For James Gifford, the jump from building push-email programmes for Australian climate activists and sitting in Geneva framing the United Nations’ Principles for Responsible Investment (PRI) was surprisingly short.

Jump to

These days, Gifford is head of sustainable & impact advisory and thought leadership at Credit Suisse in Zurich. But rewind to 2003, and you find a driven and ideological twenty-something academic with time on his hands before he kicks off a five-year economics PhD at the University of Sydney.

Instead of killing that time with leisure, he wrote to the United Nations Environment Programme Finance Initiative (UNEP FI). “I said I would love to do an internship, and that I had some ideas I’d like to contribute.”

They responded with a ‘sure, fine with us’, and so a few days later he pitched up in Geneva and got to work as an unpaid intern.

It changed his life – and in so many ways, ours too.

Gifford happened to be present at a moment when the pendulum of history swung just enough to make his decisions and actions matter. It wasn’t pure luck. He describes himself as being “really passionate about forests” since his teenage years.

A failed attempt at being a professional musician led circuitously to working for the Wilderness Society, which shot to fame in the 1980s when it protested – successfully – the damming of Tasmania’s Franklin river.

He built a programme that enabled members to email their member of parliament, to complain about anything from land drainage to primary logging.

And it was about this time that he spotted a key dislocation in how capital is owned and how it is used.

I knew that if capital just behaved in the way its ultimate owners wanted it to behave, this could be a revolution. I still believe that

James Gifford

Gifford saw that most Australians supported forestry conservation. But he also knew all the country’s adults invested in superannuation funds that allocated capital to, among many other interests, industrial loggers.

“I thought – wow, if only people knew about this, they would insist their shares be voted in a way that reflected the way they saw the world.”

And he adds: “I knew that if capital just behaved in the way its ultimate owners wanted it to behave, this could be a revolution. I still believe that. I could see that a huge amount of capital was owned by people who really do care.”

Gifford calls it his “light-bulb moment”: a realisation that there was a way to put institutional capital to work in ways that could help us and our planet to heal.

But back to Geneva.

When Gifford arrived at the Francophone Swiss city, he found himself working for Paul Clements-Hunt, a voluble Brit hired three years earlier by the United Nations to run its fledgling UNEP FI programme.

At the time, along with every multilateral institution, the UN was trying to wrap its head around the myriad impacts and effects of climate change.

Ethical investing

A key challenge was how to engage with the likes of global pension funds. Back then, ethical investing was largely an exclusionary process. Some pioneering funds, mostly US-based, set out to actively remove ‘unethical’ firms and funds from portfolios.

But most institutional investors chose to ignore factors relating to what we now call environmental, social and corporate governance (ESG). It just wasn’t part of the conversation.

This was a big quandary: how to convince fund managers, to not just take sustainability seriously, but to view it as central to their entire mandate.

As soon as he was settled, Gifford sat down to discuss this seemingly intractable issue with Clements-Hunt – a man he describes as “a visionary” – and other senior members of what was then a tiny and obscure arm of the United Nations.

Gordon Hagart, a Cambridge-educated geologist who worked in London for the investment bank Greenhill before joining the public sector, was in the room that day. So was Philip Walker, now an executive at Swiss impact investment firm Obviam.

Others in attendance never left the United Nations fold. Ken Maguire is currently head of administration at UNEP in Geneva, while Yuki Yasui is head of regional coordination for Asia at UNEP FI in Bangkok.

Gifford’s suggested course of action echoed his past work with the Wilderness Society. He proposed creating a framework – a set of core principles, that in time became the PRI, and which institutional investors could really engage with.

He remembers: “We were looking at ways to engage with pension funds. “I said: ‘Why not develop a set of principles where we focus the ownership power of the world’s largest pension funds on UN norms and principles – how can that not make sense?’.”

Clements-Hunt could see the merit of this approach. Rather than issuing a list of ‘bad’ firms to avoid – thus risking being depicted as rabidly ideological on issues that many investors didn’t understand or even viewed with active distaste – it could shift the conversation away from personal ethics and toward material issues.

“James was brilliant,” he says. “He came across as hyper-intelligent, and his attitude was: ‘Essentially, we need to engage the long-term owners of financial assets. So, our focus has to be: How do we go about doing that’?”

Clear purpose

From that day on, UNEP FI had a clear purpose. It would build a bridge between, on the one hand freewheeling capital markets, and on the other, the corset-tight arena of multilaterals, with its love of hierarchy and procedure.

