By Steve Downer, Nigel Bance and Julia Bright

Dinner at the Royal Thames Yacht Club in London on November 19, was a splendid occasion. The guests were the cream of Britain’s banks and corporations. The host: Sir David Nicolson, Conservative Member of the European Parliament, chairman of Rothmans International, and former chairman of British Airways. But the shifty-eyed, pudgy guest of honour wasn’t a fellow Briton, nor a European politician; he was an Argentinian banker, José Rafael Trozzo. Within months of that dinner, Trozzo was on the run, with a warrant out for his arrest.

Trozzo was president and owner of Banco de Intercambio Regional, which until March 28, was Argentina’s largest private bank, with deposits of around $1 billion. His connections spanned the globe. He was a member of Opus Dei, the Catholic society which numbered Spain’s most powerful people among its members, and a friend of Admiral Emilio Eduardo Massera, who represented the Argentine Navy in the junta that ousted Isabel Perón in March 1976. Trozzo wanted, above all, to be Argentina’s foremost international banker. Sir David Nicolson was only one of his distinguished friends and connections. Today, Trozzo is in hiding, leaving behind a banking failure and bitter memories in the country whose patriotic citizen he claimed to be.

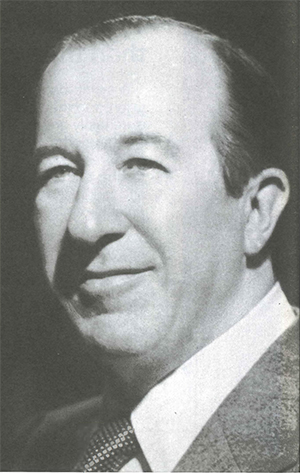

|

| José Rafael Trozzo: did he see himself as Napoleon? |

To the dinner guests at the Royal Thames Yacht Club (whose members include members of the royal family and a former prime minister, Edward Heath), Trozzo was simply a friend of their host. At least one fellow guest disliked what he saw. “He blinked all the time, looked incredibly shifty and never looked you in the face,” recalled the guest. “One’s feeling was: Christ, who’s this? But he was very articulate, very calm, and was clearly very anxious to state his and his country’s case, to dispel establishment rumours. He didn’t make impassioned pleas for more money to be invested in Argentina, but talked much more about his country’s success and the success of his bank and how it had grown. It was a small effort at personalized marketing and one had to give him 10 out of 10 for trying.”

This banker with the magnetic personality had impressed more than the British. An adviser to Banco de Intercambio Regional, until his death last year, was the US ambassador to Argentina, Robert Hill. Moreover, Trozzo’s bank was a member – and a very active member – of an exclusive international club, the Centre Européen de Coopération Internationale, or Ceci, whose president and founder is Olivier Giscard d’Estaing, brother of the French president.

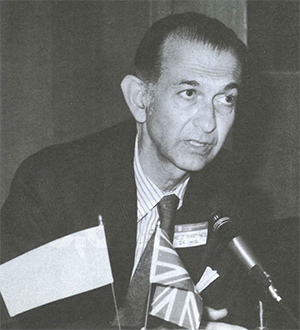

Today, naturally enough, most of those who’ve been associated with Trozzo squirm at the memory. Sir David Nicolson, for instance, was understood to be highly embarrassed by Euromoney’s investigation. Although Sir David was never on Trozzo’s payroll, he was Trozzo’s guest for a short stay in Argentina (in August 1979) and would rather he hadn’t been. Nicolson had met Trozzo through Robert Hill in 1977, and had heard Trozzo’s grandiose strategy for establishing an international advisory board for Banco de Intercambio that would include both Hill and himself.

Much more willing to talk was Laurence Levine, Trozzo’s New York lawyer. Levine told Euromoney that members of BIR’s international advisory board received $1,500 a month retainer plus a payment for each meeting. According to Levine, there were two meetings – one in New York and one in Washington. Another, scheduled for Miami, never took place. The board consisted of five members, all American. “Nicolson would have made six.”

Sir David doesn’t recollect the Board ever getting under way. “I never sat on the Board although I’d been asked. It was never properly set up, due to Hill’s death.” Last year Trozzo invited Nicolson and his wife to visit Argentina at BIR’s expense. Nicolson accepted but found he could only go there – alone – for a few days. The former British Airways chairman explained his reasons for going: “It seemed a good opportunity to have a holiday and find out about Argentina – which I’d never visited before – at the same time as doing a bit of public relations for the European Parliament. Basically, a social PR exercise.” He found the banker’s influence impressive.

“Trozzo had an amazing number of influential contacts,” Nicolson recalled.

“He arranged for me to appear on television, and I even met the ruling junta – an admiral, an air marshal, and a general.” As Nicolson remembers it, he viewed it at the time as an opportunity to talk about the European Parliament, then newly constituted, but “what I did notice was Trozzo’s unpopularity vis-à-vis the other Argentinian banks, and the Central Bank of Argentina. I felt he was far too close to the politics of Argentina and the junta.”

