Even before the coronavirus pandemic, the case for bank digitalization as a business strategy was unassailable. But during the crisis those digital strategies have also proved to have a more important and immediate impact on customers and society. Hybrid branch/web models, mobile and voice banking, services based on AI and biometrics, and broader digital transformation have ensured customers retain access to the financial tools and information they need regardless of their location. They have also physically protected customers and employees.

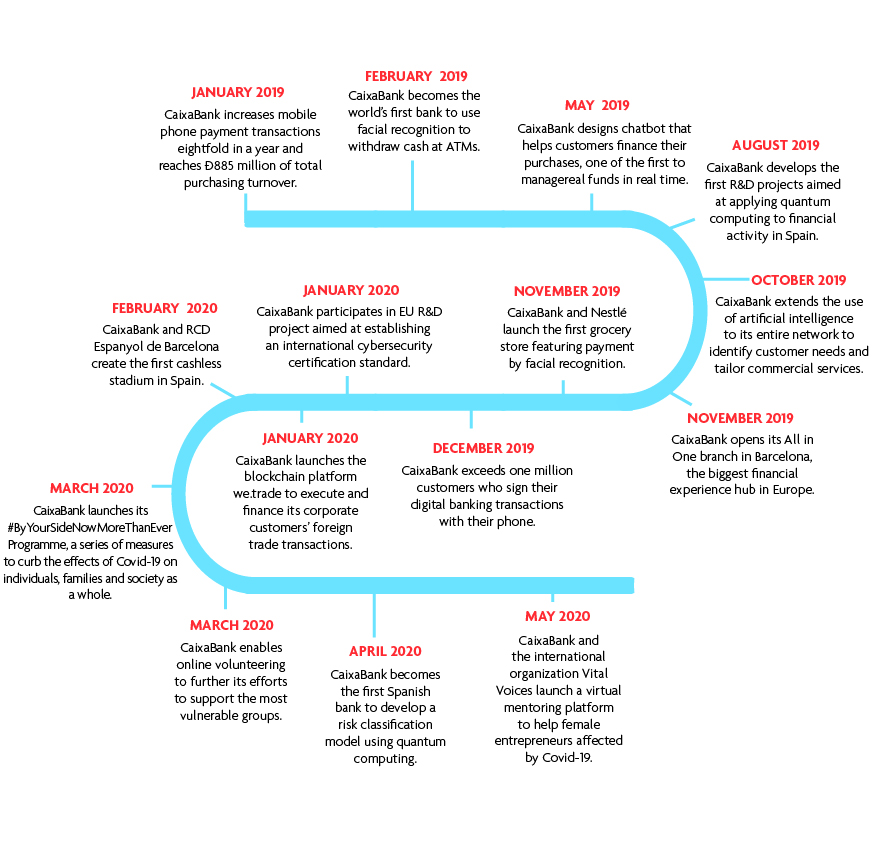

Take Spain’s top retail bank, CaixaBank. In 2019, the bank’s investments in the development and implementation of these digital technologies totalled €931million. But this was just the latest iteration of a long-standing digital strategy that has put the bank in a position to join health authorities and the wider public administration in preparing a quick response to those most affected by the Covid-19 outbreak:

• To minimize face-to-face visits to branches, digital services and ATM capabilities were further enhanced so that customers could manage their finances online through CaixaBankNow. The use of CaixaBankNow increased by 25% in the first quarter of 2020, and visits to branches were reduced by 75%.

• To help the elderly minimize their attendance at branches, AI analysis detected the services most used by them in-branch, prompting the launch of new online services specific to seniors.

• To help small retailers forced to close physical shops, CaixaBank launched Social Commerce, an e-commerce solution operating via social networks and messaging applications.

• To protect employees’ health, 50% of all branch network employees and almost 95% of employees in central services were working remotely during the lockdown, all while keeping the bank fully operational, with 90% of the branch network open.

Driven by the customer

CaixaBank’s ability to pivot so quickly to digital solutions was founded on an early shift from a traditional product-centric strategy to one that focuses on customer experience. In recent years, CaixaBank has consistently rolled out high-tech, smart banking products and services – based on sentiment analysis, customer behaviour pattern analytics, artificial intelligence and the use of sophisticated data analytics to tailor each step of the customer journey to the individual user and to remain prepared for the ever-changing demands of its customers.

At the same time, the bank has evolved its physical branch network, crucial for financial inclusion, to adopt a new hybrid distribution model that combines larger, more value-added ‘Store’ branches and 24/7 online products and services – CaixaBankNow, imaginBank (mobile-only bank), and other social media-based services.

Pioneering the latest technologies

The prompt adoption of the latest technologies will also be key both to delivering a constant stream of product and service improvements tailored to customer needs and to ensuring significant improvements in operational efficiency and productivity. CaixaBank is at the forefront of:

• AI and robotics: these will be needed to improve remote assistance and enhance the effectiveness of digital channels. CaixaBank chatbots can help customers manage their finances, answer FAQs, tell them what purchases they have made in the last week and which ones they can finance instantly. One model can even offer suggestions on the best ways for customers to make their credit payments, making it one of the first chatbots to manage real funds in real time.

• Biometrics: these typically enhance security and efficiency but are now also improving customer safety. In 2019, CaixaBank became the world’s first bank to use facial recognition as a PIN substitute to withdraw cash at ATMs; and months later, CaixaBank, Nestlé Market and the Payment Innovation Hub launched the first facial recognition payment system in a business in Spain, allowing customers to pay without the need for any physical contact, a great advantage in times of social distancing.

• Quantum banking: digital transformation will require more computational power, and quantum computing may be one of the answers. This year, CaixaBank became the first bank in Spain – and one of the first in the world – to incorporate quantum computing into its services, with the development of a machine-learning algorithm to classify customers according to their credit risk.

Delivering for customers, society and stakeholders

These innovative technology solutions are first and foremost a response to customers’ continued demands for sophisticated but easy-to-use, on-demand banking services and financial products. However, these same innovations increase revenues, productivity and efficiency across the entire bank; they empower and inform employees and allow them to serve customers better; and, as we have seen recently, they are the foundations of organizational resilience – they enable the bank to remain operational, to play its role as a key part of critical national infrastructure and to help maintain the global integrity of the financial system.

CaixaBank’s key innovation and digitalization facts and figures in 2019/2020