Big Wall Street dealers announced plans to increase dividend pay-outs and share buybacks on Friday, June 28, after comfortably passing their annual regulatory stress tests.

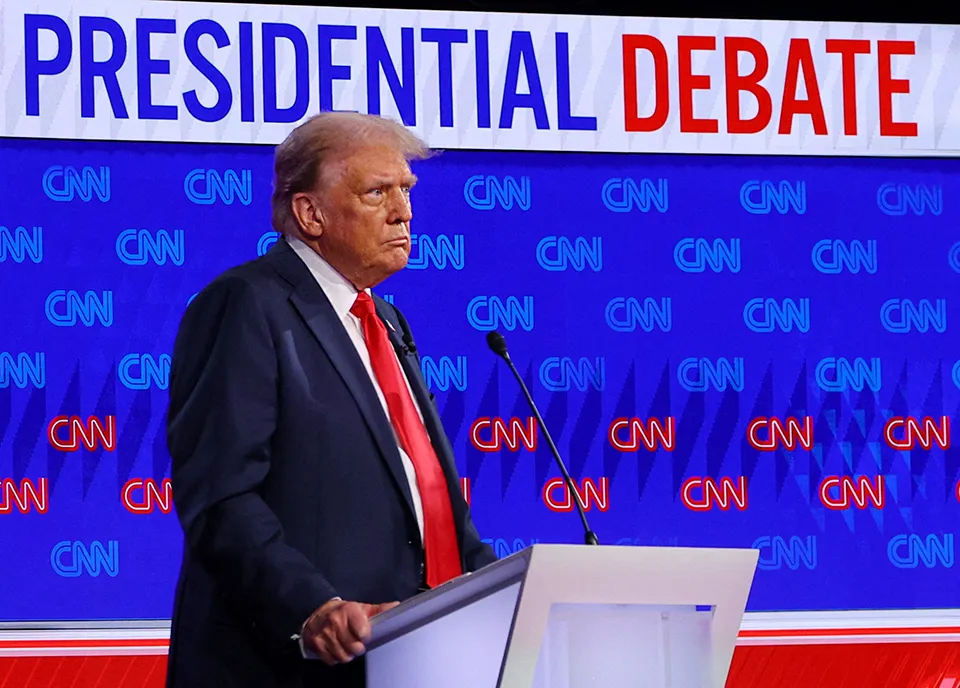

The shareholder gift bags from Bank of America, Citi, Goldman Sachs, JPMorgan and Morgan Stanley drew little attention as most people – in the US and across the world – were digesting the stumbling performance of Joe Biden in the presidential debate with Donald Trump the night before.

There are still four months before the US election, with time for political twists, but Trump is now likely to be re-elected and given a chance to deliver a promised rollback of regulations.

Trump-adjacent, or formerly adjacent, economics advisers in think tanks have been energetically promoting potential steps to ease regulation, including rules imposed on banks after the 2008 financial crisis.

Dramatic moves, such as repealing the Dodd-Frank Act of 2010, would require approval by Congress, which would be hard to obtain even if Republicans regain control of the Senate on the coat-tails of a Trump victory.

Banks can certainly expect an easier regulatory environment, however. Individual supervisors such as SEC chair Gary Gensler might be tempted to fight a rearguard action against a new Trump ascendancy.

Gensler has two years left on his term, so he could theoretically stick around, but in practice opposing a president who is determined to replace him would be challenging, especially if Republicans control Congress.

Trump bear

Trump promises to be as unpredictable in a second term as he was in the first, with an added boost from the Supreme Court ruling on Monday, July 1, that endorsed presidential immunity for acts in office.

Wall Street analysts and traders are nevertheless trying to assess the impact of Trump 2.0.

A Trump victory that was accompanied by Congressional gains would probably ensure that the tax cuts passed in his first term with an expiry in 2025 are renewed and extended.

The prospect of further tax cuts and trade tariffs – both with the potential to boost inflation – prompted some bearish positioning in the Treasury market after the presidential debate.

Analysts expect bearish curve steepening in the Treasury curve as a consequence of higher US deficits under a new Trump administration

The benchmark 10-year Treasury yield rose to 4.46% on June 1, having closed at 4.28% before the debate on Thursday.

Some analysts expect bearish curve steepening in the Treasury curve as a consequence of higher US deficits under a new Trump administration.

The argument here is that slower growth might prompt Federal Reserve rate cuts, while a ballooning deficit drives up long-term yields.

That environment would be broadly positive for banks, as would the right amount of interest-rate volatility – though not a loss of confidence in US government debt, of course.

The outlook for a recovery in M&A activity could be cloudy.

Erratic personal interventions by Trump in potential takeovers would be a risk, but a bigger threat to dealmaking would be renewed protectionist measures that spark trade wars.

M&A revenues are finally recovering after a collapse in 2023 when interest rates rose, but even the most polished advisory bankers might struggle to pretend they are busy if takeovers slump again in 2025.

Trump hedge

As bankers consider the implications of a second Trump presidency, they should probably avoid the temptation to overthink their game planning and remain wary of false market signals.

Some potential trading opportunities may prove illusory. As Trump became more likely to win re-election in recent months, shares in Trump Media & Technology Group have actually been falling, for example.

The company, which houses his Truth Social social-media platform, has seen its stock price fall by over 40% since it began trading on Nasdaq in March, and only saw a brief bounce after the presidential debate.

That could be a sign that the stock is becoming an inverse play on Trump’s political fortunes, or even a hedge against his policies.

But it is more likely to augur bouts of chaos in markets under Trump 2.0.