Simon Wilson-Taylor, who spent 17 years at State Street – which introduced FX Connect – has set up Molten Markets, along with two other former State Street employees. The new FX trading platform aims to provide a fully transparent multi-dealer trading environment, while offering two different types of liquidity pools to liquidity providers, depending on the types of market participants they wish to interact with.

Molten plans to revamp the traditional model of electronic communication network (ECN) liquidity, by creating separate anonymous liquidity pools for different trading behaviours, to develop more depth and stability of pricing.

Furthermore, instead of attracting more liquidity providers, it hopes to create more liquidity with fewer, but key, liquidity providers.

According to Wilson-Taylor, the traditional ECN model and the way liquidity is sourced and managed are outmoded. He argues that ECNs have placed too much emphasis on increasing the number of liquidity providers at the expense of the integrity of their price-making function.

|

| Simon Wilson-Taylor: "It''s really difficult to make money when there''s 30 liquidity providers, 10 of whom are quasi hedge funds" |

“It’s really difficult to make money when there’s 30 liquidity providers, 10 of whom who are quasi hedge funds – non-bank liquidity providers – who are selective when they make markets,” he says.

“And when you start prodding that beast and start picking off the top of book, suddenly you’ve got a lot of evaporation of liquidity, which is what a lot of people are complaining about, because it’s not robust.”

As a result, Molten Markets has decided to create two pools. One is designed for the leading banks, and certain rules must be complied with to become a liquidity provider in that pool – such as streaming in certain sizes for particular currencies, 24 hours a day – which favours the main liquidity providers, who are committed to providing that.

The second liquidity pool will essentially have the same providers as the “premier” liquidity pool, but with wider spreads, to reflect the more aggressive nature of the participants in that pool, such as high-frequency funds, commodity trading advisers and other more speculative accounts.

“We’ve asked [the main liquidity providers] that if we did this in such a way that it worked for them, would they put their finest spreads in there, and they said ‘absolutely’,” says Wilson-Taylor.

Although he wouldn’t elaborate on the banks that have agreed to provide liquidity to Molten Markets, Wilson-Taylor says he has commitments that equate to about 60% of volume in Euromoney’s annual FX survey.

Some of the main liquidity providers who EuromoneyFXNews spoke to say their support for Molten would be based on whether the platform had customers who needed FX rates streamed into them, rather than a commitment to provide 24/5 liquidity.

The launch of Molten Markets comes at a time when several new ECNs have launched, or are planning to launch a new product. Last month, a bank consortium, including Citi, JPMorgan and HSBC, launched FXSpotStream, a dealer-to- customer, brokerage-free model, based on an API.

A few weeks later, Tradition, the interdealer broker, launched traFXpure, a platform aimed at providing a “low-cost, convenient and equitable venue for sourcing FX liquidity, open to all users on a fair and equal basis”. It has the market making support of Barclays, Deutsche Bank, UBS, BNP Paribas and Royal Bank of Canada. Although the platform will be pre-trade anonymous, it is not a dark pool, and all counterparties will be disclosed on a post-trade basis.

According to sources, Credit Suisse and FXCM are also working on launching another ECN.

One of the constant criticisms of anonymous liquidity pools, in particular EBS, has been that non-bank liquidity players have been able to trade in that pool, and then use multiple identities to essentially spoof the market, making it almost impossible to measure trading behaviour and adjust pricing accordingly. It is something bank liquidity providers will no longer tolerate.

“We are making sure we operate ourselves in a fully ethical way,” says Wilson-Taylor. “They have one ID, and if a bank says it does not want to trade with that ID, then we can make sure that doesn’t happen.”

While that counterparty can still remain in that liquidity pool, Molten can make sure its orders do not cross, and Molten will be honest and straight forward about that, Wilson-Taylor adds. Before, when a hedge fund has been turned off by one or two of its liquidity providers in a pool, the fund might typically ask the ECN provider to give them a fresh ID, therefore further toxifying the pool.

“We’ve learned from the mistakes other people have made and we don’t intend to make those mistakes,” says Wilson-Taylor.

Transparent pricing

The creation of Molten by Wilson-Taylor – alongside John Atchue and Francisco Heredia, all of whom worked at State Street – is also predicated on the idea that while the FX markets have been relatively effective at being self-regulated, the mass adoption of electronic trading has almost perversely created opaqueness in the way trading fees are collected.

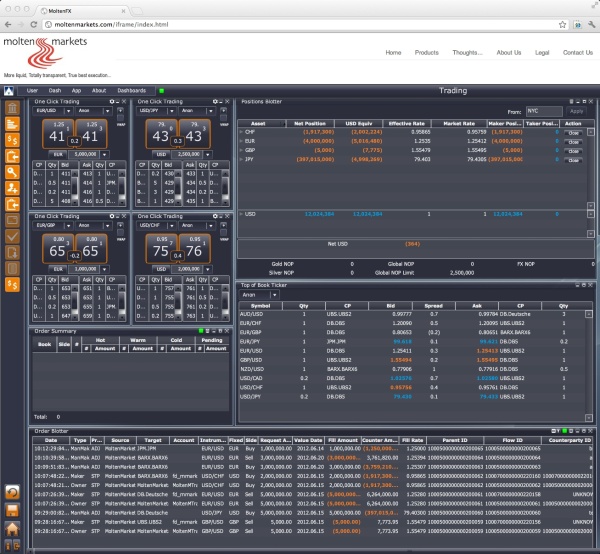

| Molten Markets GUI |

|

“As FX has gone electronic, there has been some real creativity in terms of how money is made,” says Wilson-Taylor. “And it’s down to arcane things such as latency management, or asymmetric slippage rules.”

In practice, this has meant that when a price-taker sees a price and hits it, the liquidity provider still has last look, so typically when the market moves in favour of the liquidity provider, they take that profit for themselves, and if it moves against them, they either reject the trade or they adjust the price, therefore creating the asymmetric slippage.

Wilson-Taylor says that could create a situation where an ECN that was charging $5 per million each side could be picking up an extra $10 per million by operating slippage rules.

Additionally, it has also become easy for ECNs to add a 10th of a pip to every price without anyone noticing, getting the central counterparty to collect it, and then suddenly an ECN is making $30 per million, when the tariff claims to be charging $10 per million.

“Our philosophy is that we’re going to be whiter than white – we’re only going to charge clients according to a tariff they can understand,” asserts Wilson-Taylor. “We can collect that in different ways, with their agreement, by saying we’re going to add a 10th of a pip to the price, and that’s how we collect our tariff, but they’re going to know that it’s added. We won’t hide it from them.”

Back to roots

Given the origins of the founders, Molten Markets has also developed a product specifically targeting institutional investors and hedge funds, called InstiFX, designed to “meet the sophisticated pre-trade operational and analytical needs of fund managers when trading FX”. It plans to roll it out in the fourth quarter.

“Sixteen years ago, no banks were pricing electronically and today it’s a very different world, and so we have a real opportunity to do something very different for the fund management world, that still recognizes how they work with all the workflow processes but actually moves on a generation,” concludes Wilson-Taylor.

Molten expects to start actively trading in July and then will start rolling out more products, such as forwards and swaps, by the end of the third quarter. In terms of geographies, it will start in the US time zone first and once it has received full regulatory approval in the UK, it hopes to start trading in Europe in the fourth quarter, before expanding into Asia next year.