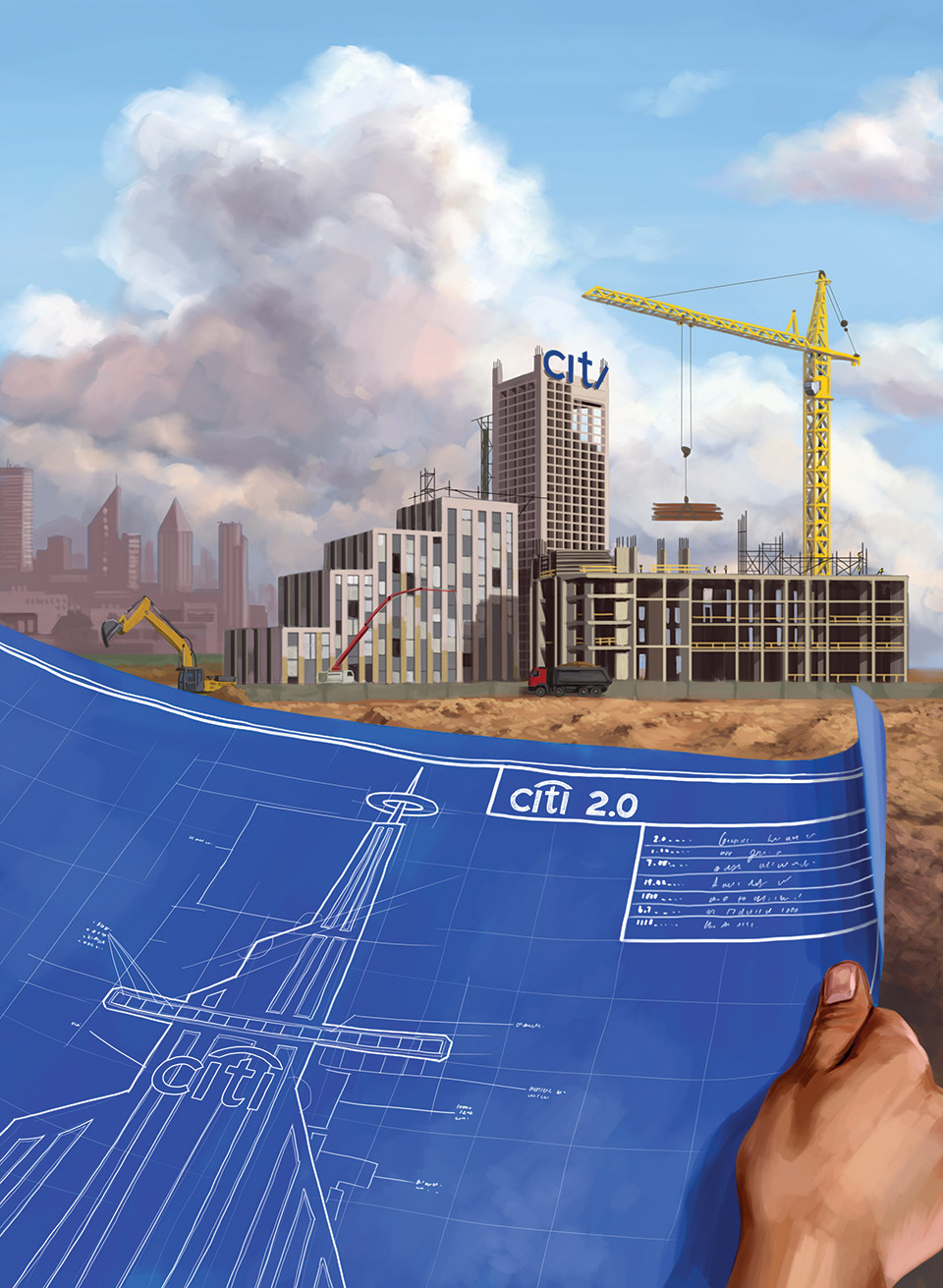

Picture the scene. After years of crisis management and recovery following its near-fatal collapse under the weight of toxic assets, Citi announces an organizational and management overhaul. It is part of becoming a simpler, more focused and better managed bank and it follows strategic decisions to shed non-core assets.

The bank, we are told, will retain its international network – “the one true competitive advantage we have,” an insider tells Euromoney. But it will strive to make more from the links between the few businesses where it is a clear leader, such as global transaction services, foreign exchange and rates for its corporate customers that operate across multiple countries.

Thanks for your interest in Euromoney!

To unlock this article: