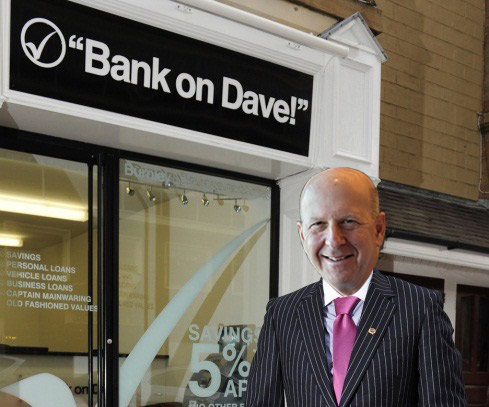

Bank of Dave, a heartwarming film about the creation of a community lender in the north of England, was a surprise hit on Netflix in January, allowing Dave Fishwick, the founder of Burnley Savings and Loans, to revel in positive coverage of his work.

Just over 3,000 miles away in New York, another bank head called David is having a less enjoyable start to the year.

Goldman Sachs delivered disappointing fourth-quarter and full-year 2022 results in January, which is increasing pressure on chief executive David Solomon.

A slump in profit to a level well below consensus projections by analysts was the proximate cause for a 6% fall in Goldman’s share price when its earnings were announced on January 17.

But a perception that the bank is floundering in its strategic direction – and underperforming arch-rival Morgan Stanley – is the bigger threat to Solomon’s long-term viability as chief executive.

A move to diversify into consumer banking by Goldman has been a costly experiment that is showing little sign of establishing the firm as a competitor to bigger banks such as JPMorgan or Bank of America.

The reception to Goldman’s investor day will be key to determining whether Solomon himself starts to seem like a liability as chief executive

Provisions for credit losses for 2022 were $2.57 billion, in a dramatic increase on the $357 million total for 2021 that was driven mainly by the poor performance of the credit-card portfolio within Goldman’s consumer banking business.

As if to add insult to injury, days after this loss was announced, there was a report that the Federal Reserve is investigating whether Goldman had proper risk-management controls in its consumer banking unit as it rushed to expand.

Combining substantial actual losses with an air of incompetence will be poorly received by Goldman veterans in longer-established divisions of the bank, who pride themselves on a reputation for excellence in risk management.

Goldman declined to comment on the report of a regulatory investigation into its consumer banking unit, which initially used Marcus as a brand name to build awareness with retail customers.

“The Federal Reserve is our primary federal bank regulator and we do not comment on the accuracy or inaccuracy of matters relating to discussions with them,” a spokesperson said.

Defensive

Solomon was already sounding defensive when talking about consumer banking on his earnings call with analysts a few days before the report about an investigation.

“We tried to do too much too quickly,” he said. “And of course, in the environment that we are in, it’s hard to go back when we started in that strategy six years ago.”

If that was an attempt to share the blame for strategic errors with his predecessor as CEO, Lloyd Blankfein, then Solomon is unlikely to find much sympathy, either inside or outside of Goldman.

As Solomon pointed out at another juncture in the earnings call, he has now been chief executive for 4.5 years, so the recent failures in consumer banking execution were made on his watch. He was also president and co-chief operating officer under Blankfein when the attempt to diversify from Goldman’s historic strengths in trading and investment banking was launched.

Solomon’s attempt to take credit for the continuing strong performance of Goldman’s markets business might also rankle with some veteran traders.

In a year when Goldman’s consumer banking experiment delivered hefty losses, and investment banking fees fell by 48%, the bank’s dealers had an excellent 2022.

Fixed-income revenues of $14.68 billion were 38% higher than in 2021, as Goldman’s traders were able to profit from volatility in the rates, FX and commodity markets.

Revenues in the fixed-income financing business that Solomon has promoted to boost client market share were higher, but most of the total – at $11.89 billion – came from old-fashioned dealing.

Solomon was nevertheless keen to take credit for all aspects of this success story, including application of business practices he imported from his own background as an investment banker, rather than a trader.

“We had never really thought about client market shares in our markets business,” said Solomon. “We had always thought about them in our investment banking business. And we really brought that ethos into the markets business.”

To be fair, he can point to metrics that reflect this progress and the fall in investment banking revenue in 2022 was in line with the industry-wide slump in deal fees.

Change at the top

But the reception to Goldman’s investor day on February 28 will be key to determining whether Solomon himself starts to seem like a liability as chief executive.

Solomon in effect asked for more time to sort out the problems at Goldman on the bank’s recent earnings call.

“The takeaway I would like investors to understand is when we see things, we look at things and we pivot. We are not married to things. We are willing to change,” he said.

But would a change at the top help?

Goldman could pivot from being the Bank of Dave to the Bank of John if investors show signs of unrest and a shift must be made at short notice.

John Waldron is president and COO, with excellent client relationships. However, he has an almost identical background to Solomon’s. Waldron made his name as a media-sector investment banker and had stints co-heading leveraged finance and financial sponsor coverage before becoming co-head of all investment banking in 2014.

Waldron was installed as president and COO soon after Solomon won the race to succeed Blankfein in 2018. The current partnership at the top of Goldman mirrors the one that Blankfein had with Gary Cohn, except that now a duo of investment bankers with long experience working together hold the top two jobs, rather than a brace of traders.

There is no other obvious internal candidate to spearhead a shift in strategy from the approach overseen by Solomon.

The only veteran trader left among the ranks of senior management – global banking and markets co-head Ashok Varadhan – has never shown much appetite for the spotlight or for roles designed to test his ability to manage teams away from his specialty of dealing.

Marc Nachmann, by contrast, shifted from a background as an investment banker to a stint as co-head of global markets and has now been given the challenging but potentially rewarding task of boosting Goldman’s performance in asset and wealth management.

That appointment only came in late 2022, so a further battlefield promotion might seem a step too far for Nachmann, as it would for Jim Esposito, one of the co-heads of banking and markets.

That could buy Solomon time to correct the perception that Goldman’s strategy is confused. The poor fourth-quarter results spoiled Solomon’s birthday and he will now hope to make it to his fifth anniversary as head of Goldman on October 1 without further weakening of his position.

Solomon will make a presentation at a Credit Suisse conference on Valentine’s Day; then he has the crucial Goldman investor day to address concerns about the bank’s direction.

Assuming that is reasonably well received, Solomon may be secure for the near term. Though if he wants to ensure he can celebrate a fifth anniversary at the top, he might want to take a break from performances as DJ D-Sol during the summer of 2023.