In the process, it would form a new language that made sense to practitioners of both and frame the six core PRI principles. These values, still in use today, are more relevant, powerful and influential than ever.

It was now that events began to snowball.

On a personal level, Gifford’s foresight secured him a salaried position at UNEP FI. When he left the institution in 2013, his title was PRI founding executive director.

He was also tasked with supervising a project that was little more than a thought-bubble idea, through to what the team hoped it would become (indeed, what it is today): a coherent set of rules that help incorporate ESG issues into investment decision-making across asset classes.

Over the next two years, the team walked a tightrope as it sought to convince everyone from global asset managers to senior UN leaders to back the plan.

It wasn’t easy, and it took a lot of hard work, proper outside-the-envelope thinking and blind luck to get it done. On the way, there were steps forward and setbacks, and a diplomatic dust-up to boot.

The first key moment came in June 2004, with the publication of two reports: one titled ‘The materiality of social, environmental and corporate governance issues to equity pricing’, and the other, in rather snappier terms, ‘Who cares wins’.

Both leant heavily on willing private-sector sources. Clements-Hunt’s team co-opted ten sell-side brokers at banks including ABN AMRO, Deutsche Bank and Goldman Sachs, who were willing to work for a good cause for free.

They were told to look out for sustainability-related factors that analysts, consciously or not, ignored when they ran the rule over corporate or financial institutions.

If these front-line financial detectives weren’t properly gauging the deleterious effect of negative ESG factors (such as a bad human-rights or environmental record), institutional investors had little reason to trim their holdings of a given company, let alone to exclude it from a portfolio.

The long-term aim was simple enough. Ethical investing had a glaring blind spot. Its believers, while ardent, were a fraction of the whole. The team had to convince more institutional investors to embrace ESG until sustainability was mainstream.

Gifford remembers how engaged the sell-side brokers were when they reported in; “They came back and said: ‘When we looked, we found stuff that’s really interesting from an investment perspective and that we hadn’t thought about before, and nobody is writing about’.”

For his part, Clements-Hunt helped the process by extracting more than 1,100 pages of data and research from a clutch of investment banks, which the team sprinkled liberally across its first batch of reports.

It was just what they needed. When meeting with institutional investors, they now wielded real feedback couched in terminology the financial industry understood.

Carrot and stick

For the first time, analysts could in material terms start to forensically audit how well – how ‘sustainably’ – a given firm performed versus its peers and, over time, against an ever-growing universe of stocks and other assets.

In its discussions with leading asset managers, the team used a mix of carrot and stick to get their argument across.

“We said: ‘Sure, discard these factors if they are not material, but you have an obligation to look more deeply at ESG issues, because the world is changing fast and some are relevant,” notes Gifford. “If you only rely on backward-facing factors and things like earnings momentum, you aren’t going to capture the full picture” of a company’s valuation.

And they depicted what would become the six founding PRI principles as positive and affirming: ideals to which to aspire.

People recognized the vulnerability of society and that helped the climate conversation. There has been far more interest in climate solutions post-Covid than before

James Gifford

This ‘get more bees with honey’ strategy worked. “We told investors: ‘Instead of shrinking your universe, expand your data set,” Gifford adds. “What happened is that [institutional investors] wound up investing in more sustainable companies once they saw that ESG issues could be material.”

He adds: “When investing is driven not by ethics but by sound financial analysis, the net result is still a more sustainable portfolio, but with a stronger financial foundations.”

Of course, this was very early days. Even the language that now defines and frames sustainability was only just taking shape.

For proof of that, think of ‘ESG’. Today, we take the acronym for granted. Yet it didn’t make its formal entrance until the release of UNEP FI’s 2004 report – the ‘materiality’ one with the long-winded title.

Even then, as eagle-eyed readers will spot, the ‘S’ is placed before the ‘E’, with the ‘G’ trailing in last.

The team soon dismissed ‘SEG’, on the basis that ‘social’ investing was, for many, still a nebulous concept. Corporate governance was then elevated to the top of the class – but ‘GES’ didn’t feel right either.

Finally, they settled on ‘ESG’, with Clements-Hunt leaning on his years of experience working at ‘red top’ British tabloid newspapers, including the News of the World and Sunday People. “ESG was just so much more catchy,” he says.

Culture clash

All was going swimmingly when the rug was nearly pulled from under the team’s feet.

