A new chief executive of HSBC stands up to speak to investors.

He’s a tough nut, a ‘lifer’ who has long coveted the top job at one of the few institutions to emerge from the global financial crisis in decent shape as a true universal lender. Now, finally, he is here, and he has things to say.

HSBC’s goal, he tells the audience in, in words that echo so many of his predecessors, is to be a “leading international bank”.

The bank’s return on tangible equity has to be far higher, while capital must be allocated in a “hard-nosed disciplined way”. In Asia, he points to three priority markets: India, greater China and Hong Kong, a city he once called home and which generates so much of the group’s profits.

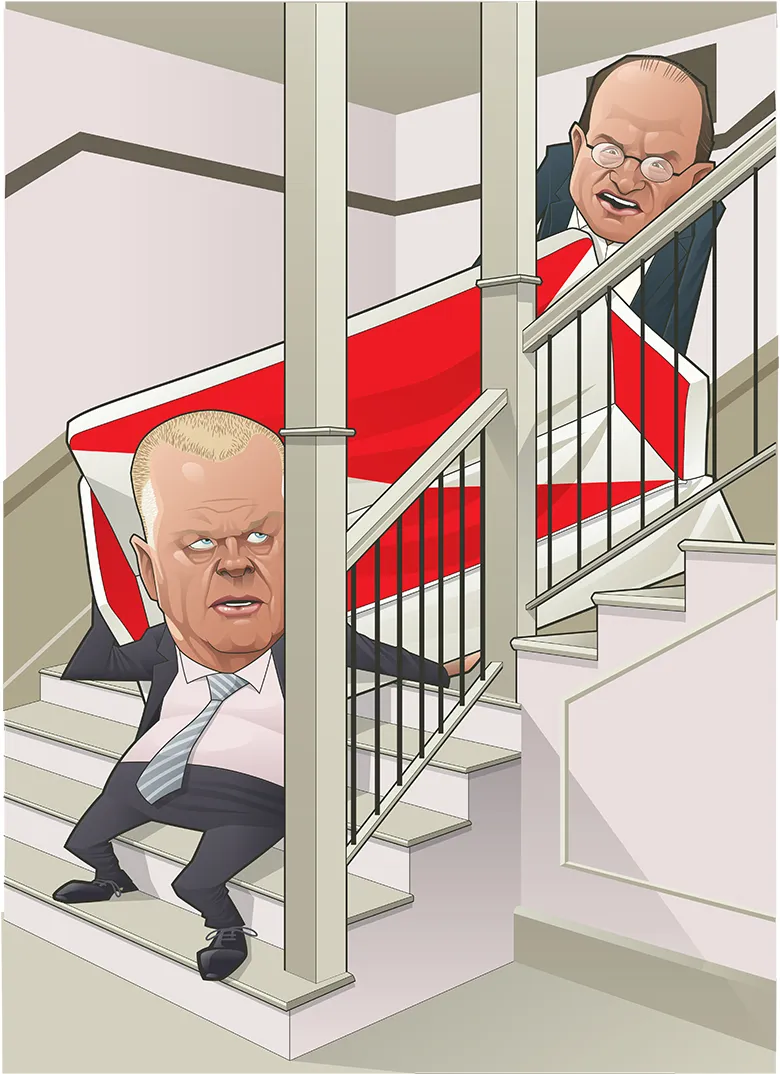

This isn’t Noel Quinn, whose appointment as permanent chief executive of HSBC was announced on March 17 by chairman Mark Tucker, after months of prevarication. These are the words of Stuart Gulliver, another respected HSBC lifer, speaking to investors in London in May 2011, four months after he succeeded Stephen Green.

Gulliver, an old Asia hand, could and probably should have been HSBC’s saviour. He rose through the ranks to transform its Asian markets business. From his office in Hong Kong, he turned a once stodgy mid-market lender into an investment banking contender.

|

|

|

Stuart Gulliver: without the lost years, HSBC could have done so much more during his leadership |

Under his aegis, HSBC largely flourished. He reshaped the bank, diverting capital to Asia and shedding assets – notably selling its stake in Chinese insurer Ping An, despite promising that day in 2011 that none of its strategic mainland assets were for sale.

