|

John Cryan, Deutsche Bank’s co-chief executive, may have the toughest job in banking today. He has to restructure a very large and complicated bank with no cash cow division providing a cushion of steady earnings and generating capital to fall back on.

Making the job even tougher, the investment bank that his predecessors built and that still dominates the group is exactly the wrong sort of investment bank for today’s heavily regulated markets. This is the business on which, over the 20 years leading up to the financial crisis, Deutsche grew from a fading European commercial bank into a global giant. The still unfolding regulatory response to the financial crisis has set out to crush precisely the Deutsche Bank model of investment banking.

One former senior Deutsche executive says: “Everything was built with a derivatives mind-set: retain ultimate flexibility, offer your private and business clients bespoke solutions, not realizing that you would soon need an army of compliance and operations staff to stick with that model.”

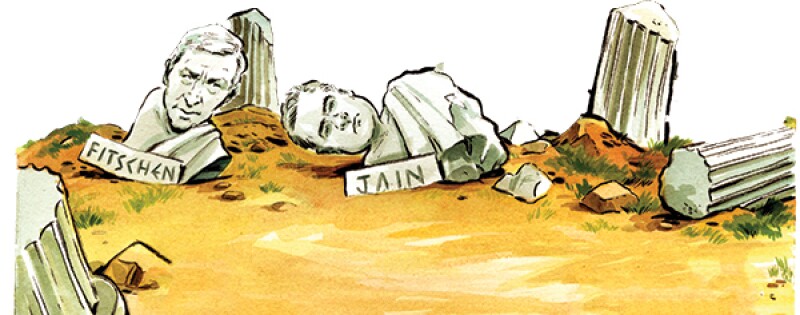

Cryan’s predecessor Anshu Jain, who he replaced nine months ago, gambled that as others got out, Deutsche Bank could both grow market share and benefit from fatter margins. He resisted voices on his own board urging him to cut back until he was forced out.

Cryan cannot pare back as far in investment banking as others have, notably UBS, because that is the bank’s core business. But he has to build a new model of an investment bank.

Many of Deutsche’s rivals have already slimmed investment banking down and relied on other businesses to cushion the cost of disposing of redundant staff and redundant risk-weighted assets. At UBS the business is wealth management; UK retail banking and credit cards at Barclays; retail at BNP Paribas; global transaction banking at Citi. Deutsche’s base is more troublesome.

“In Deutsche Bank’s case, its core business is investment banking, which represents 50% of equity, 75% of leverage assets and 50% of profits,” points out James Chappell, analyst at Berenberg. “However, investment banking is in structural decline.”

The panic about Deutsche Bank last month that saw its stock price collapse, its AT1 bonds fall to 70% of face value, its CDS spreads widen to crisis-era highs and its senior bonds trade at a discount, is a distraction, albeit a painful one.

Deutsche is not going to miss its AT1 coupons, nor is it going to breach its AT1 capital triggers any time soon. It could buy back its entire stock of outstanding senior debt out of liquid reserves if it chose to.

Its short-term prospects are fine: it is the medium- and long-term outlook that investors should be worrying about. And the most worrying aspect of Deutsche’s results announcement at the end of January was the severe drop-off in underlying investment banking revenues in the last two quarters. At a time when it needs its core business to produce profit and generate the capital buffer to shrink its balance sheet, the trajectory suggests that revenues might fall faster than costs, producing not profits but losses that eat into capital.

Here is where Deutsche’s biggest problem lies. Not only is Deutsche the last big bank to begin restructuring its investment bank; not only is the type of investment bank it had built – a leader in many trading segments and a top six or seven capital markets firm – the wrong type for today’s regulation; it is not clear what Deutsche Bank should aim to be. The only thing that is clear is that cannot continue as it is.

