Long-suffering employees love to poke fun at the kind of nonsense that sees management consultants agonize over expressions of corporate identity. Often bearing little apparent relationship to the actual business undertaken, such messaging is routinely seen as a distraction at best and an embarrassment at worst.

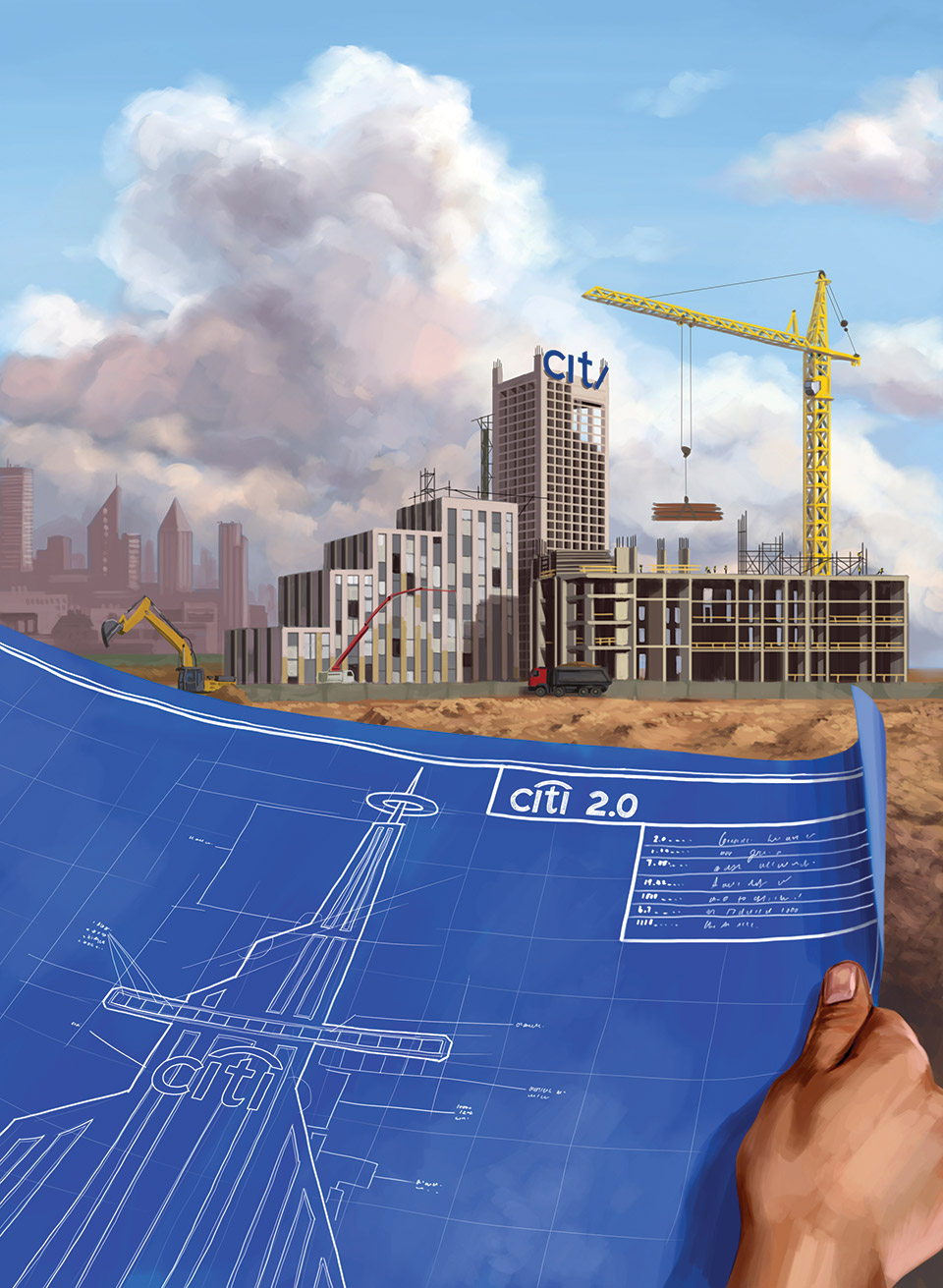

But sometimes it matters. One such case is Citi, having wrestled for many years with perhaps the most varied – and therefore least effective – identity among big global banks.