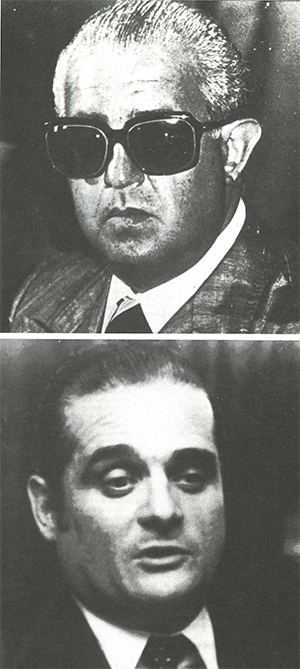

|

|

|

SIr David Nicolson, chairman of Rothermans International and of the European Channel Tunnel Group, Conservative member of the European Parliament and, once, Trozzo’s guest. |

As it happened, Trozzo was then at his peak. But on March 28, after a series of investigations by the Central Bank of Argentina, and after the Buenos Aires headquarters of Banco de Intercambio Regional had burnt to the ground, leaving its records and its files in ashes, the axe came down. Banco de Intercambio Regional, the pride and joy of José Rafael Trozzo, was ordered into liquidation by the Central Bank because of alleged unsound lending practices. A warrant was issued for Trozzo’s arrest. As we went to press, Trozzo was reported to be in hiding in Mexico.

Trozzo came highly recommended to Levine. Their first meeting was in 1976 at the Plaza Hotel in New York. Trozzo told Levine at the meeting (conducted in Spanish as Trozzo couldn’t speak English) that BIR wanted a branch in New York. “I understood that Trozzo wanted to use our firm because we had advised Banco de la Nacion Argentina in setting up its branch in New York,” said Levine. Trozzo showed Levine an impressive list of 25-30 US banks that had opened credit lines with BIR. Many were just regional banks: but the list did include Morgan Guaranty. “Trozzo was particularly proud of that relationship,” said Levine. Tony Gebauer, head of Morgan Guaranty’s Latin American Department confirmed to Euromoney that there was a facility. “However,” claimed Gebauer, “that was soon stopped despite plenty of outside pressure. We didn’t like what was going on at that bank.” Most of the credit lines were small, no more than $1 million each.

Trozzo wanted Levine to act for BIR in its bid for branch status in New York. He wanted Levine to write a memorandum in both Spanish and English outlining all necessary requirements for a branch which he could then present to Argentina’s Central Bank. “Trozzo was smart,” recalled Levine, “he even produced a copy of the memo I had written for Banco de la Nacion for its application.” Levine checked out BIR. “We really never heard anything bad. But we were perturbed later on when we read that Euromoney article about BIR in 1978.”

Ironically, Levine was in Argentina when BIR closed on March 28. “I had been postponing my trip to Buenos Aires for some time,” said Levine, “but I finally arranged to go on March 22. I wanted to make this trip a personal trip only. I did not want to get involved with BIR.” Levine even went as far as writing a letter to Walter Klein, Martinez de Hoz’s deputy at the Ministry of Economy, before he left New York stating firmly that the trip was of a personal nature and that he would not be paying visits to BIR or the Ministry of Economy. Levine read about BIR’s collapse in the Buenos Aires newspapers on Saturday, March 29. He quickly returned to New York the next day.

Levine would not say why he went to Argentina just at the time of the collapse. Sources in New York suggest that as he represents another Argentine private bank he wanted to ascertain the possibility of his other client taking over BIR’s New York branch.

Trozzo had an amazing number of influential contacts – Sir David Nicolson

Coincidentally, Levine also acted for the infamous David Graiver, a nationalized Argentinian who was one of Peron’s closest financial advisers and the banker for the Montaneros, one of several Argentine guerilla organizations. Levine told Euromoney that he was unaware at that time of Graiver’s political contacts.

Fac rectum nec time was the Latin motto chosen by Trozzo for his bank. It means: “Work correctly and you have nothing to fear.” The bank’s shield features a condor, intended to represent strength, Trozzo said in a magazine interview last year. The shield’s blue background is supposed to indicate justice. It is the same blue as used in Argentina’s national flag, “and the fact that the condor’s wings overlap the margin indicates our international ambitions,” said Trozzo.

Trozzo is in his mid-50s, is married, and has nine children. In 1974 one of his sons, who was studying economics, died in an accident at the age of 23. Trozzo said: “It was a terrible accident and it affected me tremendously. I had plans for him and me to manage all of this (his business) together.”

A year ago, when asked if he had anything to say to the people who had deposited money and confidence in his bank “and who now are anxious and on the verge of panic” Trozzo was quoted as replying: “I have nothing to tell them because that has not happened. BIR has 350,000 accounts and nobody has rushed to withdraw his money or to throw himself from a window. The bank’s motto is clear: ‘work correctly and you have nothing to fear’.”