During a tempestuous meeting in Boston in January 2006, a cultural prise de bec broke out, pitting UK and US firms against French fund managers. The issue was the context of the use of the word ‘social’ in the PRI’s founding charter.

“For more capitalist Anglo-Saxon investors, it had connotations of ‘socialism’, while the French, who have a far more relaxed attitude to the social ownership of money, were quite happy with it as it was,” explains Clements-Hunt.

“We had the principles nailed down, and suddenly the session got very heated. We had a time-out and then came back to the table, but two and a half years of hard work could have gone up in smoke.”

But it didn’t. Three months later, on April 26, UN chief Annan rang the opening bell at the New York Stock Exchange. In doing so, he launched a global programme that encourages fund managers to weigh the environmental and social impact of their investment decisions.

It was a staggeringly good piece of brand positioning. Most of the UNEP FI team were in New York that day, including Gifford, who dreamed up the PRI principles in a grey Geneva office, what must have seemed a lifetime ago.

Even then, they were barred from sharing the stage with Annan, though a “furious” Clements-Hunt says he “managed to squeeze onto the balcony and stand under the American flag, breaking all sorts of stock exchange rules”.

This eclectic group of ESG champions stared out at the trading pit, awaiting the response of some of the planet’s most hard-bitten capitalists. “We didn’t know if they would boo [Annan], but they couldn’t have been nicer,” he says.

Chain of events

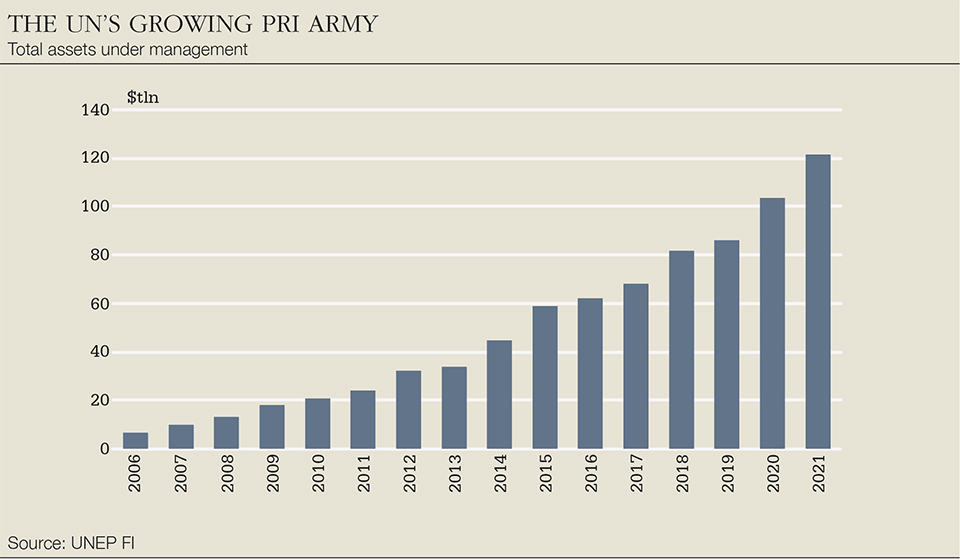

As the old proverb has it, mighty oaks grow from little acorns. When Annan rang the bell that day, the PRI boasted 63 signatories overseeing assets worth $6.5 trillion. In 2021, the respective numbers are 3,826 signatories with $121.3 trillion in collective assets under management.

These days, a 90-strong PRI team, mostly based in London, publish reports and dish out awards. There is an annual membership fee, and every participant is benchmarked against its peers, with mandatory annual assessment and reporting.

Its influence only continues to grow. Investigative sell-side analysts now busily root out potential ESG risks for clients. Nine years after the PRI principles were officially unveiled, the United Nations published its 17 sustainable development goals.

Gifford and Clements-Hunt are humble souls, but both admit there is a chain of events at work here. With the PRI principles in place, it was easier to secure approval on the far more systemically comprehensive SDGs.

Today, Clements-Hunt divides his time between the UK and Kenya, where he runs The Blended Capital Group, an impact advisory firm with offices in Cape Town and Melbourne. They do some policy work, but the focus is on small frontier-market firms that have great sustainable ideas but struggle for funding, he says.

Gifford’s personal journey has been as complex and convoluted as the development of ESG itself.

After leaving UNEP FI in 2013, he taught at Harvard Kennedy School, before alighting in Switzerland. He spent over two years as head of impact investing in UBS Wealth Management’s chief investment office, before being snagged by rival Credit Suisse.

