France shows no sign of reversing its three-year-long negative score trend in the most recent ECR survey results, after analysts downgraded the sovereign’s score by 0.4 points to 71.9 in the second quarter of this year.

The country’s score decline makes France the second-worst eurozone performer after Slovenia – though mercifully it does not share that country’s banking problems– and pushes France further down ECR’s second-tier investment-grade category.

What’s more, the country’s budget deficit target – key to arresting the decline in its debt dynamics – looks set to be missed amid weak growth.

With a global rank of 21, France is considered riskier than Kuwait, Qatar and Taiwan – three countries that continue their ascent in the ECR global rankings. Countries in ECR’s tier two typically score between 65 and 79.9 – which can be equated with a credit rating of A- to AA.

|

Rising unemployment and a weak growth outlook suggest the French economy is sliding further into crisis and were cited by Fitch as reasons for downgrading the sovereign. Unemployment jumped to a 15-year high of 10.9% in May 2013.

Meanwhile, French growth figures show the economy entered a technical recession in Q1 2013, after French GDP edged down by 0.2% quarter-on-quarter in Q1 2013, close to expectations (median -0.1%, SG -0.2%). Meanwhile, Q4 GDP growth was revised higher to -0.2% quarter-on-quarter from -0.3%, according to a report by Société Générale.

“France has experienced two quarters in a row of contraction and is thus in a technical recession,” it states. “Earlier this week, the Bank of France forecast that GDP would increase by 0.1% quarter-on-quarter in Q2 13 (the same as SG’s forecast). Therefore, the recession in France would only be mild, not a severe one.

“The carry-over effect for 2013 GDP growth is now -0.3%. Reaching the government target of 0.1% this year would require that GDP growth quickens to rates close to 2.0% at an annual rate in H2 13. This looks unlikely and suggests that the new public deficit target of 3.7% will be missed.”

And an economic contraction in 2013 will be enough to send the government’s fiscal consolidation plans into disarray. Fitch now forecasts general government gross debt (GGGD) to peak higher at 96% of GDP in 2014 and decline only gradually over the long term, remaining at 92% in 2017.

A report by Fitch states: “Risks to the agency’s fiscal projections lie mainly to the downside, owing to the uncertain growth outlook and the eurozone crisis, even assuming no wavering in commitment to fiscal consolidation. A debt ratio that is higher for longer reduces the fiscal space to absorb further adverse shocks.”

Indeed, growing government debt levels caused Fitch to strip the country of its AAA rating on Friday, after it downgraded the country’s government rating to AA+, with a stable outlook.

However, Cyril Regnat, fixed income strategist at Natixis, does not think the downgrade will have an adverse impact on the country’s borrowing costs.

“France officially lost its AAA when Moody’s downgraded France several months back,” he says. “The market was already pricing in this move by Fitch and that’s why spreads between French and German bonds have been relatively stable over the last couple of months.”

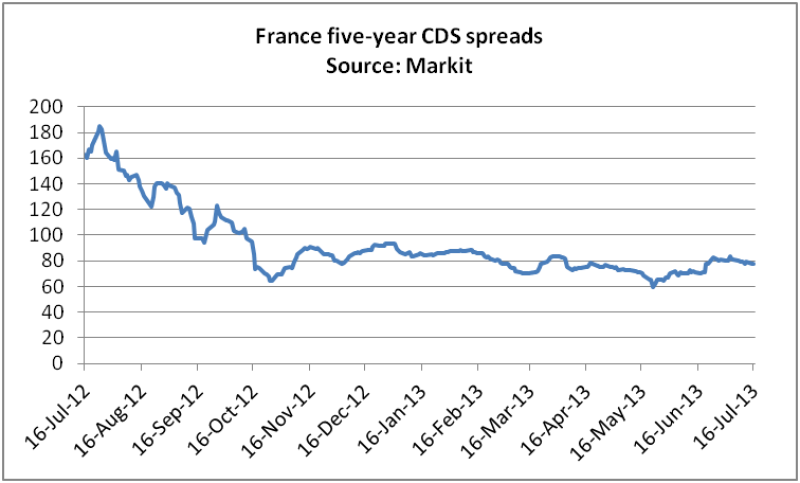

Indeed, the cost of insuring the country’s debt against default remains relatively stable and the country’s five-year CDS spreads fell to 78 basis points from 162bp compared with this time last year, according to data provider Markit (see chart below).

However, French economic fundamentals are deteriorating and the country’s growth outlook remains fragile. For this year, Natixis forecasts a contraction of -0.4% and 0.8 % economic growth for next year.

“The French government will have to reduce its fiscal deficit before thinking of improving its GDP growth,” says Regnat. “For this year, the fiscal deficit will be reduced by a very thin margin. The government is working to achieve a 3% deficit-reduction target, but I don’t think this will be sufficient – we’ll have to wait until 2015.”

With president’s François Hollande’s approval rating falling to 24%, the government will have an uphill struggle in rescuing the economy from another crisis. Hollande will need to commit his cabinet to an economic agenda that bolsters economic growth while easing the country’s debt burden.

Speaking of the government’s plans, Regnat says: “I don’t think the French government will add more austerity to an already rather austere policy. Recently, François Hollande reaffirmed his commitment to reduce the fiscal deficit to 3% by cutting public spending by €14 billion to reduce the funding gap.”

This article was originally published by ECR. To find out more, register for a free trial at Euromoney Country Risk.