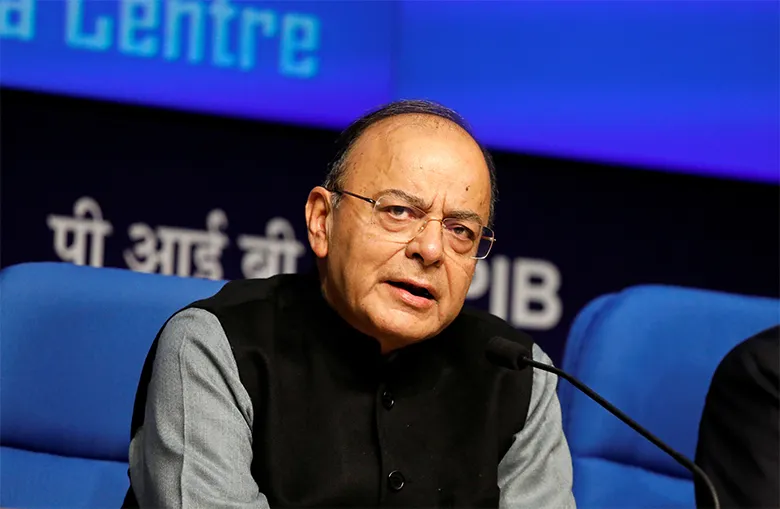

Arun Jaitley, the former finance minister of India

The passing of Arun Jaitley, the former finance minister of India, offers a chance to assess his legacy. History will judge him to have overseen some of the most momentous financial moments in the country’s modern history.

Jaitley was minister of finance and corporate affairs under Narendra Modi’s first government, from 2014 to 2019; he declined to be part of the next government following Modi’s election this year, citing ill-health.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access