In recent years, there has been a noticeable tendency for US economic data to surprise to the high side of expectations towards the end of each year, with this strength continuing through the early part of the following year, before fading through the March quarter. John Horner, strategist at Deutsche Bank in Sydney, says the pattern is even clearer if 2008-09, the height of the financial crisis, is excluded.

| Clear seasonality in US data surprises |

|

| Source: Deutsche Bank, Bloomberg |

One of the reasons given for this in the past couple of years has been problems in seasonally adjusting for the serious downturn during the fourth quarter of 2008 and the first quarter of 2009, with seasonal factors tending to look for weaker data than has otherwise typically – or seasonally – been the case.

However, Horner says while the seasonal pattern of surprises has intensified in recent years, it existed even in the years preceding the crisis, so this shock is not the whole explanation.

“Given the longevity of this pattern, it does suggest that something interesting is going on in terms of a fundamental change in the pattern of US activity,” he says.

While the full explanation behind the seasonal pattern is not clear, US data surprises in recent months have followed the usual pattern of the previous two years and are now turning lower as if on cue.

Horner says this has negative implications for US Treasury yields in the coming weeks, which does not bode well for the dollar, given the extent to which rising yields have supported the currency in recent weeks.

| Data surprises track US yields |

|

| Source: Deutsche Bank, Bloomberg |

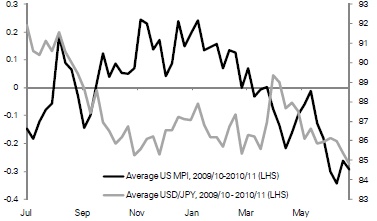

This is especially the case for USDJPY.

While US data surprises are far from the whole story in the pattern of USDJPY, says Horner, they do seem to explain at least part of the tendency for USD/JPY to slide from early April – the high for the year was in early April in 2009 and 2011, and early May in 2010.

“To the extent we are again broadly following the usual pattern of recent years, this indicates renewed weakness in USD, and especially USD/JPY, may not be too far away,” says Horner.

| Seasonal effects on USDJPY increase at this time of year |

|

| Source: Deutsche Bank, Bloomberg |