|

|

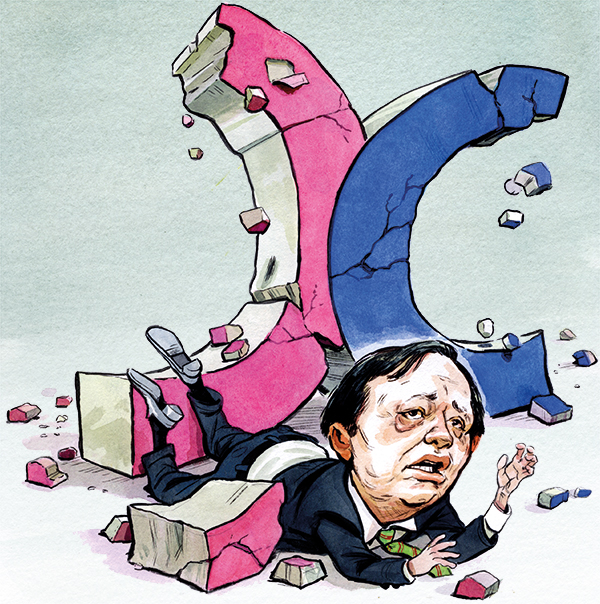

Illustration: Britt Spencer |

|

IN ADDITION |

|

Are Hong Kong’s markets broken? The mood of many international bankers and investors in the Special Administrative Region is miserable, with gripes ranging from cornerstones to liquidity, shorting to fictional orders in bond books. Chinese banks think it is all just fine as they gain market share. And Hong Kong’s exchange and the Securities and Futures Commission (SFC) are trying to make sense of the noise.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access