CME said on Monday it will apply for a UK Financial Services Authority (FSA) licence to launch a new derivatives futures exchange in London and – if approved – will launch with a range of FX futures products for trading by mid-2013.

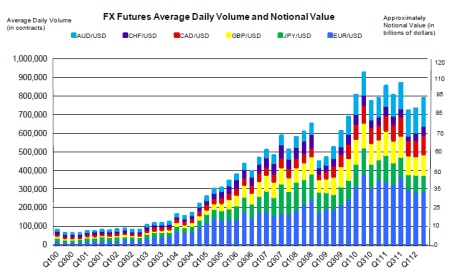

CME – the world’s largest derivatives and futures-exchange platform operator – has offered FX contracts since 1972 in the US, but it was not until 2002 that trading in the contracts took off, after the exchange’s Globex platform began offering electronic access to algorithmic and model traders.

Volumes grew 25% in 2011, after rising 142% the previous year. To date, volumes have largely come from the US.

|

| Source: CME Group |

Expanding into Europe, which represents more than two-thirds of the annual turnover of the overall market, represents a huge opportunity in what has typically been a market that executes almost exclusively over-the-counter (OTC).

For that reason, many of the large buy-side trading firms in Europe remain sceptical that CME will get any traction.

“This is where the big boys play in FX,” says the head of execution at a large London-based systematic FX trading firm. “I can’t see anyone getting excited by the fact they can now do 20 lots [FX contracts] on CME Europe.”

In its home market, the CME contracts are a more established part of US investor mentality because of the predominance of commodity trading advisors (CTAs), which favour exchange-traded FX products.

The CME says 30% of its FX volume comes from Europe and Asia. So far this year, that would amount to average daily notional volumes of about $36 billion. Still that is a fraction of the overall size of daily turnover in the European time zone, which some leading market makers in the OTC market estimate could be worth about $2 trillion.

| Daily average turnover at major |

|

| Source: BIS |

“Liquidity will be – if doesn’t become more fragmented – irrelevant in London, because you’ll get the same market makers supporting the European version of the contract that support the US contract,” says another head trader at a London-based FX hedge fund. “I don’t see that it will give you an awful lot.”

Yet, there might be some broad appeal for European-based investors who do not wish to trade in a US-regulated jurisdiction, but who want to trade currency futures, says the CME.

“We’re aware there are customers that would like to trade futures on CME, but if they’re European or Asian-based, it’s difficult to convince them to come in to Commodity Futures Trading Commission jurisdiction,” CME’s global FX head Derek Sammann tells EuromoneyFXNews.

“This is not about creating an alternative venue to the US; this is about creating an additional venue for European and Asian clients more effectively than trying to sell them back into the US market,” says Sammann.

While that is the case, the sceptics argue this is only relevant for those institutions that solely trade non-US contracts.

“If you really don’t want to be touched by American regulation, it might make sense, but if you trade US bonds or US indices you will touch the US [regulation],” says another London-based currency manager. “If you were a pure currency fund and you didn’t do anything with American banks, it might make sense, but I’m sceptical.”

The new CME initiative is also an opportunity to reinvigorate its European clearing house, which it launched in May 2011.

Sammann says the new London-based exchange would be part of a long-running strategy to build on CME’s European clearing business. So far, CME Clearing Europe has only backstopped energy futures trades and agricultural swaps specific products.

“At this point, given what we know from conversations at the FSA, our focal point is going to be on clearing OTC FX in our [European] clearinghouse, and we’ll also be clearing our CME Europe futures products in our European clearing house,” says Sammann.

As part of this, CME Europe will offer an exchange-for-physical (EFP) model for FX futures through links with the company’s US markets and clearing. CME Europe will remain a seperate entity from CME in the US.

“The same EFP mechanism [for FX futures in the US] will be made available for Europe as well, and will very much leverage the bloc functionality for customers that want bloc transactions,” says Sammann. “We will make that available in the European clearing industry as well.”

That should find appeal with some fund managers, who might prefer to trade OTC but want to clear their trades through a clearing house.

Transaction costs might also be an issue for differentiating the service offered by the CME versus OTC liquidity providers. Some FX funds argue the OTC market still offers lower trading costs, as well as better liquidity.

Nonetheless, new competition is being welcomed by some investors. One large systematic trading firm based in northern Europe believes CME’s entrance into the European exchange market would likely create a new and welcome level of competition.

However, a France-based currency fund tells EuromoneyFXNews that, despite CME’s reputation in the US and globally as a provider of secure and efficient trading platforms, it would be hesitant to transact on the planned London-based exchange until it was sure the rest of the market showed confidence in its systems and products.

“Our trading view with any exchange or counterparty – whether reputable like CME or unknown to us – is that we will wait for a long time for the market to mature around their offerings and then make a decision on whether we will transact with them,” says the French currency fund.

And, despite the potential for conjoined FX futures and clearing within Europe through CME’s offering, one FX trader also remained sceptical of the company’s plans.

“It sounds like someone’s been told in their business plan: ‘Go and do something in Europe,’” says the FX trader.