The International Capital Market Association (ICMA) sent a letter to the European Central Bank on October 25 voicing concern about liquidity in the eurozone repo and money markets.

The trade group warned that the state of liquidity is poor and cautioned that “rising dysfunction in the market could imperil the transmission of monetary policy,” in a bid to gain the attention of the central bank, which like its peers is struggling to implement a monetary policy that combats inflation without exacerbating recession.

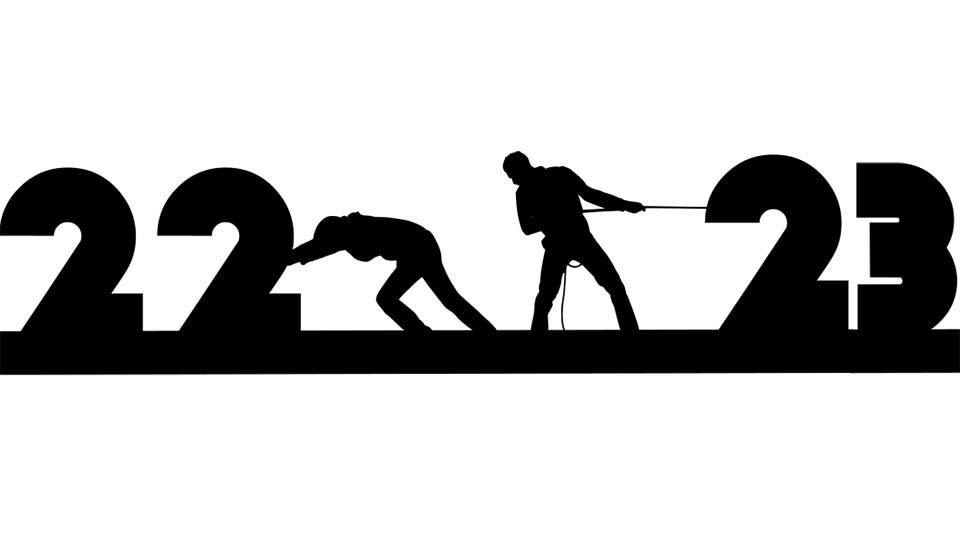

ICMA highlighted indications from forward prices that dislocations in money markets will be worse than normally seen at year end, with deeply negative repo rates as 2022 turns into 2023.

It added that the effect of poor liquidity had already been felt in September when repo rates tightened – moving as low as -0.3% – despite a 75 basis point hike in the ECB’s core deposit rate.

Some of the current problems for the euro repo and money markets are arguably because banks are obeying the letter and not the spirit of new laws for trading

ICMA had two proposals for how the central bank could address what it diagnosed as “the disequilibrium of excess liquidity and collateral scarcity.”

These propositions – effectively adoption of repo management tools already used by the US Federal Reserve and the Swiss National Bank – were perfectly sensible. ICMA did not stop there, however.

It also called for steps to improve the capacity of banks to intermediate in the euro repo and money markets “and potentially the bond and derivatives markets more broadly.”

This plea for lighter regulation to let banks sort out the problems currently ailing markets is becoming a theme among bankers, who are relishing their unusual status of not being the villains in a global financial crisis.

One banker draws a lesson from the recent problems faced by UK pension funds in managing the collateral for the derivatives they traded as part of liability-driven investment strategies.

“Banks are the solution for the liquidity crisis, you shouldn’t have to have central banks stepping in with a quantitative easing programme when they should be doing quantitative tightening,” he tells Euromoney. “Banks have the capital and they should allow us to apply it to help clients.”

Chicken and egg issue

There is an obvious chicken and egg issue with this view of the financial world. Banks have plenty of capital today because they were forced by regulators to change their leverage policies after the global financial crisis of 2008. The technical rules on leverage ratios and capital buffers that banks would now like to see eased were also proposed to make markets and their biggest intermediaries safer.

And some of the current problems for the euro repo and money markets are arguably because banks are obeying the letter and not the spirit of new laws for trading.

ICMA correctly identifies quarter ends as well as full year ends as liquidity pressure points. This is partly because banks reduce their exposure at the end of each reporting period to make their balance sheets seem healthier. More consistent policies would deliver fewer market surprises.

Outright abuses of repo markets to flatter balance sheet reporting, as practised by Lehman Brothers before its failure, are no longer standard, but skill in managing exposure over quarter and year ends is still valued by big banks. The sport of trying to pick off junior traders at rival banks and funds who are not familiar with the way prices spike at year or quarter end is also still popular with dealing veterans.

ICMA acknowledged that its banking pitch is a bit of a stretch. “While such refinements to the regulatory capital framework are beyond the gift of the ECB, it may be something where its support and guidance could be helpful,” it said, in a tone that was oleaginous enough to supply its own liquidity.

Supervisory scepticism may be warranted.