Citi estimates that reserves at active managers who report their activity on a timely basis after month-end rose by 0.4% in February. That was less than the 0.6% rise in January, but much higher than the reserve accumulation that occurred in the second half of 2011. Those managers, which together control more than $1.6 trillion of reserves, have seen their stock piles grow by almost 20% during the past two years.

Overall, that suggests reserve managers continue to face diversification needs, even if they were less dramatic than was the case from early 2009 to the end of the first half of 2011, says Steve Englander, global head of G10 FX strategy at Citi.

Recent figures from the International Monetary Fund show that reserve managers have been diversifying their new reserves away from leading currencies, especially the dollar, in a bid to maintain the value of their stockpiles.

| Reserve accumulation by active reserve managers |

|

| Source: Ecowin, CitiFX |

Englander says since the renewal of reserve accumulation since January, small G20 currencies have staged a sharp rally against the G4 of USD, JPY, EUR and GBP.

“It is certainly consistent with the view that reserve managers may still be leaning on the smalls for a disproportionate share of diversification, even if at the end of the day their capital markets are not yet big enough to absorb the lion’s share of diversification flows,” he says.

| 'Smalls' versus G4 (30 Dec 2011 = 1) |

|

| Source: Ecowin, CitiFX |

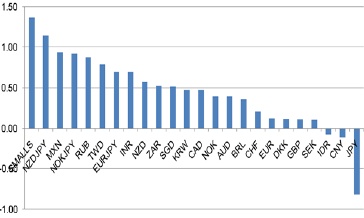

Indeed, Englander says while investors have obsessed on a minute-to-minute basis about EURUSD and whether USDJPY was set to surge higher, simply being long small G20 currencies and short G4 currencies has provided a consistently better risk return than any other FX trade this year.

He considers a basket that is long G20 smalls – specifically AUD, CAD, ZAR, NOK, SEK, NZD, SGD, TWD, CLP, INR, IDR, RUB, TRY, ARS, BRL, MXN, CNY, MYR – against the G4 currencies.

“The smalls have the highest return relative to their realized vol so far this year,” says Englander.

“No G10 currency cross had a better return relative to realized volatility.”

| Ratio of 2012 YTD return to YTD realized vol |

|

| Source: CitiFX, Bloomberg |