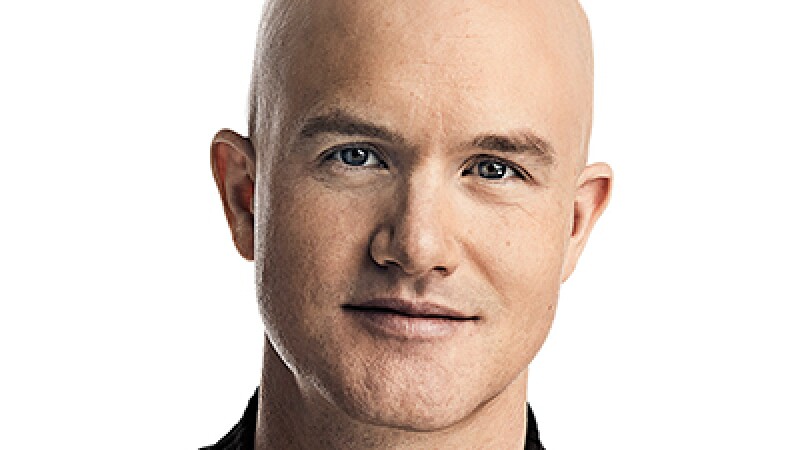

Coinbase chief executive Brian Armstrong recently bought a house near Los Angeles for $133 million, for example. His net worth has dipped a bit this year, along with the value of his shares in the crypto exchange, but it is still not far off $10 billion in a reminder of the gains on offer from submitting to regulation in order to secure a public listing.

Other crypto exchanges will surely think twice before enabling attempts to evade sanctions by Russians, if only to keep an eventual IPO as an option.

Binance, the biggest global crypto exchange and a firm with a reputation for trying to keep regulators at arm’s length, said on Monday that it will block the accounts of any Russians targeted by sanctions, for example.

Law enforcement agencies are also coming to grips with the way cryptocurrencies function. A case filed in February by the US Department of Justice against Ilya Lichtenstein (a Russian/American joint citizen) and Heather Morgan over a stash of bitcoin worth a nominal $4.5 billion that they are alleged to have tried to launder highlighted both the problems they had in converting their crypto to dollars, and the way agents were able to gain access to their bitcoin wallets and trading accounts.

With exchange heads eyeing their own interests and plenty of crypto specialists who sympathise with Ukraine’s plight, Western governments may find allies in their bid to prevent Russian sanctions evasion via digital assets.