In 1965, the satirist and songwriter Tom Lehrer said of protest songs: “It takes a certain amount of courage to get up in a coffee house or a college auditorium and come out in favour of the things that everybody else in the audience is against, like peace and justice and brotherhood and so on.”

Euromoney was reminded of his words this week, when yet another press release promoting the launch of yet another sustainability initiative for the financial industry landed in our inbox.

These are arriving at the rate of about two a week – or at least, that’s how it sometimes feels. But a couple of things made this one stand out from the crowd.

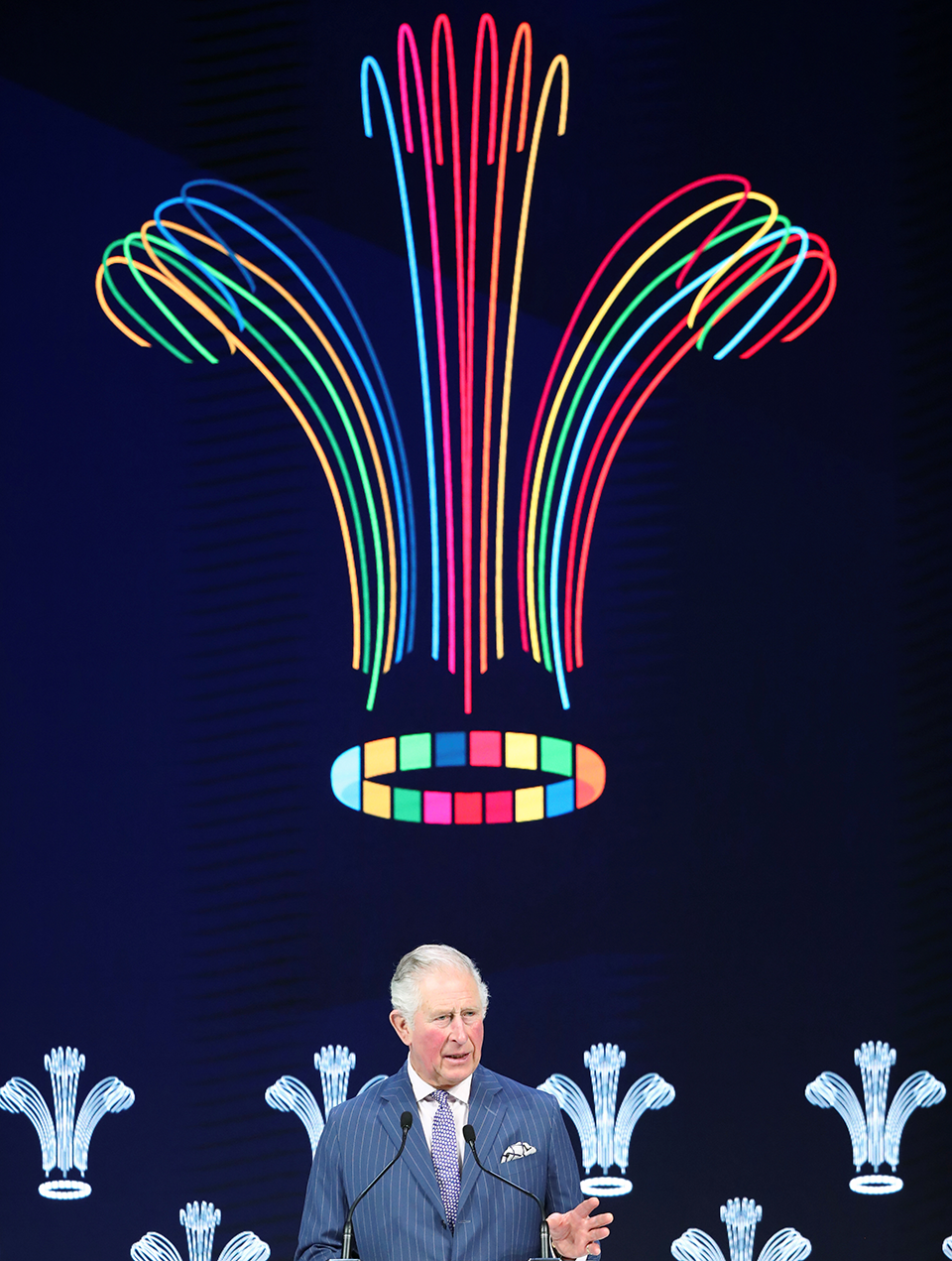

Firstly, as was made clear from the outset, this one carries the imprimatur of His Royal Highness the Prince of Wales – seven of the press release’s first eight words. Secondly, it is even harder than usual to work out what value this project is promising to add.

