The likely inclusion of South African rand-denominated sovereign bonds in Citi’s benchmark World Government Bond Index (WGBI) will trigger up to $8.8 billion of inflows from index trackers alone, analysts say.

The development would once again throw into sharp relief the gulf in the sophistication of South Africa’s capital markets compared with its illiquid counterparts in the continent - though foreign interest in frontier market bonds is growing.

In April, the domestic South African Government Bond Index fulfilled all three requirements for entry into Citi’s popular index: size of market; credit quality; and lack of barriers to entry. If this continues to be the case in May and June, the asset class will be included in the WGBI, effective October 2012, say managers of the index.

The country’s eligible debt stock at $88 billion is above the $50 billion minimum threshold, the sovereign is rated A/A3, above the A-/A3 minimum credit criterion, and the market is fully liberalized for foreign investors. With an estimated $1.5-2 trillion of funds tracking the WGBI, some $8.8 billion of inflows from index trackers would flow into the market, notes Peter Attard Montalto, an emerging market analyst at Nomura.

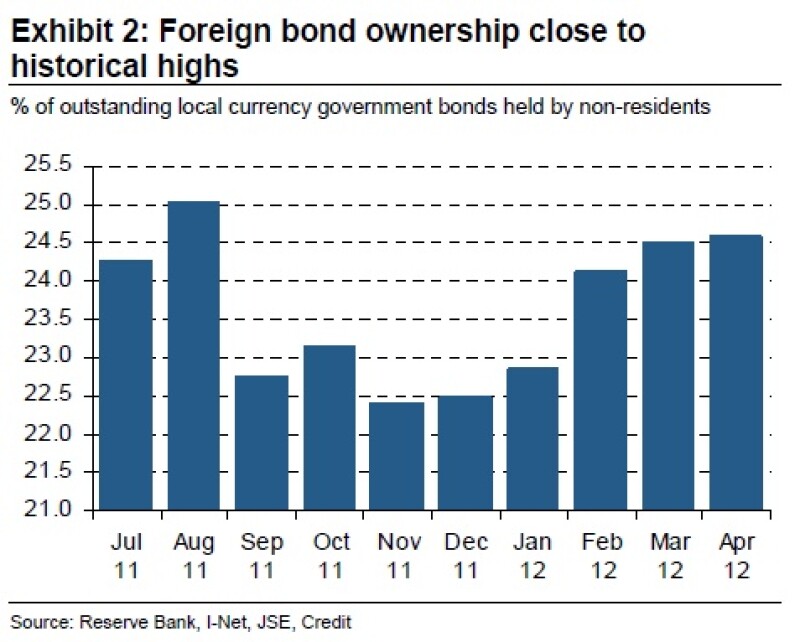

Historically speaking, real-money emerging market-focused investors have large exposures to the sovereign. However, the market has attracted a diverse and mainstream global investor base in recent years, given the wide interest-rate differential between the developed world and South Africa. In 2011, non-residents purchased $6.2 billion-worth of fixed income securities, after a record $6.7 billion the year before.

ZA in league of its own

Elsewhere in the continent, “demand for African domestic government bonds is growing but from a very low base”, says Samir Gadio, African markets strategist at Standard Bank.

At some $64 billion, the Nigerian domestic bond market represents the bulk of Sub-Saharan Africa’s investable local currency-denominated debt stock outside South Africa, compared with $6 billion in Ghana, for example, Gadio says.

In a bid to reel in foreign portfolio flows, Nigeria scrapped short-term foreign exchange restrictions in June. However, successive interest-rate hikes have triggered a sharp rise in local yields, with the 10-year government benchmark recently hitting 15%, despite a trickle of inflows from dedicated African funds in recent months.

In Kenya, Treasury bills yielded up to 20% in February – providing a lucrative carry trade for foreign investors – after aggressive rate hikes to stem rising inflation. In Ghana, as of July, about 29% of the total outstanding government debt stock was owned by foreigners. Rising oil production and the economy’s subsequent expansion should increase foreign investor interest further, says Gadio.

However, in Zambia, Sub-Saharan Africa’s next largest market, foreign holdings of domestic debt have fallen to their lowest level since foreigners were first allowed access in 2005, to represent 5.4% of the total stock of government paper, as investors fret over the new administration’s populist economic policy.

Source: Credit Suisse