With a valuation at its early-2022 funding round more than three times the market capitalization of the biggest bank in Nigeria, Flutterwave’s remarkable growth has impressed and sometimes embarrassed incumbent financial institutions in its home country.

But its expansion has not been easy, including in Kenya.

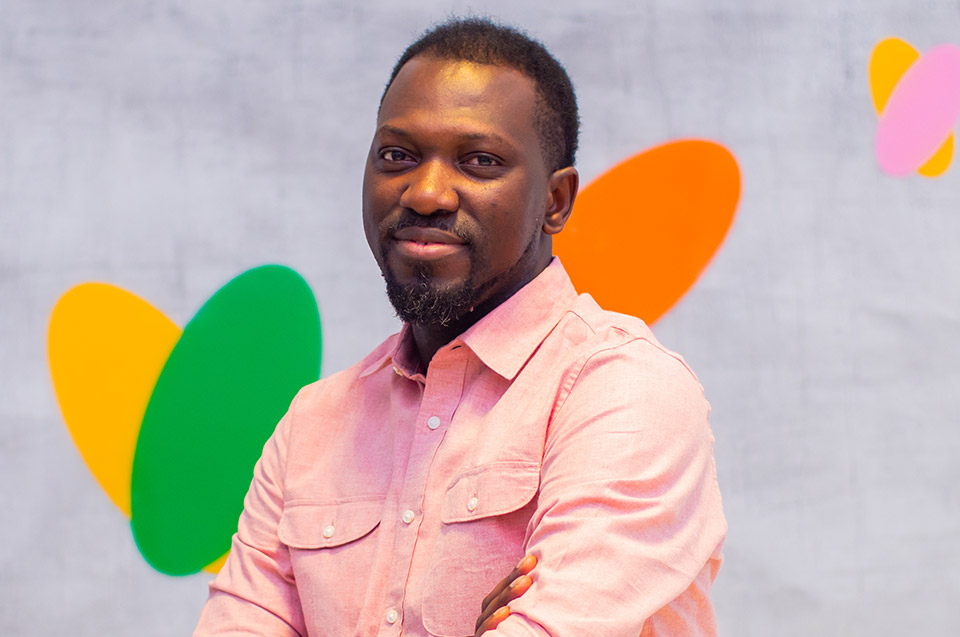

Founder Olugbenga Agboola regards Kenya as one of Flutterwave’s core markets for the future, but he had to handle negative publicity around a local anti-money-laundering investigation launched by Kenyan authorities last year.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access