[Part 1 of our analysis dealt with group and CIB results; part 2 was about DCM, ECM and advisory]

2Q18 table15FICC

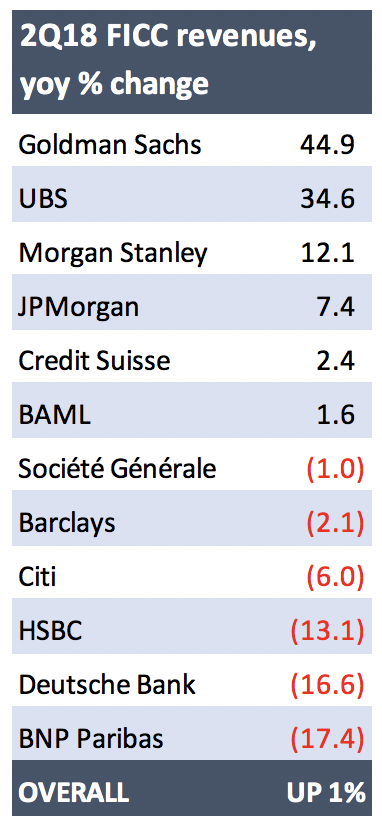

2Q18: UP 1%Biggest rise: Goldman Sachs (45%)

Biggest fall: BNP Paribas (-17%)

TTM: DOWN 11%

Smallest fall: Credit Suisse (-2%)

Biggest fall: BNP Paribas (-26%)

What an odd quarter for fixed income businesses. It was one where the divergence in US and European conditions came to the fore, with the ability to make money in parts of European FICC severely constrained by continued quantitative easing.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access