Trozzo once boasted: “I live like a poor man. I don’t smoke. I don’t drink. I eat frugally.” His thirst, it seems, was for prestige. His bank’s annual report, for example, apart from portraits of dead Argentinan heroes, is littered with photographs of Trozzo addressing trade meetings, with such famous people as Argentina’s Economics Minister José Martinez de Hoz carefully worked into the background. There is even a photograph of Trozzo with President Videla. When Euromoney last month asked Martinez de Hoz about Trozzo’s political ambitions and his reported friendship with Admiral Massera, the minister replied laconically: “He was a man who was making the rounds. “

On February 5, 1965, José Rafael Trozzo, then a young lawyer, bought, together with a small group of his friends, a tiny bank called Banco Popular de Corrientes, close to the border with Paraguay. According to Argentinian banking folklore, the building was in such an advanced state of decay that, when it rained, water leaked through its zinc roof. The employees are supposed to have used their umbrellas both inside and outside the bank. But the Banco Popular de Corrientes, founded in 1898, was the beginning of BIR.

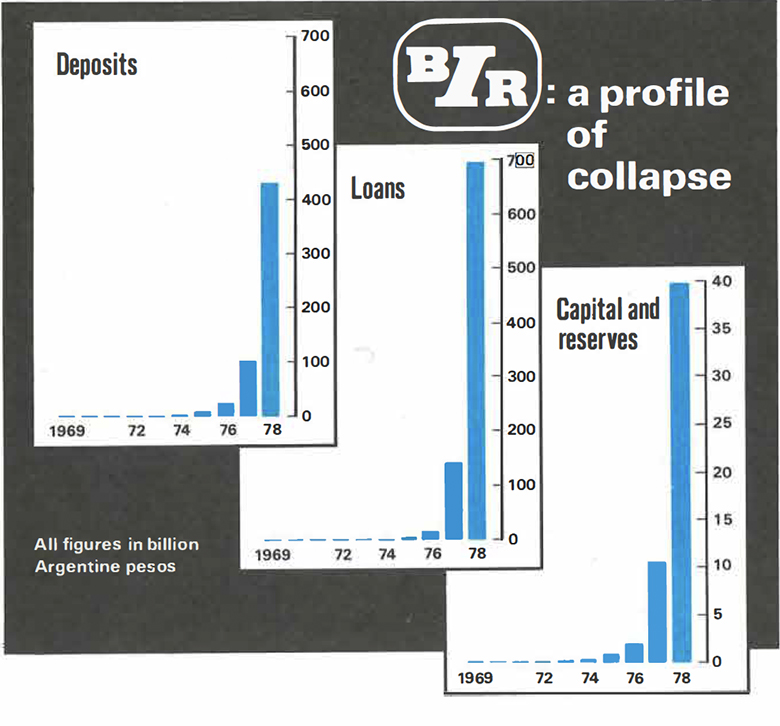

In a country where inflation was more than 1,000% at one time, and still runs at 100%, a bank’s nominal growth may be misleading. But by comparison with other banks, Trozzo’s bank grew at a breakneck pace. According to one European banker in Buenos Aires, the bank was not even listed among the top twelve as recently as March 1977. But, over the next year, BIR’s deposits grew by 1,049% against an average growth of 276.3% for the Argentine banking system as a whole.

“In this country it is very difficult to measure the borrowings of banks” commented a banker in Buenos Aires last month. “Banks are only forced to publish their balance sheets once a year. If you have inflation running at 120% (actually, the latest figure, for the first quarter of 1980, is for an annual rate of 103%), then a variation of just a few months in balance sheet debt can change the whole picture. The situation may have changed completely.”

Inflation aside, the Argentinian banking system was virtually impossible to police, largely because the system had developed its own way of survival under different political regimes.

Between 1946 and 1955, Juan Domingo Perón was President of Argentina. The Peronists believed that if you controlled the financial system, you controlled the economy. They centralized all the nation’s deposits. Two years after Perón was overthrown in a coup, deposits were freed again. Against that background, banks learned to live by their wits, as bankers will.

BIR was the sewage system of the banking business – Alejandro Reynal, Central Bank of Argentina

In 1976, after the overthrow of Isabel Perón, a free banking system was restored, but the Central Bank also guaranteed all deposits to the public. Argentinians, because of the high rates of inflation, are very conscious of rates for time deposits. The Central Bank’s guarantee tempted them to deposit with the bank that offered the highest rates, regardless of that bank’s reputation.

“The laws of competition went out,” said a Buenos Aires banker. “It went against all good banking practices. You had a situation where, overnight, a bank would increase its interest rates, say, by 15%. The staff would work until 11 p.m. and hand out coffee and biscuits to people queuing to put their money in.” That banker added: “Four months ago we were paying up to 84% on deposits. We adjust our rates once a day, sometimes twice.”

For a glorious time, Trozzo’s bank throve on the system. Francisco Soldati, director of Argentina’s foreign borrowing at the Central Bank, recalled: “Trozzo used to pay up to nine points more than anyone else in the market. Then he would lend to second or thirdrate borrowers. He wanted to become the biggest bank in the country, and he did.” (When it was closed down, Banco de Intercambio Regional was second in size only to Banco de la Nacion.) “There was totally irresponsible management at the Bank.”