Restructuring

Jain and his team had built the plain-vanilla flow-monster capability in rates and foreign exchange that might yet sustain it in future, but at its heart Deutsche Bank was a derivatives-focused, principal trading firm: a hedge fund in essence, which also had many other US and UK hedge funds as its core institutional client base.

|

A senior executive at the firm tells Euromoney: “If a real-money client came to Deutsche Bank wanting to sell a block of shares, the typical Deutsche response would be to bid for those shares as principal, take them on balance sheet, hedge them, manage the delta and work the position out over a long period. It’s the derivatives and principal trading mentality, aiming for a big pay-off. Its instinct would not be to cross that block against countervailing customer orders and take a quick and easy agency commission. But that is what market businesses today are all about.”

Cryan has to do more than carefully dismantle the bank’s old investment bank without torching its balance sheet. That is hard enough. But he also has to build a new core business for Deutsche on modest foundations, with limited capital, while long-ignored IT problems mount in the back office and the threat of big fines for past misdoings is ever-present.

It was telling on the 2015 results call in January that Cryan discussed the bank’s caution and historically low levels of market risk at the end of last year. With a capacity to run daily value at risk of €70 million, Deutsche had been running under €30 million, less than half its capacity, across the fourth quarter. In a world where prop trading has been curtailed, this suggests that Deutsche has more capacity to accommodate customer risk than it has customers willing to transact with it.

That is not being cautious amid low volatility for reasons of prudent risk management. That is a business on the edge. Even as Deutsche cuts back, it must now hire the equity sales and research staff to give it this capability to do more customer business. Given the uncertainties about the bank’s own vision for its future business model and low morale, that is a tough ask.

Cryan has set out to ditch the obvious fixed-income businesses that the capital and funding charges of today’s regulatory environment make uneconomic. Deutsche has announced that it has already exited or will exit: market making in uncleared CDS; trading of high risk-weight securitizations; agency RMBS; and even plain-vanilla swaps with other dealers that are not cleared.

It will cut back from emerging markets and especially from trading and brokerage in domestic securities with local customers.

|

But there is no playbook for this kind of restructuring. Is he throwing the baby out with the bath water? It may appear rational to exit flow credit. Deutsche was much smaller in that business than in structured credit. And the associated funding and capital charges make running illiquid investment-grade bond positions to support customer orders a tough business to make money from.

But the move still surprised the market. If the end goal for Cryan is to build some kind of relationship-driven commercial bank with a capital markets capability to service a smaller group of key European clients, then it will be tough to pitch for their DCM business against rival US and European firms that have stayed the course in flow credit.

Focus on execution

Cryan has deliberately set out to talk less grandiloquently and less often than his predecessors – including Jürgen Fitschen, currently his co-CEO and who steps down this year – about the bank’s strategy. Asked at the annual press conference that followed confirmation of dire results for 2015 to explain his vision he shrugged. “We are a bank. We are a regulated entity. We don’t have much latitude in what we do. We’ve organized in four divisions. We think they all work well together, they have a logic in being together.”

Is that it? Is the aim simply to be more narrowly focused, more efficient, better run?

Cryan talks warmly in internal notices about the quality of people at the bank and their loyalty. He may need to practise more inspiring oratory to enthuse them.

And there’s another problem that Cryan must tackle. Jain and his first boss at Deutsche Bank, Edson Mitchell, built up their derivatives-focused, principal-trading powerhouse almost as outcasts inside the bank. They had to prove themselves quickly and decisively to the sceptical German commercial bankers. To do so, they were hell bent on attracting new customers, devising new products and, most important of all, bringing in big revenues.

|

Under Anshu Jain: “Everything was built with a derivatives mind-set: retain ultimate flexibility, offer your private and business clients bespoke solutions, not realizing that you would soon need an army of compliance and operations staff to stick with that model” |

The group developed a culture that never evolved. And back-office processing capability could not keep pace with front-office innovation. “If we had a cost problem, the answer was always to grow revenues,” says one source.

Deutsche insiders tell Euromoney that those business builders are now criticized internally for having run the division for 20 years like a start-up, even after it had grown to completely dominate the Deutsche Bank group.

Cryan’s task now is to do the deeply unsexy operational management side much better.

“We built brilliant systems, like Autobahn, fantastic pricing capability, but the back office was rather botched together with tin boxes and string,” this source tells Euromoney. “A lot of IT people were retained on contract to come in and do manual reconciliation to the general ledger.”