Perhaps his greatest challenge was one foisted on him by the shortcomings of his predecessors. In December 2012, HSBC admitted to anti-money laundering and sanctions violations.

The ensuing US Department of Justice investigation dragged on for years, during which $8 billion of the bank’s capital was trapped in the US.

The DoJ finally dismissed criminal charges. HSBC paid a $101.5 million penalty relating to its manipulation of FX markets, then a $192 million penalty settled by its private bank in Switzerland over charges of tax evasion, to go with its earlier fine of $1.9 billion.

Another three-year deferred prosecution agreement with the DoJ expires in January 2021. But for Europe’s largest lender, the worst is pretty much over.

What it cannot get back is those lost years. Without the sword of Damocles hanging over its head, the bank could have done so much more under Gulliver. During the mid 2010s, plans to make the bank seamless in Asia, boost market connectivity and enable it to profit from burgeoning trade flows between China and southeast Asia, and India and East Asia, were too often stymied.

An HSBC insider remembers the red tape the DoJ’s appointees jammed into the system, gumming it up just as it was trying to strip away layers of bureaucracy.

“The level of KYC [know-your-customer] and due diligence during those years was significant for us, in that it got pretty extreme at times.

“Say a big US firm wanted to expand in a new Asian market. It might already be in Hong Kong and Singapore, but on-boarding it in Malaysia or Indonesia could be a nightmare,” one that required the signatures of executives up the chain of command. “It was a drag on connectivity.”

Certainly, the problem was one of the bank’s own making. Gulliver was personally dragged into the DoJ probe and accused of sheltering millions of dollars of income in Panama. But arguably his greatest achievement as chief executive was to strengthen the lax controls and corporate governance that led to all the investigations, fines and strategy delays in the first place.

Now, following the short-lived tenure of Gulliver’s successor, John Flint, and a period of uncertainty with Quinn as interim chief executive, HSBC has a second chance. It can revisit and perfect an idea that started under Gulliver but never quite got going.

It can follow it through this time and make it work. Or so it hopes.

Sweeping scope

In February 2020 the bank unveiled its latest strategy plan, sweeping in scope and simple in message.

It aims to cut gross risk-weighted assets by more than $100 billion by 2022, to slash adjusted costs by $31 billion over the same period and to get returns on tangible equity into the 10% to 12% range, up from 8.4% in 2019. Some of the savings will come from cutting 35,000 jobs, or 15% of the workforce.

Asia will be the focal point of its efforts, along with the Middle East. More than $100 billion in RWAs will be redeployed to faster-growing (principally Asian) markets and assets, from Europe and the US, in order to deliver stronger growth and to winkle out gains in transaction banking and wealth management. It promises that a “simpler, more efficient and empowered” operating structure will emerge.

HSBC will retain its presence in the likes of the UK, the US, Canada and Mexico, and a scattering of richer European countries. But it will skew faster and harder toward Asia, described by Gulliver in 2011 as the bank’s “most important region”, and as its “heartland”, “heritage” and “history”.

Quinn also spent time in Hong Kong, as regional head of the commercial bank, dealing mostly with corporate clients with turnover of less than $1 billion.

So can HSBC get this long-term swing toward Asia done? Yes, but four main challenges stand in its way.

|

|

|

Noel Quinn: HSBC’s new CEO is respected across the bank |

Challenge number one is Hong Kong. The city where the Hongkong and Shanghai Bank first opened its doors in 1865 is hardly a problem market – quite the opposite. It accounted for more than 90% of group profit of $13.35 billion in 2019, a number skewed by losses at its commercial banking and European investment banking businesses.

It is a landmark institution that locals still refer to instinctively as ‘Hongkong Bank’ and it has proven capable of reacting nimbly when threatened.

PayMe, its local mobile payments service, has been a success, and in November 2019 it dropped its monthly charge on holders of deposit accounts, in part to preempt any challenge from a slew of new digital lenders.

But the sheer weight of its presence can be seen as a weakness as well as a strength.

