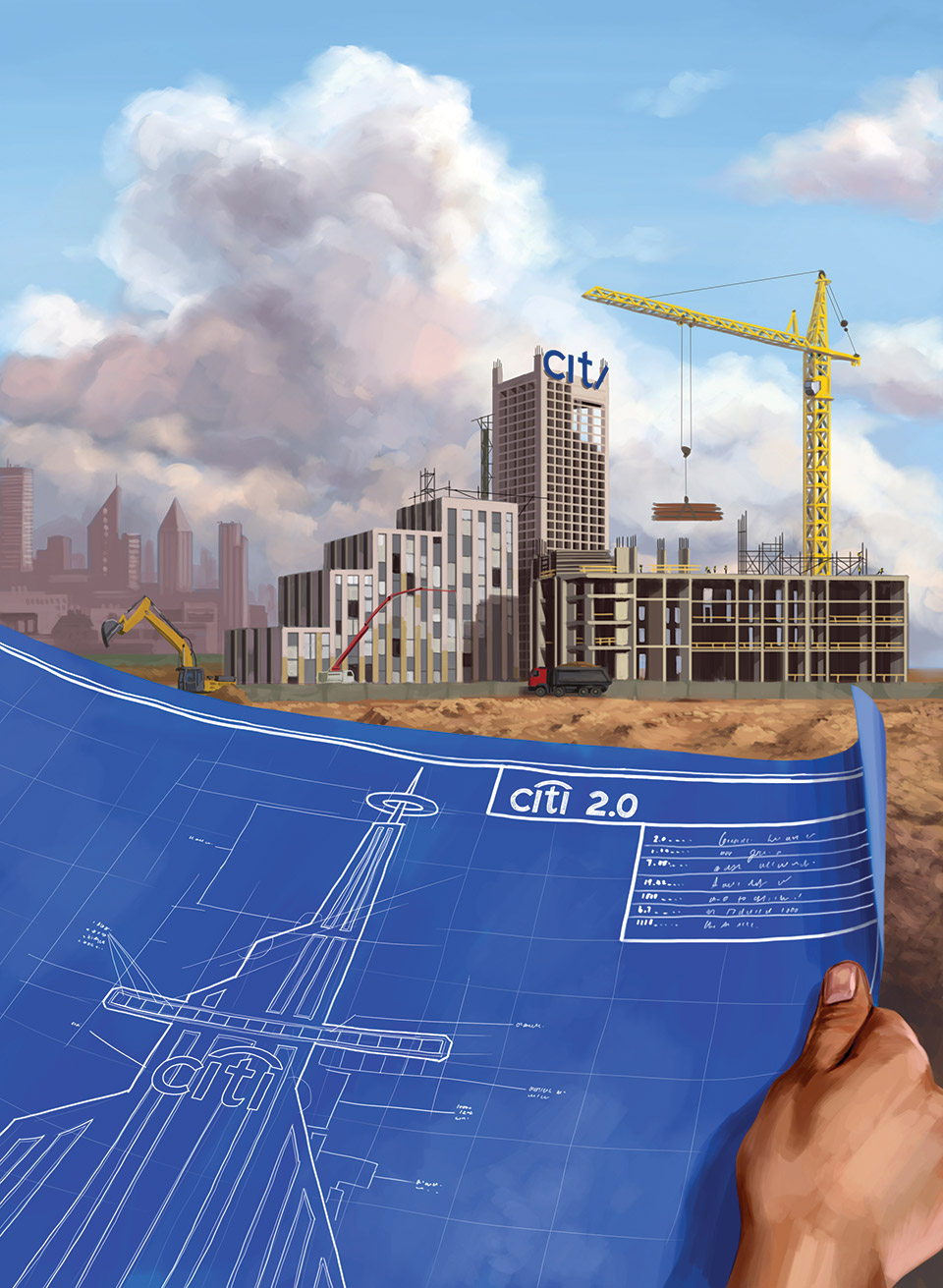

Citi’s exploration of environmental, social and governance (ESG) issues didn’t start with Jane Fraser, but the chief executive has certainly made a point of raising the bank’s sustainability profile since taking the helm in March 2021.