Little-known outside the banking industry, Cryan’s standing within it is such that almost none of his peers question the new chief executive’s ability to stick to the plan and restructure Deutsche Bank.

A former UBS colleague assures Euromoney: “Not only is John very smart, clear thinking and determined, even more importantly he is absolutely straight, honourable and honest.”

It is perhaps characteristic of the man that while Deutsche’s bankers, like most bankers, have traditionally boasted about their wonderful front-office technology, Cryan has come clean about the awful muddle of its legacy IT systems and dependence on end-of-life software in the back office. And that honesty translates to financial reporting. He has taken accounting write-downs to reflect these inadequacies – as he also has against the goodwill from acquisitions dating back to the 1990s. Rather like Jamie Dimon did at Banc One, Cryan has set about the more unglamorous aspects of restructuring: reducing the number of IT operating platforms, automating manual processes to boost efficiency and risk control, at the same time culling the committees and internal bureaucracy that slowed decision-making and blunted personal accountability.

Well-intentioned though Cryan’s determination is to focus on execution rather than on strategizing, at the moment when the morale of the bank’s staff is close to rock bottom, there is a big unanswered question hanging over the bank.

Even if it does get through the next two years without another huge fine or another big loss, even if it manages to work through the restructuring, simplify the bank, get out of the bad markets, cut costs, what then?

This is a bank that has always had a strong identity, albeit wrapped in a complex history. It still trades on its image as the house bank for Germany Inc, although the days when its ties to the country’s leading companies were cemented by strategic cross-shareholdings are long gone. Then, for the past decade or more, the bank’s leaders promoted Deutsche as Europe’s answer to Goldman Sachs: the non-US bank of choice for any global client.

|

But what is Deutsche Bank for now? It has been happy to publish target cost/income and capital ratios out to 2018, but not the mix of revenues it expects different divisions eventually to contribute or the expected allocations of group equity or share of group RWAs between them.

Is there a vision for this that might spark an internal revolt? Or is the vision still only half-formed?

Rivals scent blood. US investment banks are – almost in a re-run of the early 1990s – using the profits from their high-margin oligopoly at home to win out globally in investment banking. European rivals are suddenly ready to pounce as well. The head of investment banking at a leading European competitor to Deutsche Bank tells Euromoney: “The biggest change for me came in the second half of last year, when German corporates actively began to engage with us in a way they hadn’t before. Deutsche has lost that cachet of being the bank you had to deal with if you were a big German client. Some clients almost express shame at the state the bank finds itself in.”

There is a feeling in certain quarters in Germany, especially among public-sector financiers, that the bank that bears the country’s name long ago sold its soul to the Anglo-Saxon locusts that have ruined it.

For years, while it appeared to thrive in global investment banking, Deutsche benefited from borrowing at close to government spreads. One former chairman tells Euromoney of a business trip abroad to meet foreign clients and being ushered in to see finance ministers that mistook Deutsche Bank for the Bundesbank.

Now, it is almost the opposite. Some traders were jumping at shadows in February of the risk of contingent liability for Deutsche Bank pricing into German government bund spreads.

|

The bank’s position in its home market is a strange one, as indeed is the view of banking among Germans as a whole. Euromoney has spoken to chief executives of large private German banks that still keep their personal accounts with the local savings banks in their hometowns. Banking in Germany has traditionally been seen as a social function, or deemed a profession for foreigners. But because Deutsche was the only German bank of global significance and the bank for its largest and most successful international corporates – while Commerzbank was the hausbank for Mittelstand companies – Deutsche was deemed to be special. It attracted a reverence that it probably did not deserve.

That aura is fading now and fading quite fast.

A C-suite executive at another large European bank tells Euromoney: “I think for many years up to the crisis its German clients could always tell themselves that Deutsche Bank was the Mercedes-Benz S-Class of European banking. It’s now dawning on them that it may be more the Volkswagen Polo.”

