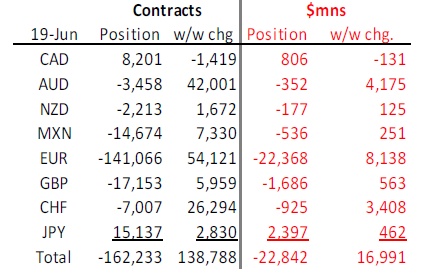

The move coincided with a drop in volatility and a breakdown of market correlation that suggests investors are slowly positioning for a bounce back in risky assets. The latest Commitment of Traders report, issued by the Commodity Futures Trading Commission, showed investors slashed their net long positions by 43% to $23 billion in the week to June 19.

| IMM dollar longs cut back - but still elevated historically |

|

| Source: Scotiabank, IHS, CFTC |

Most currencies are still held short against the USD, but positions have been pared back, with the most sizeable weekly changes coming in the EUR, AUD and CHF.

| Net long (short) non-commercial positions on IMM - USD long |

|

| Source: CFTC |

The biggest shift came in the EUR, in which the net short position was aggressively cut back from close-to-record levels, as the market-friendly result of the Greek election lessened the near-term chance of Athens leaving the eurozone.

The reduction in short EUR positions came even as the yield on Spanish government bonds rose to euro-era highs and most likely reflects hopes that this week’s summit of EU leaders will address the region’s debt crisis and hatch a plan to spur growth.

Investors cut the value of the net short position in the EUR by $8.1 billion to $22.4 billion. The shift was primarily the result of short covering and reduced the value of bets against the EUR to levels last seen in May.

| IMM short EUR position retreats from record levels |

|

| Source: Scotiabank, IHS, CFTC |

Jane Foley, FX strategist at Rabobank, says while the short covering in the EUR might reflect relief that Greece now has a workable government, the eurozone debt crisis remains at critical levels.

“While it can be argued there has been some improvement in the eurozone debt crisis relatively to the start of this month, it is still difficult to see the eurozone position as anything other than perilous,” she says.

Furthermore, Foley says this week’s EU summit might help to underscore the view that politicians are committed to the Economic and Monetary Union long-term, but it is unlikely that any of the political positioning will provide direct relief to the near-term struggles relating to Spanish debt.

“Against this back-drop, we would not expect investors to wander too far from their USD longs or to reduce EUR shorts much further for now,” she says.

“The size of the last week’s shift in EUR shorts suggests that EURUSD could struggle on the upside near-term. For choice, we would continue to see rallies as selling opportunities near-term and continue to see scope for dips back towards $1.22 during the summer.”