Daily trading turnover in long-dated UK government bonds is typically around £10-£12 billion. At the worst moment of the liability driven investment (LDI) debacle in late September, pooled funds managing assets of UK defined-benefit pension schemes were set to sell £50 billion in a single day: a vast fire-sale with no buyers.

Having already sold off by 160bp in three days, the biggest move in 200 years, UK government bonds changed hands at one point at 50% of face value. That’s a distressed price more typical of an emerging country heading into IMF negotiations on debt restructuring. Some LDI funds were close to zero asset value and insolvency.

This was the hottest moment so far in a rolling conflagration across developed market government bonds that has scorched investors badly this year. It burned out quickly. The Bank of England stepped in and promised to buy up to £65 billion. The country’s finance minister and prime minister were both replaced within a fortnight.

UK government bonds changed hands at one point at 50% of face value. That’s a distressed price more typical of an emerging country

But though a measure of order has returned to UK gilts, the Bank of England must now raise rates and, as the fight against inflation forces yields higher and increases the cost of refinancing the now vast stocks of government debt, all around the leading economies investors are asking difficult questions about debt sustainability.

Central banks, the marginal buyers for the past 14 years, have bought trillions of pounds, dollars, euros and yen worth of government bonds and are now desperately trying to get out from under and shrink their balance sheets before the whole Ponzi scheme collapses around them.

Has it already gone on so long that these debts are unrepayable?

Sustainability

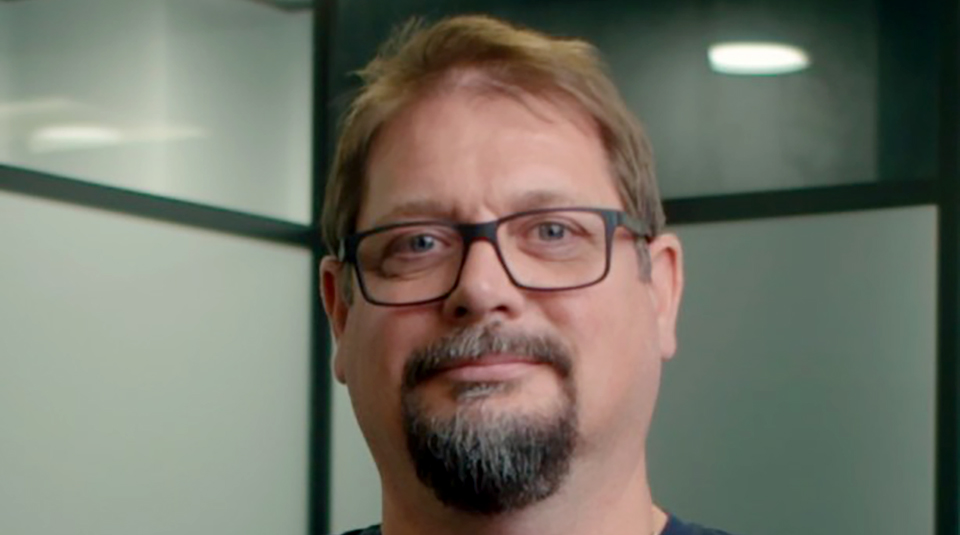

“What scares me the most is that while current levels of debt look elevated, they ignore the unfunded liabilities, for example of state and public sector pensions,” says Ryan Shea, crypto economist at Trakx, a provider of digital index tracking instruments to institutional investors. Shea has been studying the issue for more than 30 years. As an economist at Lehman Brothers, he co-authored a study in 1994 on the sustainability of public pensions. “Our conclusion back then was: ‘this isn’t going to work.’ And not much has been done about it since,” Shea says.

He points to studies by the OECD which add the cost of future unfunded pension liabilities and healthcare for an ageing population and suggest that, even without these costs, debt-to-GDP across developed economies would be on track to rise from around 100% today to 140% by 2060. Add those costs – typically left to taxpayers – in as well, and OECD debt-to-GDP ratios rise to 200% by 2045 and 300% by 2060.

“The underlying problem is fiscal incontinence across many governments,” Shea says. “Fiscal policy has been used and abused in the era of quantitative easing, especially during the Covid pandemic.”

It is already too late for easy answers. Reneging on public pensions promised to older people who have worked all their lives isn’t popular and neither is cutting healthcare. Policymakers have talked for decades about growing GDP faster than debt by improving productivity through structural reform. But the short-term costs of investment and education and the delayed pay-offs don’t fit election cycles. So, structural reform never happens.

Shea thinks that governments will likely exert fiscal dominance over central banks and bring them back to bond buying. After all, they give independence and they can take it away.

However, the biggest example of yield curve control, in Japan, where the central bank caps the yield on 10-year bonds, is not inspiring. For four days during the gilt sell-off, Shea points out, there was not a single reported trade in 10-year Japanese government bonds. That market barely exists anymore. However, yields are climbing beyond the points of yield curve control as inflation heads up even in Japan and the currency collapses.

Shea describes global financial markets as a thin layer of water on a flat tray. It doesn’t take much of a tilt for it all to flow one way, at the moment out of world markets and into the US. If more countries attempt yield curve control, they may need capital controls as well.

“We have been talking for a long time about the Japanification of Europe,” says Shea. “We should be asking how Japan gets out of this. Because hoping for a significant increase in output driven by productivity growth to get debt-to-GDP down, is like pinning hopes on a Deus ex Machina miracle.”

He adds: “If I were a young Japanese person, I would be putting all my spare money into bitcoin.”

Governments will try to get out from under high debts in the traditional manner, by inflating them away, helped by as much fiscal consolidation as scared voters will allow through public spending cuts and tax increases.

Crypto opportunity

Where crypto might really come into play is with central bank digital currencies (CBDC). While the deluded and brief UK government of Liz Truss and Kwasi Kwarteng promised tax cuts to boost growth, other governments are more likely to raise taxes to ease deficits and keep a lid on debt growth while letting inflation, hopefully moderate inflation, do its work.

The famous Laffer curve shows that when governments raise taxes beyond a certain optimal point, their tax take declines as people lose the incentive to work or to set up businesses and concentrate instead on finding innovative means of tax avoidance.

Almost every central bank is now experimenting with CBDC, forced into it by the threat to their control of money supply from Facebook’s now abandoned Libra. The public sees no need whatsoever for CBDC: private bank money is already digital and users, protected by deposit guarantee schemes, regard it as equivalent to public money.

But governments, not central banks, will likely force the pace.

Tax authorities would love CBDC in order to make tax avoidance difficult – no bundles of bank notes for builders, cleaners, nannies – and tax collection cheap and automatic.

There is an opportunity for private cryptocurrencies here as well, if people become more familiar with digital wallets, private keys and all the infrastructure associated with CBDC but take against the loss of privacy and turn hostile to state authorities simply withdrawing tax from their accounts – sorry, digital wallets – in return for lousy public services.

States can declare it illegal to transact in cryptocurrency. But they can’t stop it from happening.