The new Financial Services Taskforce (FSTF) is part of the Sustainable Markets Initiative (SMI), a venture co-chaired by Prince Charles and Bank of America’s Brian Moynihan that was launched with much éclat at Davos 2020.

By its own account, the SMI is “a network of global business leaders and others committed to creating truly sustainable markets through the integration of natural, social and financial capital”.

So far, so laudable. But what of the new FSTF? It has managed to attract some big names. Chaired by HSBC boss Noel Quinn, it also counts among its membership the chief executives of Barclays, Citi, BNP Paribas, NatWest, Standard Chartered and, of course, Bank of America.

As to what tasks it will undertake – well, this is where it gets a bit murky.

The idea is that, as part of the preparations for the COP26 climate change conference in November, the FSTF will focus on three areas: net-zero carbon emissions; accelerating investment into sustainable infrastructure; and “climate solutions”, which here seems to mean carbon markets.

It would be hard to argue that these topics are undeserving of attention or are not critical for the banks involved.

Citi, Bank of America and Barclays all ranked in the top 10 funders of fossil fuels in the four years after the signing of the Paris Climate Agreement, according to the Rainforest Action Network (RAN), with HSBC and BNP Paribas close behind.

The question is whether HRH’s taskforce can add anything useful to what is being done already.

Take carbon emissions. Here the FSTF is promising to “define a credible pathway for how banks can achieve net zero”, “work to advance industry best practices” and “engage across industries to help accelerate the transition to a net-zero economy”.

The track record of the SMI does not raise high hopes for its offshoot

Is there anything here that big banks haven’t already committed to doing? Or that investors, employees and activist groups haven’t been urging them to do for years? Even the FSTF admits that it will be “building on the ongoing efforts of its members and the broader sector”.

Similarly, when it comes to carbon markets, the press release states that the taskforce will “[build] on the work of the Taskforce on Scaling Voluntary Carbon Markets”, the influential initiative set up by Mark Carney in September – which, incidentally, counts most of the FSTF banks as members.

Beyond that, the FSTF will “provide a clear collective demand signal” that finance “stands ready to accelerate the flow of capital towards all forms of emissions reduction, avoidance and removal projects globally”.

To which the only response is, of course it does. Finance stands ready to accelerate the flow of capital towards anything that is legal and, ideally, socially acceptable. That is its raison d’être. And if the capital flows involve lucrative sustainable finance products, so much the better.

This could be unfair, and the FSTF may do extremely valuable work. The track record of the SMI, however, does not raise high hopes for its offshoot. According to its own publicity, the greatest achievement of this royal venture in its first year of operation was organizing “more than two dozen” roundtables.

It has also launched a network of chief sustainability officers, a Natural Capital Investment Alliance, a “content platform showcasing … inspiring business innovations”, and the Terra Carta, “a framework for private sector acceleration and action”.

Distraction

The risk is that it is distracting time and attention from more worthwhile initiatives. If banks are serious about tackling climate change, there are plenty of things they can do internally and existing projects they could put their weight behind.

They could sign up to the Principles for Responsible Banking, an initiative that – unlike the FSTF – requires members to make firm commitments to assess their impact on people and the planet, set targets for improvement and report publicly on their progress.

More than 200 leading global banks have made that commitment, but Bank of America and HSBC are not among them.

Alternatively, big banks could use their immense lobbying power to promote any of a number of genuinely impactful policy measures, from the establishment of proper carbon markets to mandatory reporting using the standards set out by the Task Force for Climate-Related Financial Disclosures (TCFD).

Or they could just get on with working out how to meet their own net-zero commitments – something they have all the resources to do and which in any case, judging by this year’s letter to CEOs from BlackRock’s Larry Fink, will soon not be optional.

Of course, none of these options involve the opportunity to rub shoulders with royalty. They also require positive action rather than vague promises.

Lehrer commented that the nicest thing about a protest song “is that it makes you feel so good”. Unfortunately, the same might be said of certain sustainable finance initiatives. It is to be hoped that the FSTF is not one of them.