Hong Kong will remain a dominant generator of revenues and profit at group and regional level for years to come. Yet there is little doubt the events of 2019, when Hong Kong was riven by months of riots, forcing HSBC to shutter branches, weigh on staff.

At the time of writing, the iconic lion sculptures that guard the entrance to its local HQ are still shielded from view, after being sprayed with paint by protestors.

No sooner was that put to one side than coronavirus burst on to the scene, a nasty reminder of the Sars epidemic of 2003. Covid-19 has spread faster and farther than its predecessor, and the $600 million that HSBC pledged in February to set aside to deal with the business fallout, will surely rise.

Many of its staffers in Hong Kong and around Asia are working from home, and on March 5 it was forced to evacuate part of its offices in London’s Canary Wharf, after an analyst contracted the virus.

“It isn’t always great to be so dependent on one market,” says a Hong Kong insider, noting that the riots are likely to resume when Covid-19 ebbs. “That threat has only been allayed for now. I believe it will return.”

Hard grind

The second challenge IS China.

HSBC has bet big on the mainland, steadily opening branches in first-tier cities such as Beijing and Shanghai, and across the southern Greater Bay Area, encompassing Hong Kong, Shenzhen, Macau and Guangzhou.

In 2017 it became the first foreign bank to secure approval to own a majority stake in an onshore broking joint venture, HSBC Qianhai Securities.

This March it said it would merge its wealth management and retail banking divisions. At the heart of its plan is tapping into China’s vast reserves of wealth, both onshore and offshore. It aims to triple its roster of mainland billionaire clients over the next three years.

China’s current contribution in terms of profits and balance sheet weight is limited. However, it is strategically important for the bank’s future growth – Sonny Hsu, Moody’s Investors Service

HSBC’s wealth division has $1.4 trillion in assets under management, nearly half of which is sequestered in Asia.

But after decades of hard grind, HSBC remains little more than a bit player in Asia’s largest economy. Part of the reason for that is Beijing’s long reluctance to open the door faster to foreign banks, despite pledging to do so in 2001, when it joined the World Trade Organization.

By any measure, HSBC is a third-tier operator onshore behind the big state banks and an army of smaller city and rural lenders. It reckons it has less than one half of 1% of the market.

At the end of 2019, 3.4% of all customer deposits managed by HSBC were held in mainland China, against 29% in the UK and 35% in Hong Kong.

“China’s current contribution in terms of profits and balance sheet weight is limited,” says Sonny Hsu, senior credit officer for financial institutions group at Moody’s Investors Service. “However, it is strategically important for the bank’s future growth.”

|

|

|

Mark Tucker prevaricated for months before making Noel Quinn CEO |

Questions also remain over the bank’s local set up. It has no fewer than four chief executives, one for each of Hong Kong, Macau, mainland China and, depending on your definition of greater China, Taiwan.

A fifth, Helen Wong, quit as chief executive of HSBC Greater China in August 2019, the same week as the exit of Flint, to join a former employer, Singapore’s OCBC Bank. Her umbrella role, insiders said, is likely to be eliminated.

But China is a long-term play and HSBC is determined to transform it into one of its most fertile markets. The bank abounds with China experts, including the unflappable Asia Pacific chief executive Peter Wong, who at the ripe age of 68 is likely to step down soon, and Tucker, who spent a decade running Prudential’s Asia business before joining insurer AIA in 2010 and overseeing its $17 billion Hong Kong listing.

Sooner or later HSBC has to deliver in China and in a big way. It has no other choice. The decision to go big on wealth management is the right one, given that its mainland client list includes wealthy families as well as well-run private firms, many of which it serves out of Hong Kong.

But China’s decision in January 2020 to allow foreign investment banks to own up to 100% of onshore businesses from April ups the stakes.

It will be competing onshore with every big foreign name desperate to profit from China’s vast personal wealth. It can succeed, but it has to move fast and smart.

Diversification

The next challenge is diversification. Beyond greater China, HSBC just doesn’t pull in enough business in Asia. Hong Kong accounted for 65% of Asia-wide profit of $18.47 billion in 2019. Mainland China’s share of that total was 15.6%, with its third largest market, India, posting a profit of $1 billion, for a 5.4% share.