Last year at its German capital markets conference in Berlin, Euromoney asked a room full of German borrowers and investors if they were not embarrassed that an economy of their size boasted just one global systemically important bank, and that (Deutsche, of course) a bank that only just fitted that category. From maybe 300 people only a couple of hands went up, belonging to treasurers of frequent German bond issuers.

Vision for Deutsche Bank

Soft-spoken and with a subtle British sense of humour that his new domestic audience does not always pick up on, Cryan may need to take a lesson or two in how to bullshit.

At the analyst call on January 28, he almost audibly shifted tone as he went from the tell-it-like-it-is for the analysts to the give-the-troops-something-to-cheer-about closing section. “The core strength is Deutsche Bank’s brand and client engagement that continues to be extremely… strong. I have been very impressed with the depth of client relationship,” Cryan said.

|

He has said this so often in internal dispatches that he clearly believes it. But later, during the gruelling two-and-a-half hour annual press conference that always follows the full-year results, Cryan let slip his worry that: “The Deutsche Bank brand isn’t resonating with clients quite so readily.”

The bank does have a strong global transaction bank and, while Cryan remains unwilling to, or incapable of, publicly articulating his vision for the bank, it seems likely this will be at the heart of its future. The bank is genuinely good at trade finance, payments and associated transaction services. And this was true from Deutsche Bank’s foundation in the 1870s when the families behind Siemens and certain other large German industrial companies grew sick of seeking trade credit from bankers in London and Paris and capitalized a bank of their own.

Even in the past 20 years the bank’s single biggest markets trading success was in foreign exchange, a business that, initially at least, grew out of those relationships with German and European companies, based on handling their payments and trade-finance flows.

Deutsche Bank now must define a simpler model for the whole group: around fewer products, in fewer countries, serving far fewer clients, and it has to maintain the discipline to standardize around them. But in 2015, global transaction banking pulled in €4.6 billion out of the Deutsche Bank group’s more than €33 billion in revenues. A lot has to go desperately wrong for GTB to dominate its results.

Deutsche Bank wants to grow transaction banking and asset management, in which it is strong in no-growth Europe, by picking up market share in the US and Asia, where competition is fiercest. Its whole future in the US remains an open question.

|

Jeff Urwin will run a new, expanded corporate finance division that includes transaction banking |

The corporate finance businesses will in future sit alongside global transaction banking in a new corporate and investment banking division, run by Jeff Urwin, recruited from JPMorgan last year.

Debt and equity sales and trading will be separated out into their own global markets division, now looking rather orphaned. Is this an effort to make transaction banking look bigger and so attract a premium valuation on to that division’s earnings?

A lot of bank changes to divisional and segmental reporting amount to little more than re-applying lipstick on the pig. These divisions will have many separate business P&Ls below them. Does it even make sense to separate market trading from corporate finance? The capital markets businesses will just have to re-form as the old joint ventures of years past. Global transaction banking might well be the glue that binds the Deutsche relationship with a corporate client, but transaction bankers will not help the corporate financiers to run that ECM or M&A advisory deal quite as well as the salesmen who cover the equity and debt investor accounts.

Deutsche Bank is, once again, declaring its intention to hire M&A bankers. M&A advisory is a lousy business on a cost/income basis, but at least it is light on capital. The decision to hire once again in this area indicates, perhaps, a certain lack of confidence in a vision for Deutsche’s core business as a pure commercial banking, transaction banking and capital markets provider to corporate clients. Hope springs eternal that banks that provide those services also have a shot at marquee advisory deals and that M&A capability has some kind of multiplier effect. But this is an old debate. Deutsche seemed to be getting there years ago under Anshu Jain and Michael Cohrs. It looks to be gearing up to fight once again over ground repeatedly hard won in the past and then easily lost.

Cryan is right to dismantle the derivates-focused principal risk-taking investment bank that Deutsche built up over the past 20 years. Is he trying to go back to the commercial banking model of the 1980s? Wouldn’t it be better to build a bank for the future, one with far more technologists and fewer traders?

