The best efforts of regulators to improve the resilience of financial markets since the financial crisis have both increased requirements on market participants to source high-quality collateral – for example as initial and variation margin for cleared interest-rate derivatives – and reduced the ability and willingness of bank intermediaries to provide it.

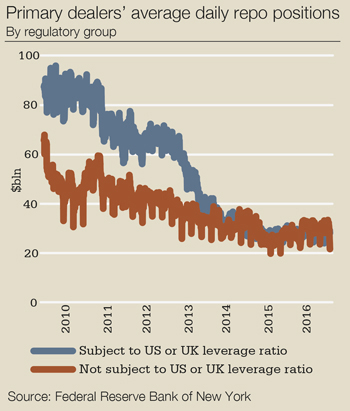

Balance-sheet constraints on even low-risk activities imposed through leverage ratios have made banks pull back from repo and most only extend balance sheet now to select clients that pay them adequately for it.

Concern that the inner-working of the capital markets are being gummed up by well-intended regulations constraining the supply of short-term repo financing and the free flow of collateral within the financial system has been growing louder.

Central bankers, too, are worried about the impact on monetary policy operations. However, the Federal Reserve, the Bank of England, the European Central Bank and the Bank of Japan are hardly in a position to sound the alarms on this. Their fingerprints are all over rules intended to reduce banks’ use of short-term repo borrowing to disguise excessive leverage.

And their own quantitative easing might have further damaged the $9 trillion market in repo and reverse repo secured against high-quality government bonds – by reducing the supply of such bonds in circulation.

|

|

William Dudley, New York Fed |

Repo markets are not yet settled according to William Dudley, president of the Federal Reserve Bank of New York, who says: “The effects of unconventional monetary policy and regulatory reforms work in opposite directions in many cases, and they are not the same in all markets.

“We need to keep an eye on this market because it is critical for the smooth functioning of the system.”

Perhaps a more useful study appeared last month from Bank of New York Mellon, which shifted attention away from bank intermediaries towards what the buy side – including pension funds, insurance companies, asset managers and hedge fund – are doing in response to the uncertain availability and higher cost of collateral and repo trades intermediated through banks.

“What came through loud and clear is that the buy side is looking for a range of solutions,” James Slater, head of securities finance and global collateral services at BNY Mellon tells Euromoney. “Some firms have been looking to add new sell-side counterparties. The problem with that, however, is that if they only have a certain budget to spend with financial services providers then spreading that too thinly might not win them access to greater balance-sheet capacity for collateral and securities finance trades.

“For hedge funds the story is different – post-2008 many expanded dealer relationships to diversify their risk, but are now pulling back a little in a market where bank liquidity is scarcer. This approach essentially wagers that placing more flow with a bank counterparty will result in favourable pricing/preferential treatment.”

Buy-side initiative

BNY Mellon together with PwC surveyed senior executives at 120 buy-side firms and found that the single most striking response has been to create or work towards a central integrated treasury function for funding, liquidity and collateral management that can act like an internal capital market.

“That is the kind of infrastructure that the sell side has had in place for many years,” points out Slater.

“Some asset managers have established dedicated collateral management functions, led by a head of collateral. These specialist desks operate as a centralized collateral and/or liquidity management function that develops and implements a cohesive liquidity, funding and collateral strategy either by business line or for the firm as a whole.”

BNY Mellon finds that 60% of buy-side firms have built or are building such functions.

One of the first things such heads of collateral at buy-side firms must do is seek to internalize collateral management as a means to optimize funding, seeking ways to move high-quality collateral from those legal organizations where it might initially be booked to those that might need execution facility eligible collateral as margin, for example for swaps contracts to hedge liabilities in life-insurance contracts.

|

|

James Slater, BNY Mellon |

Slater says: “Buy-side firms are starting to look at collateral and financing like a waterfall, first channelling and aggregating information on all internal resources, identifying cheapest to deliver assets, concentrating first on what self-financing options might be available and only then looking to access the external market as needs be.”

Those buy-side firms seeking new sources of liquidity and high-quality collateral are increasingly willing to look beyond banks and dealers and some – BNY Mellon identifies in particular EU-based asset managers and Canadian pension funds – are looking to engage with other asset managers, insurance companies, pension funds and hedge funds.

Slater says: “During the interviews, the non-dealer counterparty discussion naturally progressed into discussions around peer-to-peer models. These platforms – like BNY Mellon’s cash and collateral marketplace DBVX – allow firms to transact with banks as well as directly with non-traditional counterparties. DBVX provides a level playing field where all counterparties transact on the same terms, allowing them to supplement their existing relationships without the heavy lifting of negotiating bilateral contracts.”

He adds: “Peer-to-peer platforms like DBVX offer advantages over trying to identify and directly connect to others. Other advantages include price transparency in an electronic market, risk management with pre-trade anonymity, and a faster, cheaper and simpler way to connect to supplementary counterparties.”

A source at one midsize pension fund says: “On a peer-to-peer platform I would much rather deal with another pension fund than with a bank. From a credit perspective, a pension fund has a much better risk profile than a bank.”

|

Such peer-to-peer platforms for collateral and repo now look like a natural next step for big investors that have already begun to make prices to each other in cash bond markets in response to reduced dealer balance-sheet capacity to accommodate large portfolio trades.

Such platforms might support internalization efforts through arms’ length transactions with affiliates as well as bringing diversification of counterparties, including cash-rich corporates looking to lend cash short-term on a collateralized basis as well as other asset managers discouraged from depositing cash at banks.

Institutional investors are looking for new ways to finance securities transactions, and source and generate return on collateral that make their lives easier and must be simple to use – for example in terms of trade matching and post-trade processing as well as credit intermediation.

Another option is to engage in repo and securities financing in marketplaces with central clearing, where trades can be netted, so reducing the impact on banks’ risk-weighted assets, though at the cost of participants contributing to default funds, posting margin and taking central counterparty risk.

At the end of June, the Depository Trust & Clearing Corporation opened its new centrally cleared institutional tri-party service with a first cleared repo trade between Citadel and Morgan Stanley. The hope is that expanding the central clearing counterparty guaranty to a broader number of participants might lower the risk of diminished liquidity in the tri-party repo market caused by a large-scale exit of participants in a period of market stress.

Tom Wipf, vice-chairman of institutional securities at Morgan Stanley, says: “The combination of expanded market access for our clients and the overall reduction in counterparty credit risk is a major step forward for all participants in the repo market.”

However, no one should declare victory yet. The market in securities finance transactions is big and complex. Already the International Capital Market Association (ICMA) warns of problems ahead in the European credit repo market that sustains already limited liquidity in the cash market for corporate bonds.

The looming central securities depositories regulation mandatory buy-in regime, expected in late 2019 and now the subject of intense lobbying, looks like a threat.

ICMA’s June study reports: “The overarching market view is that this will have dramatic and potentially devastating consequences for credit repo market liquidity. Quite simply, it is the ultimate deterrent to lending corporate bonds.”

There’s always something.