While the recent appreciation of the currency might deter some investors – the krone stands at its highest level on a trade-weighted basis since 1986 and EURNOK is at a nine-year low – the Norges Bank’s meeting on Wednesday is likely to open the way for further gains. The strength of the currency is irritating Øystein Olsen, Norges Bank governor. He has come under domestic pressure from union leaders over the high value of the krone and said last month its level would influence monetary policy.

However, most see an attempt at verbal intervention at this week’s meeting more likely than any action to cut rates.

That is because any action from Norway’s central bank to loosen monetary policy – or even follow the Swiss National Bank (SNB) and impose a floor in EURNOK – will only aggravate inflationary pressures in Norway’s economy, particularly in the housing sector.

The Norges Bank, with interest rates at 1.75%, has room for cuts even after lowering them by 50 basis points in December.

The problem for the Norges Bank, however, is that, unlike the SNB, low interest rates are not appropriate for the current economic situation, given the country’s rapid credit growth and house-price inflation.

| Low real rates have led to continued house price increases |

|

| Source: Goldman Sachs |

Steve Barrow, analyst at Standard Bank, says there might not be any bubbles as yet, but the Norges Bank could start to sail close to the wind if it responds to currency strength with further cuts in rates.

“For this reason, we suspect it will leave policy unchanged at Wednesday’s meeting,” he says. “The conclusion is likely to be continued strength in the krone, even if this creates continued angst among politicians.”

Goldman Sachs says the krone is now trading like an Asian surplus currency, with the logical move from the Norges Bank to let the currency appreciate given that it has little scope to ease monetary policy amid rising asset and house prices.

“This is already happening to some extent but we think there is more scope for appreciation and hence we have strengthened our already bullish Norwegian krone forecasts,” the bank says.

Goldman now forecasts EURNOK, which currently stands at NKr7.47, to rise to NKr7.30 in three months, NKr7.20 in 6 months and NKr7.20 in 12 months.

One trader at another top-tier bank believes once the meeting has passed, NOKSEK has the potential to break higher through SKr1.20 given the increasing appeal of the Norwegian currency as oil prices rise.

He expects the NOK to remain in demand, especially among real money and medium-term investors, even given heightened long positioning in the currency. That is because Norway has tangible resources that Europe will still need even if emerging-market demand for resources is negatively affected by a supply-side shock.

“The krone is a bit of a lit firework, but it’s something the market wants to own and with good reason,” the trader says.

The reason why the Norges Bank has less chance to quell krone strength now than when it verbally intervened in September after the SNB’s decision to impose a floor in EURCHF is that its arguments against further appreciation carry less weight.

Then, the Norges Bank could justifiably argue that Norway was not the new Switzerland – in other words, a haven for funds seeking a refuge from the problems in the eurozone. Other larger currencies, even the pound, could lay better claim to that title.

Now, however, fears of an oil-price shock amid rising tensions in the Middle East are the driving force behind gains in the krone and those forces are harder to fight.

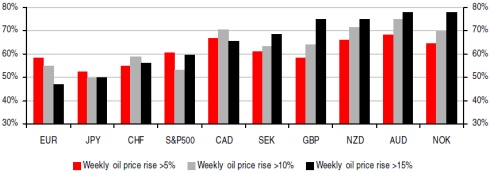

Indeed, research from HSBC shows that the Norwegian krone is the most highly correlated currency with out-sized oil price gains.

| Percentage of time currency gains vs dollar when oil prices rise |

|

| Source: HSBC, Bloomberg |

Unless tensions ease in the Middle East, or Norway takes a gamble on triggering a housing bubble in its economy, it will have to live with a strong currency.