“Having leading ESG practices is core to our mission of enabling growth and progress, and it’s embedded in how we do business every day and the value we deliver,” she said in her opening speech at Citi’s investor day in March 2022.

Back when she took office, Fraser announced the bank’s pledge to reaching net zero in its financing activities by 2050. In achieving this, the bank would be in line with the Intergovernmental Panel on Climate Change’s recommendations to keep global warming at 1.5°C above pre-industrial levels.

What followed was a series of announcements about the commitments Citi would make towards this goal. Today, Citi is manoeuvring in a highly politicized environment and facing greater reputational risk as a result.

“ESG touches on most of the decisions that we make,” says Ed Skyler, the bank’s head of public affairs. “We see it as a lens through which companies and their actions are assessed, and not as something within itself.”

To become a frontrunner in sustainable finance, the lender must convince the market that ESG isn’t just about image.

Capital commitments came soon after the net-zero pledge. In April 2021, Citi announced a $1 trillion target of sustainable finance by 2030, building on its 2025 Sustainable Progress Strategy from 2020. The target included an environmental finance goal that was bumped up from $250 billion to $500 billion.

Citi’s is the third-largest sustainable finance goal in US banking, after JPMorgan’s $2.5 trillion and Bank of America’s $1.5 trillion.

But in January 2022 the bank placed itself ahead of its US peers with its 29% absolute emissions-reduction target by 2030 for the energy sector and a 63% reduction in portfolio emissions intensity by 2030 for power. Wells Fargo is the only other American lender to have followed suit, in May 2022, with a 26% absolute reduction target for energy.

Since then, banks have had to cope with a rapidly changing geopolitical environment. Russia’s invasion of Ukraine in February 2022 and the impact of this on European energy security reshaped global energy markets. Oil and gas firms made record profits last year, disincentivizing their banks from reducing funding to fossil-fuels.

In the US, political pushback against ESG materialized in several states, going as far as boycotts of financial companies seen to be integrating ESG into their financial decision making. And now, the Israel-Hamas war is drawing attention to the Middle East and raising fresh concerns over supply-chain security.

“The geopolitics didn’t change the path that we were on, but it highlighted the harsh realities we face as a financial institution,” says Skyler.

New hires, new sectors

Dealing with those realities has led the bank to make changes to its risk-management structure and make room for climate governance.

In 2021, Fraser created an ESG council that “provides a senior management forum for oversight of our ESG commitments and priorities” and to which the bank reports its progress, according to its latest ESG report. The firm also grew its climate-risk and clean-energy transitions teams and appointed a head of net-zero operations, Justin Gore.

On the product side, Citi recognized the need for new positions to be implemented to embed ESG topics into every one of its business lines, especially for its social finance ambitions.

“We now have someone responsible for financial inclusion in personal banking, which is separate from the financial-inclusion experts in our community investing team,” says Skyler.

The geopolitics didn’t change the path that we were on, but it highlighted the harsh realities we face as a financial institution

Ed Skyler, Citi

The ‘S’ in ESG has always been Citi’s strong suit. In 2020, the bank was the financial adviser to Covax, a global alliance set up to deliver billions of vaccine doses to low-income countries.

Since then, the bank’s social financing activities have slowed down slightly. It logged $18.8 billion in social finance in 2022, down from $21.8 billion in 2021 and $25.2 billion in 2020. Impact metrics were also down, with 294 jobs supported in 2022, down from 1,398 in 2021.

“It does require some adjustment,” says Skyler. “We noticed that the benchmarking we did was in the height of the Covid pandemic and that activity has slowed since then.”