In an interview with Euromoney last month, Alejandro Reynal, VicePresident of the Central Bank, alleged: “Banco de Intercambio Regional was the sewage system of the banking business.”

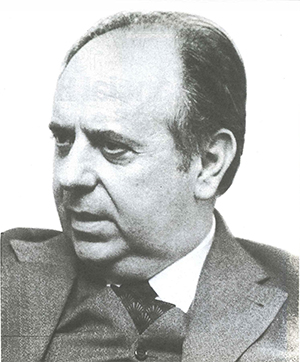

|

|

|

Alejandro Reynal, vice-president of the Central Bank of Argentina and responsible for the supervision of the domestic banking sector. He took over late in 1979 from Christian Zimmermann, who retired through illness and now works for the Inter-American Development Bank. |

Reynal said: “BIR had more than doubled its size in real terms in two years. When the new financial institutions law was passed in May 1977, there were 740 financial entities brought under the supervision of the Central Bank. Up to then only about 50% of them were controlled by the Central Bank. Some were under the control of the Welfare Ministry. The monetary system in 1976 (when the coup occurred) was only 50% under the bank’s control. The rest was absolutely clandestine, handled by exchange houses, by non-authorized finance companies, or by money desks.

“This was a consequence of having fixed interest rates that bore no relation to inflation. So people flew away from the legalized system of the Central Bank and went to black market intermediaries. The others went to foreign exchange operations and others, and the result was a de-monetization of money. With inflation at 900% per year, and the largest interest paid by banks standing at 45%, people ran away from money. Things got so bad that the relation between total monetary resources and GNP was about 6%. Normally, monetization ratios are about 50 or 60%. In Argentina in the 1960s, it was about 30% or 40%. But inflation and unrealistic interest rates made people shy away.

“The situation was so bad that the decision was taken in 1977 to lift most controls that had been imposed on the financial system. Exchange controls were lifted. Interest rate ceilings were abandoned. The Central Bank no longer controlled the ultimate destination of credit.

“Before, the Central Bank would determine that a bank should give, say, 10% to industry, 15% to agriculture and so on. We said the only way to create peso savings here was to free interest rates. For a normal industrial company at that time, it paid to have one peso in money, and five pesos in debt. All the money you could borrow was cheaper than the appreciation of your assets. It always paid off to have debts. When the opening of the financial markets was implemented, some people did not recognise the dramatic change it implied and continued to be heavily in debt, despite the Government’s warnings. In particular, those who could not restructure their working capital started having problems.

“Together with these changes, the political decision to guarantee all deposits was taken. Some institutions decided to attract deposits by the mere device of increasing interest rates. So it is true that the BIR and Los Andes banks grew much more than average by the simple vehicle of paying depositors high interest rates. Apparently what happened with BIR is that it had bad loans with industrial companies that were experiencing difficulties. The BIR was the sewage system of the banking business.”

But, in the meantime, Trozzo was having his days of glory, setting up offices overseas, and dreaming grandiose plans of international advisory councils modelled on those of Morgan Guaranty and Chemical Bank. A full branch of BIR was set up in New York in 1978, and a representative office in Washington ahead of the IMF annual meeting in Washington that year, presenting Trozzo with a wonderful opportunity to have visiting international financial dignitaries at the reception for the opening. Being Trozzo, he seized the opportunity.

But his most notable connections were in Paris, home of Ceci, an international club founded in 1975 by Olivier Giscard d’Estaing. Ceci’s founding members were European banks and corporations who were concerned that Japanese and American corporations were squeezing them out of Third World business and investment opportunities.

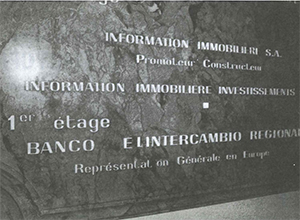

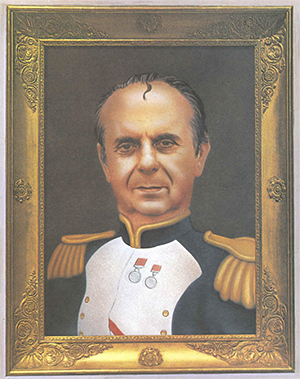

|

| To reach the Paris office of BIR, in the Boulevad des Capucines, one makes one’s way past the Hole in the Wall bar and into the dark entrance which BIR shares with a sex cinema and the Opera Mandarin Chinese restaurant. The office is on the first floor. |

BIR became a member of that club, acting as Ceci’s representative in Argentina. Its membership was a huge success. Last autumn, Olivier Giscard d’Estaing led a Ceci mission to Argentina. The Ceci people, like Nicolson, were astonished by Trozzo’s contacts and influence in Argentina.

Paris was useful for more than the Ceci connections. As it turned out, it was the French banks who were to keep lines of deposits out to BIR to the end. With his typical zest, Trozzo won over a senior French banker to be his European representative: André Anstett, former head of the Latin American department of France’s largest bank, Crédit Lyonnais.