He gently declines the opportunity to trumpet his achievements. The Principles for Responsible Investment may have originally been his big idea, but he was part of a wider team that together invented and promoted the concept of ESG.

He describes himself as a technology optimist but seems amazed at how far impact and sustainable investing has come.

“For me to reflect 20 years ago that big banks like Credit Suisse would be putting money to work in venture capital funds investing in new battery technologies, nuclear fusion, plant-based meats, this is really cool,” he says.

Asked to highlight a handful of sectors set to be deluged with investment capital as Covid wanes, he points to financial and education technology. Credit Suisse helped Owl Ventures to raise $585 million across two new funds in September 2020; the San Francisco-based EdTech specialist has since asked Gifford to be an advisor.

And in May 2021, the Swiss bank closed its Climate Innovation Fund, a $318 million facility that will invest in disruptive technologies that radically cut carbon emissions.

He also highlights utility-scale battery storage systems, which offers a future in which we can store renewable energy for 150 hours or longer. Gifford describes it as a “complete game-changer”, adding: “If we can cut utility-scale storage costs by 80%-90%, suddenly the entire renewable energy industry can become base-load power.”

In early September, California-based Energy Vault announced plans to go public via a merger with special-purpose acquisition company Novus Capital Corp II. The deal should value the gravity-based energy-storage firm at around $1.6 billion.

With a note of pleasant surprise, Gifford points to the level of investor engagement in all areas of climate finances since the pandemic nearly overwhelmed the world.

“There was a huge interest in climate change investment even after Covid hit,” he observes. “I thought investor interest in non-health impact solutions would decline, but the opposite happened. People recognised the vulnerability of society and that helped the climate conversation. There has been far more interest in climate solutions post-Covid than before.”

ESG is a journey we are all on together. If all goes well, we will never reach the destination, as over time it will become integral to everything we do.

For the intense yet amiable Gifford, it’s a highly personal adventure: one that began when he realised he’d never make it as a rock star, and instead reached out to a group of free-thinking officials in a then-obscure European arm of the United Nations.

Hopping aboard a flight to Geneva that day in 2003 changed his life – and ours too.

Getting the money on board

UNEP FI’s reports were backed by a slew of big lenders: 20 – from Banco do Brasil to Westpac – endorsed ‘Who cares wins’.

It would take much more, however, to convince global asset and fund managers to get on board. Most saw the primary role of listed institutions as maximising profits and shareholder returns in any way possible – so long as they weren’t breaking the law.

This cohort shared a belief that non-financial factors should not be considered when making investment decisions. This rested, rather bizarrely, on a 1985 English court case that pitted the controversial union leader Arthur Scargill against the trustees of the UK’s National Coal Board.

For decades, a self-servingly narrow interpretation of the Judge’s ruling, by fund managers, ensured that ESG factors were overlooked or wilfully ignored by virtually the entire financial services industry.

But the world was changing, and in October 2005, a team of lawyers at Freshfields, led by Professor Paul Watchman, published a UNEP FI-backed report that ripped this argument to shreds.

“Paul put his neck out,” remembers Paul Clements-Hunt. “He spent $3 million of Freshfields’ pro bono budget on the report. His team [of 25 lawyers] argued that fiduciary law adjusts to prevailing policy, so as sustainability gets more important, there is a greater need for investment decision makers to consider ESG factors.”

There was pushback from some conservative elements in fund management, but the die was cast. Watchman’s report continues to make waves today. It is believed to be the most downloaded report ever published by the United Nations.

The fight for respectability continued. Some roadblocks were internal. Kofi Annan championed a global compact on human rights, labour and the environment in 1999. Even so, it took nearly a year of badgering to secure a typed letterhead bearing the UN secretary-general’s name and title.

With that in place, it was easier to get global asset managers to the table. Clements-Hunt describes it as a “trigger” moment in the development of the PRI. He points to good work done by UN Global Compact founding director Georg Kell, and Gavin Power, a former senior UN official and current head of sustainable development at Pimco. Both were instrumental in convincing Annan to sign up.

Also key to the process were Carlos Joly, a Cambridge academic and advisor to Natixis Asset Management, and Vincent Zeller, a former chief investment officer at Groupama Asset Management. The pair chaired a working group that assiduously lobbied asset managers, convincing them to put their name to the PRI principles.