Just before Christmas, the Financial Conduct Authority (FCA) published new rules to encourage companies to list in the UK.

These will reduce the requirements that used to be imposed on issuers seeking a premium listing on the London Stock Exchange (LSE) that would bring with it the promise of index inclusion.

Instead of a premium listing or a standard listing, which used to attract mid-cap stocks but denote them at the outset as lower-quality companies, the LSE will now have one listing category of commercial companies.

There will no longer be a strict eligibility requirement for historical financial information, revenue track record and clean working-capital statements, although prospectuses will still require disclosure of these.

To attract initial public offerings from innovative technology companies, the FCA will allow founders to retain separate classes of shares with enhanced voting rights.

Doing away with that old fashioned, one-share-one-vote notion is designed to protect them from being taken over by anyone acquiring a majority of the second-class shares that outside investors will now be allowed to buy.

The total number of IPOs for 2023 fell to just 24, a 47% decrease on the 45 recorded in 2022 and the lowest number since the LSE began publishing records in 1995

There will be no sunset clause restricting dual-class share structures to just the first few years after listing.

What is more, the FCA will do away with the requirement for shareholder votes to approve certain important transactions, such as M&A deals that might see a company sell a division accounting for a substantial share of its earnings, as well as for votes on related-party transactions.

This is a not a good look for a regulator now clearly following instructions from a government desperate to salvage something from the wreckage of its hard Brexit.

Bim Afolami, economic secretary to the Treasury, stated in the announcement of these final rules: “We want to make the UK the global capital for capital, attracting the brightest and best companies in the world.”

He claimed: “We are strengthening the UK as a listing destination, taking forward reforms to make it quicker to list, improve disclosure and make our capital markets more efficient and open.”

Afolami, who once famously resigned live on television as vice-chair of the Conservative Party amid revelations of the latest misdeeds by then prime minister Boris Johnson, is founder of the Regulatory Reform Group of MPs, lobbying for an overhaul of UK regulation.

Disclosure is now meant to compensate for the removal of shareholder protections.

Let’s try and be fair to the FCA and to the UK government. They had to do something.

No deal

The LSE attracted just one IPO in the final quarter of 2024, although counting English wine maker Chapel Down transferring its listing from the Aquis Exchange to AIM without raising new capital as an IPO is probably being generous.

In truth, there wasn’t a single deal. The last time three months passed with such low volumes was the start of 2009, when global financial markets lay broken after the collapse of Lehman Brothers.