High cost of litigation

While Cryan grapples with all this behind the scenes, there are two additional areas for investors to worry about beyond high restructuring costs and weak earnings. These are the extent of potential fines and legal costs from any more skeletons in Deutsche Bank’s rather crowded closet; and the possibility of worse than expected damage to the bank’s balance sheet if the global economy deteriorates.

Deutsche Bank increased litigation reserves to €5.5 billion at the end of last year, with a further €2.2 billion held against other contingent liabilities. Further charges are inevitable this year. And while the bank hopes they will not be as big as they were for 2015, the recent experience of European banks shows this is rather hard to predict.

Analysts see potential for large settlement costs still to come relating to US residential mortgage-backed securities – on which Goldman Sachs paid a higher-than-expected settlement of $5 billion in January – and possibly to foreign exchange markets. Credit Suisse estimates that while the bank has reserved €5.5 billion, it might face another €5.5 million in costs to settle these and other market-manipulation and misrepresentation cases.

The big unknown remains the investigation into so-called mirror trades: off-setting buy and sell transactions for wealthy Russian clients simultaneously conducted in Moscow and outside the country, a practice that went on for at least four years and comprised many billions of dollars’ worth of transactions.

There is a limit to what anyone will say about the investigation but Cryan has taken it very seriously. At the end of January he reminded journalists at Deutsche Bank’s annual press conference: “We have closed our markets business in Russia and off-boarded a large number of clients.” Deutsche is in wholesale retreat from what it now classes as 10 high-risk countries – the high risk being to its own liability for failed compliance on anti-money laundering and know-your-customer regulations. Cryan says the bank is in the process of closing “hundreds of thousands of customer accounts”.

What will the final bill be? All banks claim to follow accounting requirements to reserve in accordance with best estimates of likely costs, but they all invariably manage to underestimate the size of payouts that eventually come due.

It is not even clear to what extent the Bank of Russia is still taking the lead on the investigation into mirror trades and to what extent US regulators are looking at possible sanctions breaches. The European bank analyst team at Barclays led by Jeremy Sigee suggests that most of the provisions for litigation Deutsche now carries relate to US RMBS trades and to Russia. “From the timing and language of P&L charges booked so far, it appears that the €5.5 billion might include around €3 billion for RMBS and €1 billion to €2 billion for Russia,” say the Barclays analysts, adding that, “these provisions may be sufficient.”

The unquantifiable risk, of course, is that instead of a charge in the order of the $1.9 billion HSBC took for handling the money for Mexican drug cartels, or the $1 billion Standard Chartered paid, Deutsche Bank may end up being hit for closer to the €9.6 billion BNP Paribas swallowed for breaking sanctions on Iran.

In that case, all bets are off.

|

A price-to-book valuation of 0.4, which Deutsche touched after it announced 2015 losses, implies the market expects it to make no better than a 7% return on tangible equity. Fine perhaps for the tough years of a restructuring, but not a sustainable business model to present to shareholders.

When a bank’s share price falls further and values it at under 0.36 times tangible book value per share, as Deutsche’s did in mid-February, it raises the question of whether or not investors have gone beyond concern about its earnings prospects and capital position. Have they simply lost faith in its reported numbers?

The bank has begun to take adjustments to intangible items such as goodwill on previous acquisitions, leading some insiders to admit, not for attribution, that the bank may have been a little slow to make such revaluations in the past. This raises questions about the valuation of more tangible items, such as the financial assets on Deutsche Bank’s balance sheet.

In 2014, Deutsche had one of the lower proportions among big European banks of more reliable level 1 assets, which are mainly valued in line with executable market quotes, comprising just 13% of those financial instruments measured at fair value (rather than at amortized cost) on its balance sheet. There are banks with much higher percentages of the most open-to-question level 3 assets. Deutsche had just 3% of level 3 assets. But it has a very high percentage of level 2 assets, comprising 84% of all its fair value assets, and for which valuations may be calculated using observable inputs rather than actual market quotes.

Adding it all up, analysts at Citi have concluded that if it should turn out that all large European banks might have managed to overestimate by 1% the value of their level 2 assets and by 10% the value of their level 3s, Deutsche Bank would rank as the most exposed in terms of the sensitivity of its shareholders’ equity to such an adjustment.