The Paris representative office of Banco de Intercambio Regional opened, in the splendid style that was Trozzo’s hallmark, in February last year. Among those attending: Olivier Giscard d’Estaing.

Today, the office of BIR in Paris in the Boulevard des Capucines is still functioning after a fashion, but Anstett’s health has been failing. The collapse, he claimed during an interview with Euromoney at the BIR office last month, could not have happened at a worse time. “I was on the way to modifying the image of the bank” he said. “As an international banker, I wanted to get it across that the bank was run on international lines.”

When BIR was shut down, it had around $35 million in outstanding deposits from 40 foreign banks, many of them French. It’s thought that the total was much greater at one time, and that, as the rumours about BIR increased during 1979, there were substantial withdrawals of deposits by foreign banks. By the end of last year, most of the American banks, for example, had withdrawn their deposits with BIR. An American banker in Buenos Aires said: “There were approaches to us for lines of credit, but we recognized he [Trozzo] was growing too fast. We thought the bank was over-extended. We could see the difficulties he was getting into.” Some Argentinian banks also withheld credit.

Roberto Bullrich, President of Banco de la Provincia de Buenos Aires, confirmed to Euromoney last month that Trozzo had approached his bank’s Los Angeles agency for a credit line of $1.5 million. “We refused,” recalled Bullrich, “and at the same time we stopped all credit lines.”

|

|

|

The nameplate stays – but only in the dark hallway of the Paris office, international lifeline of BIR, whose opening ceremony was attended by Giscard d’Estaing. |

According to Anstett, it was only in February of this year that he learned of the full difficulties at BIR. He claimed that he had received nothing but positive information about the bank from the Argentinian Central Bank. “However, I was aware that the portfolio included many business failures. BIR was badly run. Many of the Argentine private banks aren’t, unfortunately, run by professionals.”

Curiously, in the light of events, Anstett is proud of the Crédit Lyonnais relationship with BIR. While at Crédit Lyonnais he persuaded the bank to make a direct loan of $15 million to Argentina’s Central Bank in late 1975. During the Isabel Perón chaos, Crédit Lyonnais was the only major bank in the world prepared to lend to the country. Anstett also used all his powers of persuasion to get the French banks to participate in the $1.2 billion rescheduling of Argentina’s foreign debt in 1976. “That took a lot of convincing” said Anstett last month. “No-one trusted the Argentinians – even the team that did the renegotiating.”

It was Anstett’s job to ensure continued credit lines from Europe for BIR. This he did to good effect, opening up credit lines not only in France, but in Germany, Italy and Britain, with Crédit Lyonnais, Crédit Agricole, and Banque de l’Union Européenne in France; Berliner Handels-und Frankfurter Bank, Bayerische Landesbank and Vereinsbank-und Westbank (40% owned by Bayerische Vereinsbank) in Germany and in Britain with Barclays, Midland and Williams & Glyn’s. In Italy, Banca d’America e d’ltalia had lines. The French exposure is the largest: Crédit Lyonnais had deposits with BIR of $5 million, Crédit Agricole $2 million and Banque de l’Union Européenne $1 million. Crédit Lyonnais, however, was not excessively concerned about its $5 million outstanding; according to JeanLouis Tournigand, deputy head of Crédit Lyonnais’ Latin American department, that amount has now been reduced. But in any case, a banking collapse involving interbank Eurodollar deposits of $35 million is not anything approaching a threat to the health of the Euromarkets generally.

Until April 13, when the foreign bank depositors with BIR were informed by the Central Bank of Argentina that all advances made by them to BIR would be treated as documentary credits, and would be subsequently guaranteed by the Central Bank, some of the foreign banks had not been as relaxed as Crédit Lyonnais. One European banker said: “Crédit Lyonnais may be able to take it on the chin, but we certainly can’t!”

With hindsight, there are plenty of bankers, both inside and outside Argentina, who say they saw the collapse of Trozzo’s bank coming. What everyone did see, in June last year, was a fire at BIR’s headquarters in Buenos Aires. It killed three people, and destroyed the bank’s computer and records room. At the Central Bank last month Francisco Soldati recalled: “We were inspecting the bank at the time. It was a general inspection and had been going on for two weeks. Some files were not available afterwards.”

According to Soldati, the police and fire brigade said that the fire had started accidentally. Soon after the fire, Trozzo announced that he would build an 80-storey building to replace the burnedout structure. (Trozzo wanted it to be the tallest building in South America.)

|

|

|

José Rafael Trozzo: the fire at his headquarters killed three people and destroyed the records. |

Acquaintances in Buenos Aires recalled that, when in the city, Trozzo was guarded night and day, either at his bank or at his smart apartment in Avenida Alvear, one of the smartest areas in the city. His private life, unlike his business affairs, never made the headlines. Generally an untidy dresser, he shocked the diners of a plush restaurant in Buenos Aires when he arrived wearing a T-shirt rather than a suit. “When rumours began to intensify there was a considerable change in Trozzo,” said one senior Argentine banker. “From being usually tranquil, he became very nervous.”