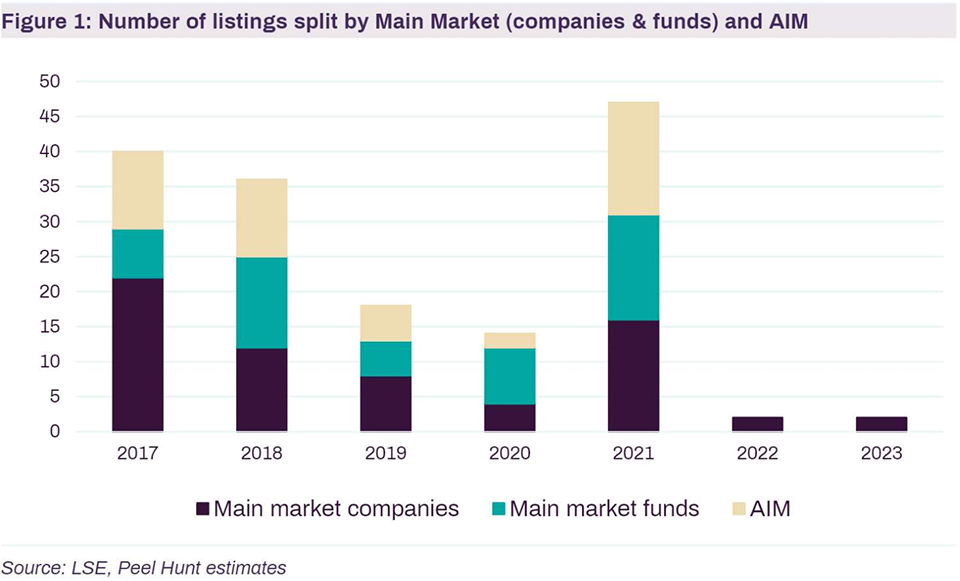

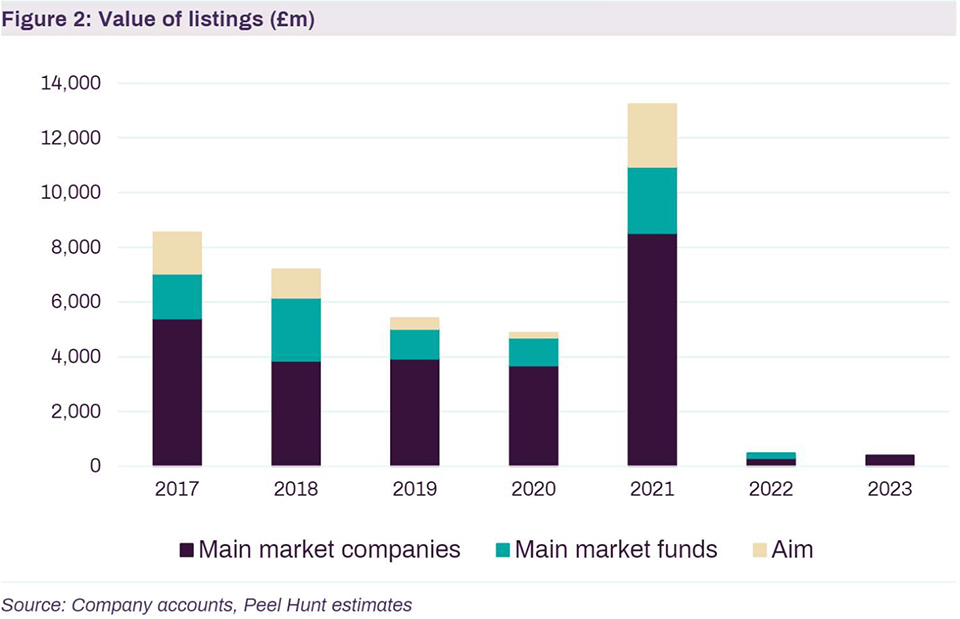

The total number of IPOs for 2023 fell to just 24, a 47% decrease on the 45 recorded in 2022 and the lowest number since the LSE began publishing records in 1995.

Sure, it has been a bad time for IPOs everywhere since rates started rising. But the US saw 33 IPOs in the fourth quarter of 2033, an 83% increase on the 18 recorded in the final quarter of 2022.

It comes to something when UK equity bankers in January were on tenterhooks over whether Tekcapital might list MicroSalt, a company that sells saltshakers on Amazon, on AIM before the end of the month.

ECM bankers are optimists by nature. They all agree that the UK IPO market will revive. Unfortunately, more now seem to see this revival coming in 2025 instead of 2024.

Treating the symptom

Here is the problem with the FCA’s new listing rules. They will achieve very little good and may do quite a lot of harm.

The reason why so few companies seek to list in the UK is that domestic investors, notably pension funds, have abandoned the market, leaving it illiquid and unattractive.

This is why the executive and supervisory boards of TUI in January advised shareholders to cancel the Germany-headquartered and dual-listed travel group’s listing on the LSE.

Since the 2014 merger that created the group, most of the stock trading has flowed back to Germany.

Changing listing rules to favour issuers is treating the symptom. Removing investor protections risks making the disease even worse.

Rather than deregulation driven by political ideology, the UK stock market needs the application of a stiff dose of common sense

Attracting lower-quality companies with greater risk of failure will not help a UK equity capital market that already suffers from the poor performance of some recent big-name listings, such as CAB Payments, and previous IPOs that attracted hype such as The Hut Group and Deliveroo.

Short-sellers already see UK IPOs as a target-rich hunting ground.

Rather than deregulation driven by political ideology, the UK stock market needs the application of a stiff dose of common sense.

Charles Hall, head of research at Peel Hunt, offered a few useful suggestions in a paper that came out after the TUI board recommendation.

Hall points out that reviving investor demand is an essential pre-requisite to attracting new listings. He argues that it is essential to reverse the negative fund flow in UK equities, which has now lasted for 30 consecutive months, because it is highly unlikely the UK will ever have a vibrant IPO market if fund managers do not have funds available to invest in new companies.

This is particularly true for small and mid-cap companies, which see limited appetite from overseas investors.

In the past 25 years, UK pension funds and insurance companies have gone from owning 44% of the UK stock market to just 4%.

Hall suggests that making an allocation of say 10% of UK pension fund investments to UK equities mandatory would be reasonable, given that pension funds, including self-invested pensions, benefit from favourable tax treatment.

This need not make UK pension funds any riskier. And remember that other countries limit the amount of pension funds that can be invested overseas.

The UK has already proposed greater allowances encouraging pension funds to invest in private equity. But these are high-cost funds that might eat all of a pension funds’ budget and leave the rest to fall into passive funds tracking US tech stocks.

Surely it would be better to use tax policy to redirect some investment to domestic listed mid-caps.

Hall suggests that one sensible response to companies like TUI abandoning dual listings in London because of poor liquidity would be to relax rules for secondary listings to be eligible for index inclusion.

There is a lot that can be done to reverse London’s decline as a listings venue without resorting to a regulatory race to the bottom.