The latest results of the European Central Bank (ECB)’s climate stress tests incorporated the energy performance of buildings as a contributing metric to determine banks’ resilience to climate shocks. It revealed that European banks’ mortgage books could be exposed to a higher credit risk because of this.

“The test was a learning exercise,” a source at CaixaBank tells Euromoney. “It enabled us to look transversally across our different portfolios, including the mortgages book.”

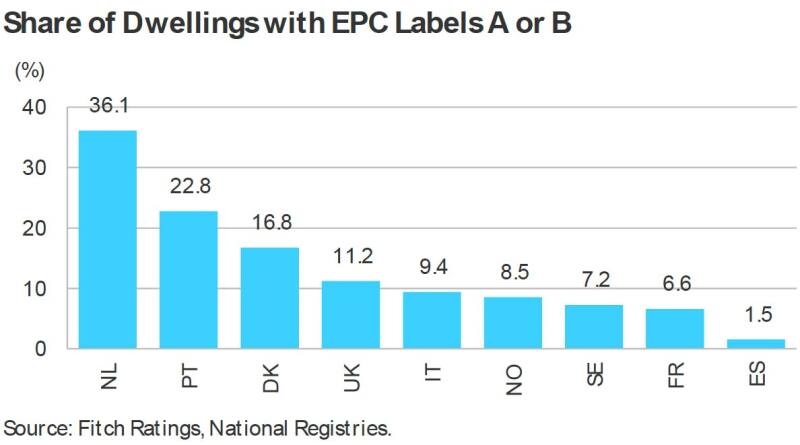

The Madrid-headquartered bank has the largest mortgage portfolio in Spain. Its book mirrors the quality of the overall housing stock in the country.

As legal frameworks across Europe adapt, it will become impossible to sell or rent properties with poor energy performance certificates (EPC) ratings.

In France, the recent Climate and Resilience Law requires properties to have at least a class F EPC by 2025, class E by 2028 and class D by 2034 to be rented out. Between 700,000 and 800,000 homes need to be renovated annually to adapt the national housing market, often referred to as a ‘passoire thermique’ or thermal sieve.

There is a risk that such ambitious targets could polarize the housing market.

“It’s