This may finally be set to change. As we set out in our extensive report this month, Citi’s situation is not exactly rosy. But neither is it entirely negative. Even though she is well through her honeymoon period as the bank’s chief executive, Jane Fraser is still getting the benefit of the doubt.

Fraser not only stands out among her big US bank peers for being the only female CEO – surely a distinction that many will find disappointingly unique as 2023 comes to a close – but also for her bank’s long-running underperformance on the kinds of metrics that pesky investors like to watch: costs, risks and returns.

Happily for Fraser – and for Citi shareholders – there are plenty of reasons to be optimistic, at least on the performance front. There is also at least one big reason to be cautious.

First, the good news. Few would argue with the fundamentals of the strategy that Fraser set out for Citi on her watch at the firm’s investor day in March 2022. At that time, she outlined a plan to dispose of more of the bank’s sprawling international consumer business.

She and her teams also outlined paths to growth for the businesses where the bank will continue to compete, aiming to capture benefits of scale by rolling out existing platforms to new client sets. And there have been investments (more costs!) into ways of making franchises more efficient and more joined-up.

Most importantly of all, she is pivoting the entire operation to be focused on returns. Shareholders might be forgiven for thinking that it seems a very long time since that was the priority at Citi.

Now, the not so good news. While Fraser’s plan has hardly been rejected by the markets, neither has it been wholeheartedly embraced. A stock that is trading at less-than-half tangible book value, when some universal banking peers are in a different league, is all the evidence you need of that.

The biggest reason to doubt Citi’s ability to meet Fraser’s ambitions is the fact that historically it has failed to do so. Yes, there is trimming on the way, but this is a bank that still employs an astounding 240,000 people. An organization of that size cannot be turned on a sixpence.

Fraser and her team are not trying to do quite that, of course. They have stressed that theirs is a multi-year plan. But they must also quash once and for all the sense that Citi’s scale inevitably makes it a compliance basket case, packed with hidden dangers just waiting to rear up in the form of colossal losses, fines – or both.

Investors are still waiting to see if she is as good at building a bank fit for today as she is at designing one

Articulating an identity for Citi may be the toughest challenge that its CEOs have always faced. What might be different this time is that the plan – and the way Fraser is going about it – seems uncompromising.

How many times in the past have we heard that Citi would focus on its unique advantages, its geographic and transaction services footprint, and therefore its ability to service the cross-border needs of multinational clients, and its most sophisticated personal clients, only to find that it has instead clung on to all sorts of odd domestic-looking franchises?

And while some of those were undoubtedly attractive, every one that fell outside the supposed core focus diluted the message of what and whom Citi was for. Some would argue even now that the bank should limit further its investment bank ambitions, for example, instead of persevering with activities where it is arguably subscale. Many still argue that the bank’s biggest weakness of all is its lack of scale with the US consumer.

Execution key

Guarding against disappointment is what Fraser will have to be most alert to. That is why if you ask anyone – internally or externally – what Citi most needs to get right, you will get one answer: execution.

Fraser has talked a good game on the structural changes that she has recently put in place to ensure the bank is shaped to fit the strategy. Some historical perspective might not go amiss, though. These are hardly “the most consequential changes for 20 years”, as she describes them.

What about Vikram Pandit, who split the firm in two and set in motion the dumping of hundreds of billions of assets? What about Mike Corbat, who continued that job and exited 32 consumer markets?

Nonetheless, she might yet turn out to be, as one analyst argues, the best architect that Citi has ever had – could ever have. Investors are still waiting to see if she is as good at building a bank fit for today as she is at designing one.

Even then, the task will not be over. If she builds it, will they come?