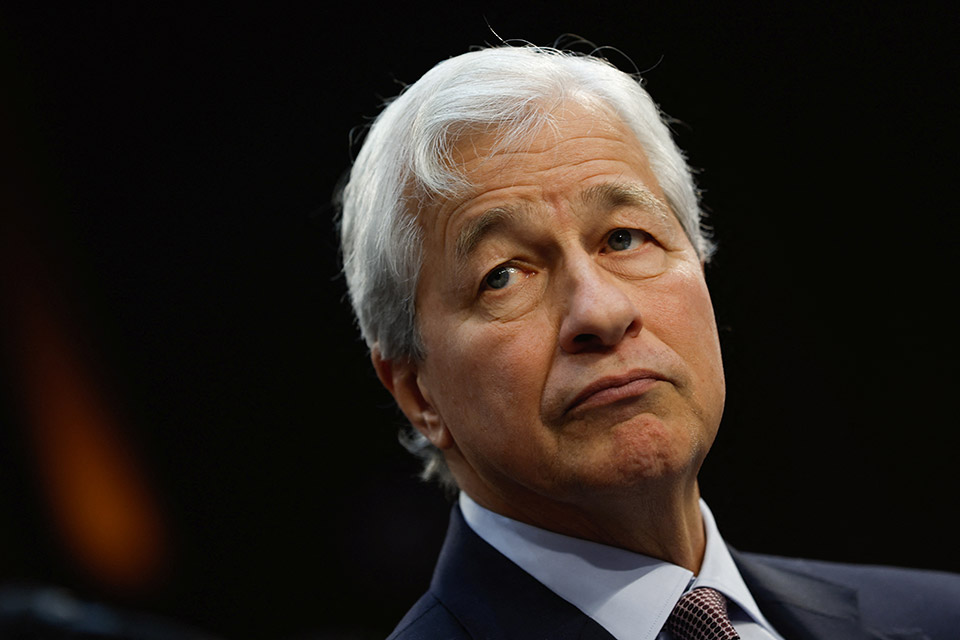

It is not going to be easy, but eventually the moment must come. One day, Jamie Dimon, the greatest banker of his generation, is going to step down at JPMorgan.

And while the JPMorgan board has previously offered Dimon a generous retention package of stock options designed to hold onto the boss until 2026, who knows when the moment might arrive?

He has often been talked of as a potential US Treasury secretary. At Davos, Dimon suggested that in his first term Donald Trump had done a good job on the economy, tax and trade reform as well as being “kind of right” about NATO and, err China.

Could he be angling for a surprise appointment in 2025?

Dimon’s latest senior management changes, announced on Thursday, show a fine judgement in preparing the potential candidates to succeed him.

This has been described as a two-woman race between former chief financial officers of the firm, Marianne Lake and Jennifer Piepszak.

The two had previously co-headed JPMorgan’s consumer and community banking division.

Lake now becomes sole chief executive of that business, which also includes credit cards, small business lending and wealth management, and accounted for half the bank’s profits in the final quarter of last year.

But Piepszak now adds to her experience co-heading the consumer side by shifting across to co-head an expanded wholesale division that brings together corporate, investment and commercial banking.

Another potential candidate to sit alongside Jane Fraser at the head of a national champion bank is Mary Erdoes, who remains chief executive of asset and wealth management.

That division is smaller but accounts for $5 trillion of assets under management and includes the world’s best private bank.

But keep an eye out for another chaser coming up on the inside rail. Troy Rohrbaugh, the bank’s former co-head of markets and securities services, now steps up to co-head the entire wholesale division alongside Piepszak.

Rohrbaugh may be less familiar to investors, never having regularly faced them on quarterly earnings calls as Lake and Piepszak have. He has somehow managed to keep a low public profile, even while his reputation inside JPMorgan has been high since soon after his arrival in 2005.

Insiders have been pointing him out to Euromoney as one of the bank’s stars and a contender for the top ranks for over five years.

Anyone who wants to learn more about him might start with our article on the bank in 2019, which went into some detail on how he revived its fallen FX business and for the first time made it a top player in equities trading.

Rohrbaugh’s long-time boss, Daniel Pinto, remains president and chief operating officer of JPMorgan and so nominal second in command and likely to step up in an emergency. But a strategic succession plan at the global systemically important bank with the most obvious key-man risk is becoming a little clearer.

And Dimon doesn’t seem inclined to pretend the change may be a long time coming, even offering the board a first stab at how they might send him off.

At the end of the management announcement, Dimon added: “Looking back on the past two decades, it’s remarkable to see how our businesses have significantly grown revenue, increased market share, delivered outstanding products and services to our customers and expanded into new markets – all while serving our employees and shareholders and lifting up our communities.”

It sounds almost like the start of a long – or, perhaps, not so very long – goodbye.