To be fair, it is an arbitrary test. And the Citi analysts also had some good news for investors worrying about Deutsche’s leverage ratio. “The 2014 data also confirms our view that Deutsche Bank has the highest level of collateralization, which means that the balance sheet is probably somewhat less risky than suggested by its absolute size.”

This has long been the bank’s own contention: that it has been punished for running a large balance sheet even though this was a low-risk one thanks to the good quality of assets and the hedging of exposures. But with a balance sheet still coming in at a hefty €2 trillion and a market cap of closer to €20 billion, Deutsche’s balance sheet leverage remains far higher than the levels Lehman Brothers was running before its demise. It is a sobering thought.

The bank’s contention that it runs a low-risk and well-hedged balance sheet came into question following the loss in 2008 arising from correlation trading on capital structure arbitrage. And with subsequent investigations into potential mis-reporting of derivatives exposures, a suspicion has always lingered that Deutsche Bank somehow blagged its way through the financial crisis without taking bigger mark-to-market hits at the worst moments, even if those trades eventually came right somehow.

A question of capital

It is against this background of uncertainty over its earnings, its potential contingent liabilities and its balance sheet that Cryan must now force through his restructuring of the bank.

Cryan is already finding, as other CEOs have before him, that as a bank cuts costs, revenues disappear and there is no neat and linear improvement in the cost/income ratio. Deutsche Bank is determined to get risk-weighted assets down, but weak earnings in its core operating business and poor capital generation do not give it much capacity to take the hit of dumping assets at a big loss. It can deleverage and shed high capital-consuming assets that at least earn revenue, but almost as fast as it does so, regulators hit it with higher operational RWAs in recognition of past regulatory and compliance failures.

|

Seven months into a five-year plan, with the two toughest years ahead, and Deutsche appears to be running full speed only to stand still.

It needs to get that common equity tier-1 capital ratio up to 12.5% in 2018, just to be marginally above the 12.25% demanded by regulators. That would leave it with a much thinner buffer than most banks aim to work with. Today it stands at 11.1%, and it may be down to close to 10.5% by the time Deutsche Bank next reports first quarter 2016 earnings.

Deutsche wants to reshape the retail bank by IPOing or selling Postbank, improving the leverage ratio and deconsolidating €40 billion of RWAs in one shot. Deutsche Bank shareholders should not hold their breath as equity prices, particularly those of European banks, collapse. The deal, originally set for this year, might happen next.

The financial markets will no doubt be pressing around Deutsche Bank again before long. Even after two poor quarters in a row, Cryan has suggested that 2016 could yet be the peak year of the bank’s restructuring, when its financials are hardest hit. It would seem optimistic to predict that Deutsche can break even for 2016.

With a weak leverage ratio, a tough path to a middling CET1 target, large business disposals delayed, the core business not generating much in the way of earnings to retain and the market for asset disposals illiquid and unwelcoming, the obvious question is about capital.

Cryan has risked a lot of credibility on executing the restructuring without tapping shareholders again. He has to caveat the promise: “Absent the fully unexpected and material external event,” pause for breath, “we see no need to raise capital at this stage and continue to think we can manage our risks with the capacity we have at hand.”

It is not a promise that many analysts are putting much faith in. Most see the timing and size as the only questions worth debating.

As soon as Deutsche pre-announced its 2015 loss, Andrew Coombes, banks analyst at Citi declared: “We believe a capital increase now looks inevitable and see an equity shortfall of up to €7 billion, on the basis that Deutsche may be forced to book another €3 billion to €4 billion of litigation charges in 2016.”

Now would not be a good time to do it. Raising €7 billion would amount to 38% of Deutsche Bank’s market capitalization as at mid-February: no wonder Cryan does not want talk of potential further supply to overhang the already weak share price.

If he gets through without raising capital, then he really will have broken with Deutsche’s troubled recent past. But before that, even if just to assure the troops that the tough restructuring ahead is a battle worth fighting, Cryan may need to more fully articulate what sunny destination this all leads to.