But Trozzo continued to invite weekend guests to the island he owned in Bariloche, a winter resort. Trozzo had bought the island from Jorge Antonio, a close associate of Perón, now living in Spain.

Trozzo is a fully qualified lawyer, according to himself, in an interview some time ago. “But I never liked the profession because to succeed you always have to be defeating somebody. I have always been more attracted by finance and economics. The money I have made I have made as a financier. I have never been affiliated to any political party. I’m a man of the centre, a typical Christian Socialist.”

An enthusiast of Argentinian painting, and of dogs, Trozzo once organised a world canine exhibition in the resort town of San Carlos de Bariloche, in Rio Negro province. An Argentinian banker, who said Trozzo offered him a partnership in the late fifties or early sixties, called him “a religious fanatic”. And a former consultant to his bank said: “He was the most arrogant man I ever met. If you’d told him he could be the Pope, he’d have agreed with you.”

Today, it’s apparent that Trozzo doesn’t have a lot of friends left. But he was a member of Opus Dei, a powerful body of traditionalist Catholics, and had managed to become a member of other bodies. Said an American banker who knew Trozzo well: “Someone who can build up a bank and do what he has done has to be driven by some force above normal. I think the man was dedicated to the profit motive.”

Trozzo was an aggressive publicist, and also a publisher in his own right: he owned two newspapers. To capture new customers for his bank, he mounted a vigorous newspaper advertising campaign, urging prospective parents to open an account at BIR for their unborn children, earning the bank the nickname “The Bank for the Unborn Child”.

“He was a fantastic public relations man” said one acquaintance. Trozzo ran seminars and conferences in a bid to promote Argentine exports. Martinez de Hoz, the Economics Minister, was obliged to be present at many of them.

Did Trozzo have political ambitions? Buenos Aires at one time hummed with reports that Trozzo wanted to replace Martinez de Hoz as Economics Minister, perhaps under Admiral Massera if the latter were to succeed President Videla when he steps down next March. (Massera is now a civilian again. His political power has waned and his chance of succeeding Videla has vanished.)

A European banker in Buenos Aires commented: “I don’t think Trozzo had political ambitions. He only wanted protection for his bank.”

According to the Central Bank’s Alejandro Reynal: “We cannot trace any direct or indirect relationship with high military officers. It’s normal for a person with problems to try to tie himself with high-ranking military officers.

“I have to say that, to my knowledge, there was never a case where a high military officer tried to intervene. On the contrary, there was a complete hands-off policy. But it’s true that, every time a businessman gets into trouble, he pretends he has people who can advocate on his behalf.”

The major puzzle to many is why, if the Banco de Intercambio Regional had been suspect for so long, the Central Bank didn’t decide to close it down sooner. In December 1978, Euromoney reported that the Central Bank’s then vice-president, Christian Zimmermann, had sent in his inspectors five times to examine the books, but that the inspectors had been satisfied with the results. A lesser puzzle, arising from that, is why New York banking superintendent Muriel Siebert then allowed BIR to open a full branch in New York.

|

Argentina’s banking law limits the bad debt to net worth ratio to 30%. The Central bank alleges that, in BIR’s case, this ratio had reached an astonishing 200%, possibly more.

Alejandro Reynal said: “How could the Central Bank let it go so far? It’s very difficult to say when the time has come for a hard decision in this field. The Financial Institutions Law prescribed a black or white solution.

“Either you let a bank do what it wants, or you liquidate it. During the six months before the liquidation every effort was made to have the bank sold by its owner, to change its management, to increase its net worth. Every single course of action was investigated. When the decision (to liquidate) was taken on March 28, it was because the Central Bank could not see any possibility of keeping the bank going. It had lost between two and three times its net worth in bad loans, which was hidden. With the bank supervisory system here, if you renew everybody’s loans the day of maturity it’s difficult to know who has the ability to pay and who has not. The bank had been playing this game.

“It’s difficult to agree on the timing of a measure,” Reynal went on. “The interest of the depositors has to be balanced with the interest of 3,000 employees, the economic impact of the decision, the interest of suppliers of credit, clientele, and shareholders. Foreign bankers were absolutely aware this bank had had problems for years. Most of them based here, or travelling, knew this bank was experiencing serious problems, to such an extent that BIR had only $35 million in lines with foreign banks. Banks four times smaller had credit for $150 million. All bankers abroad knew this bank was in serious trouble. The few that stayed in did so because they didn’t believe the Central Bank would ever dare take corrective action, or they were making so much money that they thought the risk was worth taking.”

According to Reynal: “Everyone who means something comments favourably that finally the BIR has been done away with. It’s obvious that, before this liquidation took effect, Dr. Trozzo made every effort to save his bank. It was made very clear to him that the only way he could save the bank was either to bring in new money, or to sell the bank and to put the proceeds back into the bank.”

|

|

|

Franciso Soldati, Central Bank of Argentina |

What has also emerged is that Trozzo had hired several Central Bank officials to work, at higher salaries, at Banco de Intercambio Regional. Asked about this, Reynal replied: “Dr Trozzo decided to hire some inspectors, and there are legal investigations going on. Under the law, you cannot go to work for the companies that have been under your supervision. Five or six people went.”