After that, the numbers fall away sharply. Just 2.6% of its Asian profits were generated in Singapore last year. That share falls to 2.4% for Australia, 1.9% for Malaysia and 1.2% for Indonesia. Considering HSBC has had a presence in Singapore since 1877 and in Malaysia since 1884, more could have been expected by now.

Certainly, all these markets are tough nuts to crack.

“India and Indonesia both have strong local incumbents,” says Moody’s Hsu. “HSBC has a decent business in Singapore; in Taiwan it’s mostly wealth management serving high net-worth individuals; and in Australia, it has small local market share but makes decent revenue contribution for the group. Malaysia is OK, profitability OK, without a big market share.”

In a conference call to investors after the bank’s full-year 2019 figures were announced, Quinn pointed to three core growth engines for Asia: “China generally, the Greater Bay Area in particular, and across southeast Asia”.

It is a laudable ambition, but one that must for now surely be made more in hope than expectation.

“We are doing well in India,” says a source. “Also in China, but we’re just a grain of sand there. Vietnam, Indonesia, the Philippines – these are countries where there is a lot of potential in areas like wealth management. But there’s no denying that we underinvested in southeast Asia for a few years. I would like to see additional investment and growth there.”

India will need more attention too, given it is on track to be the world’s largest consumer market within 20 years.

Scale doesn’t have to mean everything, everywhere.

When the threat from Covid-19 wanes, we are likely to reenter a world with more borders, not fewer. If anything, more countries are sure to pull up the drawbridge: how this will affect a bank like HSBC, which operates in multiple markets and regions, and profits from the proliferation of seamless regional and global trade, remains to be seen.

We’ve always been the nice bank, the guys who don’t fight over every scrap, every cent in every dollar. Our returns in this part of the world have always been OK, but they have to be better if we are going to be a leader – HSBC banker

A likely narrative in the early 2020s will involve a surge in outward investment from China, as mainland corporates look to build factories and supply chains in southeast Asia.

That’s the kind of outcome that could well help HSBC, reinforcing the logic of having a presence in cities from Jakarta to Kuala Lumpur to Ho Chi Minh City.

The coming recession could reinforce rather than weaken HSBC’s regional status and strength. If Asia bounces back faster than the West, a reasonable expectation is to see some US and European banks beat at least a partial retreat to core markets. As they do so, they will likely cross paths with HSBC as it continues its gravitational shift eastward.

Hence the need for HSBC to show some extra love to markets like Singapore (the financial heart of southeast Asia), Malaysia (decent growth, good multinationals), and Indonesia and Vietnam (low-cost, good demographics, set to benefit from the outward sweep of China).

According to data from the CIA World Factbook, four of China’s five largest trade partners in 2019 were Asian countries, including Vietnam and South Korea.

Financial bridge

The fourth and final challenge facing HSBC in Asia is making it all fit together.

This is easier said than done. With the exception of its global markets business, the bank has often seemed less a centrally run financial institution than a loose connection of parts, one where, sniffs one insider, “local fiefdoms” including those in Asia, “have been allowed to flourish”.

HSBC has worked hard to paint a picture of itself as a financial bridge between India and Singapore, Indonesia and east Asia, and China and pretty much everywhere.

In Mukhtar Hussain, it has a well-respected figure overseeing its approach to China’s Belt and Road Initiative and to the need to keep trade flowing along regional business corridors.

But, notes one insider, “you will struggle to find anyone in HSBC who believes they have cracked the [business corridors] thing.”

For HBSC to be able to say its decision to redeploy assets and capital to the region has been a success, several things must happen.

|

|

|

John Flint: his time in charge was short lived |

First, it needs good clients with the right attitude. If its ambition is to boost returns on risk-adjusted capital by making more from the capital it deploys and feeds into RWA calculations, it has to drop its less-profitable clients, including some that have been with it for a long time.

“We’ve had serial underperformers [on our books] for years,” says one well-connected corporate banker. “Clients who are just in one country or in one product or who just use our balance sheet. They won’t get us to where we need to be.”

