The comments came as the BIS released an in-depth review of its 2013 triennial survey of the FX market, which showed trading volumes hit $5.3 trillion a day in April, up 35% from its 2010 report.

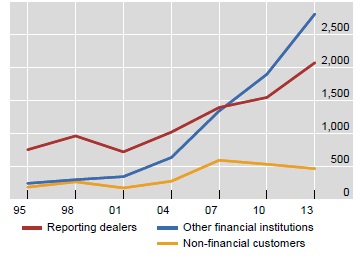

Non-dealer financial institutions – such as lower-tier banks, institutional investors, hedge funds and high-frequency trading firms – were the main drivers of growth in FX volumes, with their turnover growing by 48% to $2.8 trillion a day.

In contrast, the inter-dealer market grew more slowly, while the trading volumes of non-financials – mostly corporates – contracted.

| Global FX market turnover by counterparty ($billion) |

|

| Source: BIS |

The BIS says the climb in FX turnover between 2010 and 2013 appears to have been mostly a by-product of the increasing diversification of international asset portfolios rather than a rise in interest in FX as an asset class in its own right.

“With yields in advanced economies at record lows, investors increasingly diversified into riskier assets such as international equities or local currency emerging market bonds,” says the bank.

“By contrast, returns on currency carry trades and other quantitative investment strategies were quite unattractive in the run-up to the 2013 survey, suggesting that they were unlikely to have been significant drivers of turnover.”

The FX market has become less “dealer-centric”, to the point where there is no longer a distinct inter-dealer market, according to the BIS.

That has been driven by the proliferation of prime brokerage, which has allowed smaller banks, hedge funds and other players to participate more actively in the currency market.

Trading costs have continued to drop, thus attracting new participants to the currency market and making more strategies profitable, says the BIS.

“This trend started with the major currencies, and more recently reached previously less liquid currencies, especially emerging market currencies,” it states.

The BIS says today’s market structure involves a more active participation of non-dealer financial institutions in the trading process.

It notes while trading activity remains fragmented, aggregator platforms allow end-users and dealers to connect to a variety of trading venues and counterparties of their choice.

With more counterparties connected to each other, search costs have decreased and the velocity of trading has increased.

“The traditional market structure based on dealer-customer relationships has given way to a trading network topology where both banks and non-banks act as liquidity providers,” says the BIS.

“This is effectively a form of hot-potato trading, but where dealers are no longer necessarily at the centre.”

The declining importance of inter-dealer trading is reflected in the fact it now accounts for just 39% of turnover, down sharply from more than 60% in the late 1990s.

The BIS says the primary reason for the fall is that the main dealing banks net more trades internally.

“Due to higher industry concentration, top-tier dealers are able to match more customer trades directly on their own books,” says the BIS.

“This reduces the need to offload inventory imbalances and hedge risk via the traditional inter-dealer market.”

New, more granular data in the triennial survey allows more light to be shed on the make-up and participation levels of non-dealer financial institutions.

That shows that 24% of dealers’ FX transactions are with lower-tier banks. Meanwhile, institutional investors – such as mutual funds, pension funds and insurance companies – and hedge funds, which include high-frequency trading firms, both account for about 11% of turnover.

| FX turnover by non-dealer financial counterparties (% share) |

|

As the chart below shows, the trading of non-dealer financial institutions is concentrated in a few locations, in particular London and New York, where the big dealers have their main FX desks. Prime brokerage has been a crucial driver of the concentration of trading, as such arrangements are typically offered via investment banks in those two cities.

| Trading of non-dealer financial institutions and the geography of FX trading |

|

The BIS says the trend towards more active FX trading by non-dealer financial institutions and a concentration in financial centres is particularly visible for emerging market (EM) currencies.

A decade ago, EM currency trading mostly involved local counterparties on at least one side of the transaction, but trading now is increasingly conducted offshore. It has, says the BIS, especially been non-dealer financial institutions that have driven that trend.

Furthermore, the ease and cost of trading EM currencies has improved significantly, with bid-ask spreads steadily declining and converging almost to levels seen in developed currencies.

| Currency internationalization and trading costs |

|

The BIS says the growing participation of non-dealer financial institutions has been facilitated by the increased availability of electronic platforms.

“The FX market of the 1990s was a two-tier market, with the inter-dealer market a clearly separate turf,” says the BIS.

“This has changed. There is no distinct inter-dealer market any more, but a co-existence of various trading venues where also non-banks actively engage in market making.”

The BIS says the number of ways that the different types of FX market participants can interconnect has increased substantially in recent years, suggesting that search costs and trading costs are now considerably reduced.

“This has paved the way for financial customers to become liquidity providers alongside dealers,” says the BIS.

“Hence, financial customers contribute to increased volumes not only through their investment decisions but also by taking part in a new hot-potato trading process, where dealers no longer perform an exclusive role.”