There were certainly attempts by those who run the Central Bank to bail out BIR over the last year. Levine and Trozzo spoke together on the phone in January this year (their last contact). Trozzo told Levine that there was either the possibility of a merger or of raising new capital. Levine suggested that Trozzo should find a foreign bank to take a major participation in BIR. Levine pointed out that Andre Anstett, BIR’s Paris representative, had heard of one European bank willing to buy into BIR. (It was rumoured that a major Spanish bank was interested.) Trozzo turned the idea down: he told Levine that Argentina’s Central Bank would not allow the country’s largest bank to have a major foreign shareholder.

Martinez de Hoz called Trozzo into the Central Bank several times last year to discuss ways of saving BIR. He told Trozzo to raise an extra $125 million in new capital or to sell a considerable proportion of his 95% shareholding.

There was also a rumour that one former senior member of the Central Bank also had made a bid for BIR. That would not be surprising: many of the economic team working with Martinez de Hoz come from the private banking sector. Some maintain substantial shareholdings in both commercial banks and finance houses. Francisco Soldati, for instance, has a shareholding in Banco de Credito Argentino. Soldati’s father, before he was murdered by Montanero guerrillas in the centre of Buenos Aires last year, was chairman. And Soldati’s brother is a director of Arfina, one of the smaller commercial banks which has recently been upgraded from a finance house.

We tried to find people who were interested in buying it. Nobody was interested in buying it. – Franciso Soldati, Central Bank of Argentina

JSome of the rescue attempts became publicly known. On March 27, 1979, the Economic Survey, a weekly economic bulletin edited in Buenos Aires and sold by subscription only, published a story on its front page under the headline: “The end of an adventure.” It reported that Raul Pinero Pacheco, a businessman, was interested in buying the BIR.

Pacheco headed a syndicate which included the Patron Costa family, prominent in the Argentine sugar industry. Just before BIR’s closure this group had begun to rearrange the management structure of BIR and had hired several Argentine bankers from the Buenos Aires office of Citibank. Pacheco and Trozzo are old friends: Pacheco had been a client of BIR for several years.

|

|

|

In jail: Hector Greco (top) head of the Los Andes Bank, and Luis Alberto Oddone (below), head of Banco Oddone. Both banks, however, continue to operate under trustees. |

The BIR denied the report and organized a press conference at which Pinero Pacheco himself echoed the denial. According to Francisco Soldati, however, Pinero Pacheco was to have received 20% of the bank’s ownership after six years of giving it financial support.

Soldati said in an interview with Euromoney: “We reached the conclusion that many of BIR’s loans were bad loans… as there was no solution, we liquidated the bank. We tried to find people who were interested in buying it. Nobody was interested in buying it. Nobody knew how many contingencies the bank had. Of the bank’s total portfolio, only 45% is of normal execution. The rest is in arrears, or in difficulties, or cannot be repaid. We don’t know how much it will cost the Central Bank.” (By early May, the bank is said to have paid out more than $2 billion to depositors of BIR. and the other three banks that got into difficulties.)

A European banker in Buenos Aires commented: “How the hell did the Central Bank allow it to get into this situation? Every single bank turns in a confidential balance sheet to the Central Bank every month. So it depends if you have the right figures down. What happens if you carry on not reporting a bad debt? The only way the Central Bank can check is by sending in its own inspectors and doing a credit inspection. But there are 500 banks, and the total number of employees in the Central Bank is 2,000 to 3,000. It all depends on gentlemanly behaviour.”

The liquidation of BIR was accompanied by three other major banks plunging into difficulties: Banco Oddone, Banco de Los Andes, and Banco Internacional. The heads of two of them are now in jail. Luis Alberto Oddone, 37, who reportedly began his money-lending operations from a telephone booth half his lifetime ago, is in jail in Buenos Aires, and Euromoney’s Latin American correspondent Stephen Downer tried – unsuccessfully – to get into that jail to question him. In jail, too, is Hector Greco, head of the Los Andes Bank, who, as we went to press, was being moved from Mendoza to Buenos Aires for questioning. The three banks, however, unlike BIR, have been placed under government trusteeship and continue to operate.

As an emergency, once-only measure, the Central Bank has agreed to guarantee 100% of all private deposits up to 100 million pesos in the four affected banks, and to guarantee payment of up to 90% for deposits over 100 million pesos. Corporate deposits are guaranteed up to 90%. Soldati said: “We shall be making it law very soon that every bank must have external, independent auditors.”

Asked about the previous work of the people Trozzo hired from the Central Bank, Soldati said: “They were doing a bit of everything. Some were in the inspecting sectors.”