The challenge is exacerbated by the fact that risk “is greater even now than it was three or four months ago,” says the banker. “Even if we do nothing right now with our portfolio, there will be a migration of risk, simply because coronavirus has made our clients more risky.”

That means telling clients that HSBC has to be a favoured financial provider, not simply one of the herd.

“It means quid pro quo,” says an insider.

If HSBC deploys its balance sheet, say to help a firm based in Jakarta, it needs to know the client won’t squeeze it on fees or leave it fighting over scraps when it sells additional equity or prints a bond and puts HSBC on the underwriting ticket, fighting over a fee pool of $150,000 alongside a half-dozen other local and foreign firms.

Another insider adds: “We’ve always been the nice bank, the guys who don’t fight over every scrap, every cent in every dollar. Our returns in this part of the world have always been OK, but they have to be better if we are going to be a leader – and if as a bank we are going to be a leader anywhere, it has to be here.

“All clients will have to give us a larger share of their wallet.”

Customers see us as bullet-proof, particularly during bear markets. That’s why we often come out of crises in a stronger position – HSBC banker

That may happen. Crises tend to work that way. After the events of 2008 to 2009, many Western banks left Asia behind. The same happened in the wake of the Asian financial crisis a decade earlier, when some regional lenders withdrew to their home market to lick their clients’ wounds.

“Customers see us as bullet-proof, particularly during bear markets,” says one HSBC banker. “That’s why we often come out of crises in a stronger position” than our rivals.

HSBC would never say it and it is hard to justify thinking of a silver lining while the world combats Covid-19, but in truth this isn’t the worst time to redeploy capital to Asia, despite its problems.

It’s not the right decision at the right time, so much as the right decision at this particular time.

Potential

Questions remain. Can HSBC make a good fist of it in China? Will the India division live up to its obvious potential?

Given that southeast Asia’s three largest economies together made up just 5.6% of its pan-Asian profit in 2019, will that region ever be more than a link in the chain, allowing it to extend banking services to firms from the US, Britain, Germany, China and the UAE?

China will always loom large in this equation. Hong Kong apart, it’s hard to think of another market in Asia where it can be a powerhouse. It has the brand (including the ‘Shanghai’ in its name), the reputation and the commitment not just to itself in China but to helping Beijing to professionalize its banking system and create fully working onshore capital markets.

No other foreign bank has more than its 149 branches and sub-branches. It was the first foreign bank to issue bonds in the China Interbank Market (CIBM), in 2015, and the first lender to facilitate a T+3 trade in the CIBM in August 2019.

Even as coronavirus spread in January 2020, it completed the first interest-rate swap by a foreign investor using the CIBM’s counterparty clearing model.

Perhaps the biggest long-term question is one that HSBC has wrestled with ever since it moved its primary listing to London in 1991: is it an Asian bank or a Western bank?

If the answer is the former, then surely its primary listing should be in Hong Kong, the city in which it was born and which still does so much to keep it financially nourished.

It’s a question that’s raised every few years. The last time it was in 2016 when the bank opted to stay in Britain after a 10-month review.

That decision was aided by the UK government’s willingness to halve its levy on banks’ global balance sheets and to apply it only to the onshore assets of British lenders.

The reason HSBC won’t move its primary listing from London to Hong Kong, despite the importance of its Asian business and the fact that its largest single shareholder is the Chinese insurer Ping An, has nothing to do with finance and everything to do with politics.

Simply put, HSBC cannot afford to be seen as a ‘Chinese bank’ by a US government hostile to Beijing.

An additional complication is America’s willingness to weaponize the US dollar against anyone or anything it doesn’t like. No institution, least of all an international bank such as HSBC, can afford to be locked out of the global financial system.

Under its newly permanent chief executive, a man respected across the bank, HSBC now has a clear-minded plan in place, which will see it build on the never-completed strategies of the past.

Reallocating capital, assets and risk to Asia won’t be easy – it will dent performance in the short-term, against the backdrop of a looming recession and a worsening pandemic. But as long as the region bounces back faster than the West, there are few universal lenders better placed than HSBC.