The yen fell dramatically at the start of April after the BoJ, under the stewardship of new governor Haruhiko Kuroda, went beyond market expectations by announcing plans to double its balance sheet during the next two years, ushering in a fresh wave of quantitative easing in a bid to fight deflationary pressures in the Japanese economy.

That saw USDJPY soar from below ¥92 at the start of the month to a high of ¥99.95 on April 11, its strongest level in four years.

Since then, however, yen weakness has stalled, with the currency the best performing G10 currency during the past week. That pushed USDJPY down to a low of ¥95.80 on April 16, from where it has gained some poise to stand around ¥97.80.

Part of the reason for the slowdown in yen weakness was the flight to safety seen amid escalating fears over global growth as weaker-than-expected Chinese economic data added to concerns generated by a recent soft patch in the US economy.

That saw a shake-out in the commodity markets, which temporarily revived the yen’s haven appeal.

While that downward move in commodity prices might have run its course, opening up the way for further yen weakness, the yen’s drop has also been halted by caution ahead of the G20 meeting of finance ministers and central bank heads in Washington this week.

It is no surprise that smaller countries such as South Korea have been critical of Japan’s monetary policy stance. The yen has, after all, dropped more than 20% against the dollar since standing below ¥80 when Japanese prime minister Shinzo Abe was elected in November after a pledge to reflate the country’s economy and tackle the strength of its currency.

However, fears that the G20 will seek to sanction Tokyo over its policy of pursuing yen weakness were fanned by reports – which did surprise some observers – that the US will put pressure on Japan over its currency at the meeting.

Aditya Bagaria, analyst at Credit Suisse, dismisses this suggestion. He notes that formulaic comments from the US on currency wars are a necessary part of US domestic politics.

“However, rather than being a block to further weakness, our discussions with senior policymakers continue to suggest that the major industrial economies, including the US, are – behind closed doors – strongly supportive of governor Kuroda’s moves to end deflation,” says Bagaria.

That suggests that the tone of the meeting in Washington is more likely to follow the views of Christine Lagarde, head of the IMF, who earlier this month welcomed the monetary stimulus unleashed by the BoJ, saying it was a welcome step in supporting the world economy.

“Given this view, the current pause in the yen should be viewed as a half-time break, with the fall likely to resume after the G20 meeting,” says Bagaria.

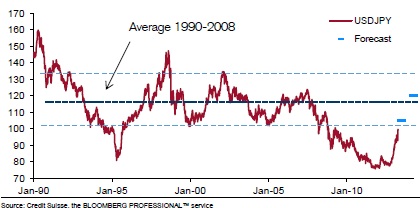

Indeed, history suggests there is considerable room for USDJPY to strengthen further.

The return of USDJPY to around ¥100 is, as Bagaria observes, just a normalization of the yen, returning it to the range that has prevailed for most of the post-bubble period in Japan since the start of the 1990s.

| First stage of yen normalization complete |

|

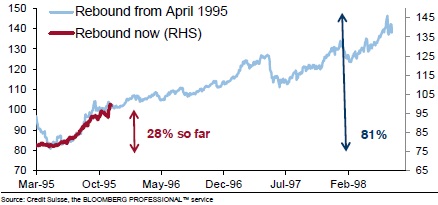

Furthermore, the last time USDJPY fell to ¥80, in 1995, it subsequently rebounded to ¥147 as the US began its strong dollar policy under Treasury secretary Robert Rubin.

“While the circumstances are different this time around, it is clear that an equally game-changing policy – this time from the Japanese – is in play,” says Bagaria.

He says that suggests Credit Suisse’s 12-month ¥120 target for USDJPY might well turn out to be too conservative.

| USDJPY: Has the rebound just begun? |

|

As the chart above shows, there is a similarity between the pace of the rebound in USDJPY in the mid-1990s to that seen since the end of last year.

If that similarity continues, it suggests that once USDJPY rises above ¥100, the pace of yen depreciation will slow, but that it still has a long way to go.

Yen bears might get a new lease of life after the G20 meeting.