Soldati said that the measures taken by the Central Bank “can only strengthen our position and our desire to make this system a clean system, in which only those who are competent and serious can remain and in which those who grow in an unexplained way, taking all the risks, have to pay for what they do… those who are not responsible have no right to handle these institutions. In no way is our monetary policy out of control because of these measures…” Only a small number of foreign banks have been hurt, and not very much.

|

| Juan Angel Seitun, head of Banco Internacional and chairman of Sasetru, Argentina’s largest grain producer, which was the majority shareholder in Internacional. |

An Argentinian businessman commented: “BIR was the start of the problem and had an important impact, not only on the financial market but on the economy itself. For instance, when the BIR was closed, the public became agitated. People started to withdraw their money from private banks and to put it into state banks.

“So private banks started not having sufficient money to support their operations. New loans were stopped. In the past 30 days nobody has started new operations. Only cold money operations between banks have been continuing. I would not say the system is in danger of collapse, but companies in commerce are starting to pay the consequences of this problem, because no-one can get a bank loan.”

Whether other banks get into difficulties or not, it’s felt in Buenos Aires that the Central Bank is now in control, and that any danger of an outright banking collapse is over. One of the major concerns, however, is the impact that the Central Bank’s lifeboat operation may have on Argentina’s inflation. An American banker said: “I think it’s noteworthy that you can have the four largest banks in the country, in terms of deposits, virtually collapse. But still you see the economy of the country and the banking system are continuing to operate as though nothing had happened.”

He added: “I don’t think we have seen the end of it yet. The tendency is for money to leave the new, small banks and finance companies and flow into the traditional system. We are re-cycling it into treasury bills. The only question I don’t know how to answer is how the Central Bank is generating the cash to pour into those banks. The last figure I saw was $2 billion equivalent. Hopefully, they are not printing it. If they are, it will be disastrous for inflation.”

People have to learn that, if we give them a certain amount of freedom, they have to exercise it with responsiblity – Jose Martinez de Hoz

José Martinez de Hoz, probably the architect of Argentina’s economic recovery, put it this way to Euromoney’s Stephen Downer in Buenos Aires last month: “What has happened is that four banks in different ways have violated different regulations of the Central Bank. The fact that some of them are large in deposits shows the soundness of the system that applies the rules, however big they (the banks) are. It is like a criminal court. The fact that there are burglars doesn’t mean there is something wrong with society. The first bank (BIR) wanted to grow. Its owner had a craze of wanting to be the first bank. That doesn’t mean you are the best bank. This bank kept on offering tremendously high interest rates to attract depositors. It was easy to do because the depositors had the guarantee of the State. Then, of course, it (BIR) had to lend that money… This bank accumulated a large number of bad loans and, when it went over the limits established by the Central Bank, the bank fell into the position of overstepping itself and the Central Bank had to decide on its liquidation. It was a question of people who had overstretched themselves. That does not reflect on the system. After the decision was taken to liquidate, people began to realize you had to be careful. People began to withdraw deposits from one bank and put them in another. The other major concern is the impact, if any, that the banking problems may have on Argentina’s credit standing in the Euromarkets and elsewhere. It’s too early to answer that one, but the immediate reaction from international banks is that it won’t affect Argentina’s terms by much, if at all.

|

| Jose Martinez de Hoz, Ministry of Economy |

“There were three banks that people became suspicious of. As it turned out, all three had lent a lot of money to industrial or commercial business companies owned by the same shareholders of the banks, and had overstepped the limits established by the Central Bank. They were using the depositors’ money to cover up excesses of their own industrial groups or commercial groups, so it was again in violation of Central Bank rules.

The Central Bank’s action had shown, Martinez de Hoz said, that the big fish were not going to get away with it any more than the small fish. “People have to learn that, if we give them a certain amount of freedom, they have to exercise it with responsibility. This does not affect the economic process or the rest of the banking system.”

How will it affect Argentina’s credit rating?

“It has nothing to do with Argentina’s credit rating abroad. Under the trusteeship system, the three banks (Oddone, Internacional and Los Andes) will continue to operate. “

Will inflation this year increase because of the Central Bank’s flow of money to guarantee deposits?

“What the Central Bank has had to pay to depositors has been quickly absorbed by treasury bills. The Central Bank has practically absorbed all the surplus liquidity.”

Why was the situation at BIR not detected before?

“Things go through the normal process. The Central Bank just cannot go in and knock a banking institution down… The Central Bank has intervened at the proper time and according to legal regulations. One thing is knowing about it and another is proving it…”

In a sense, Martinez de Hoz and his colleagues at the Central Bank appear to view the banking problems as almost a necessary event: as something that will prove, once and for all, that the Argentine economy is no longer to be protected, either from its own actions, or from foreign competition. At the Central Bank Alejandro Reynal said: “We have liquidated 38 financial institutions in the last three years. That’s a consequence of many people not understanding the meaning of living responsibly. The system has to work, with its rewards, and its punishments.” The fate of the man who had aspired to being Argentina’s most international banker, José Rafael Trozzo, is proof of that.