Citi has also been grappling with new trends in innovation and tech. The bank has been quietly experimenting with artificial intelligence for the last three years, but prefers to be methodical, even if that means letting a competitor go first.

“I think that there has been merit in being a fast follower at times and letting somebody go first,” says Skyler, who chairs Citi’s reputational risk committee. “We must be careful on how we engage with this. Jane’s message on AI was an honest take on how we intend to assess this exciting technology that is growing exponentially fast but that carries significant risk.”

Curating an image

Not everybody believes that new internal structures with ‘ESG’ or ‘sustainability’ in the title necessarily lead to concrete action, however.

“Citi seems more concerned about hiring senior PR staff to improve its reputation than delivering action,” one climate finance communications expert tells Euromoney.

As at some other US banks, the topics of ESG and diversity, equality and inclusion feed into the public affairs executive at Citi. Skyler says the decision relates back to when the topic was still in its infancy.

“ESG is part of my team because it grew out of the work we were doing in our foundation,” he says. “Years ago, it was housed in the team that managed our grant making and, as the field matured, we pulled it out.”

The bank knows it needs to manage new ESG-related risks very carefully. The thorniest issues go through the reputational risk committee – and, given the current political context, many transactions will have a thorn or two.

“We’re looking at products and transactions that may not age gracefully,” adds Skyler. “It’s important for us to consider trends and think about how a decision will be viewed in six months.”

But the bank’s critics argue that simply managing reputational risks isn’t enough for a credible net-zero strategy.

“We always look at what the policies say because it shows what banks can ask from their clients,” says Caleb Schwartz, climate policy analyst at Rainforest Action Network (RAN).

What prevents Citi from being considered a leader in ESG, Schwartz argues, is its position on fossil-fuel energy expansion.

Unlike many European banks, Citi does has not set any exclusion on projects or corporate lending for oil and gas expansion. The bank is the second-largest financier to coal, oil and gas companies expanding fossil fuels in 2022 after JPMorgan and the second-largest financier of fossil fuels for the period 2016 to 2022, according to RAN’s Banking on Climate Chaos report.

The bank has been criticized for several recent deals, including the ExxonMobil $59.5 billion merger with Pioneer, for which it was lead adviser, and its corporate lending activities for Canadian pipeline company Enbridge.

Citi also faced shareholder resolutions in 2022 and 2023 that flagged concerns over some of its funding activities and its impact on indigenous communities. Both received over 30% of shareholder support.

Asked if the bank was taking such resolutions into account and whether they had influenced conversations with its energy and power sector clients, Skyler says that the bank regularly engages in “respectful dialogue with a range of stakeholders”.

“We believe that this engagement makes Citi a stronger institution,” he adds. “We’re committed to helping drive the transition to a low-carbon economy. The energy transition and energy security are not mutually exclusive; they are mutually reinforcing… and we’re focused on supporting clients on both fronts.”

Citi has also recognized the rights of indigenous peoples as an area of high caution under its environmental and social risk management policy since 2008.

In addition, the bank has been accelerating its sustainable finance activity. According to Refinitiv Deals Intelligence, Citi ranks second in the sustainable bond bookrunner league table for the first nine months of 2023 after BNP Paribas, with 150 deals and more than $29.6 billion of credit. It is also second in the global ESG bond league table.

On the loan side, Citi has risen five places year on year to third in the sustainable loan bookrunner league table, overtaking Bank of America and JPMorgan. It ranks eighth in sustainable equity capital markets, down from second place, and sixth in sustainable M&A, up from 10th.

Crucially, the first half of 2024 will mark the end of a two-year engagement and assessment process during which Citi has reviewed transition pathways with clients in energy and power. Unless its big energy clients like ExxonMobil come out with a credible pathway to net zero, the bank could face even greater reputational damage.

Skyler knows his team won’t be able to please everyone.

“Some people think we need to go faster and some think we shouldn’t be doing this at all,” he says. “We need to have thick skin and do what’s in the best interest of our clients and other stakeholders.”