The destroyed port in Beirut

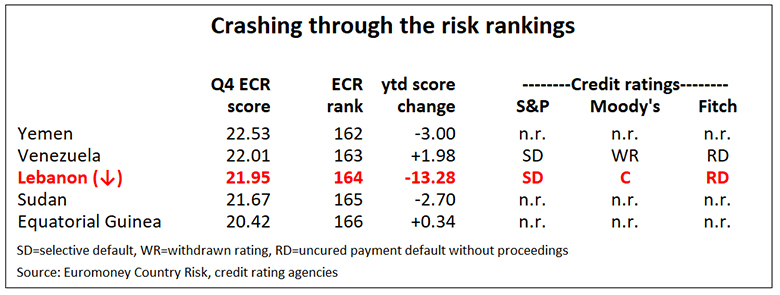

The impromptu special survey shows Lebanon’s total risk score downgraded further to less than 22 points out of a maximum 100, pushing the country deeper into the lowest of the five tiers containing the world’s worst default risks, to 164th out of 174 countries.

That puts it on a par with Yemen, Venezuela and Sudan in the global risk rankings:

Lebanon’s fall from grace is nothing short of dramatic for a country with such huge potential in a region where failed states are now becoming only too commonplace.

Thanks for your interest in Euromoney!

To unlock this article, enter your e-mail to log in or enquire about access: