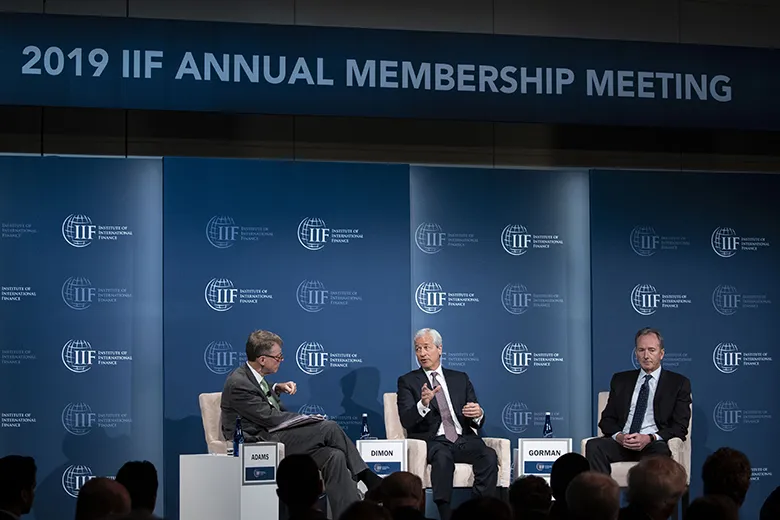

The Friday lunchtime US bank chief executive chat is the star turn at the Washington DC meetings of the Institute of International Finance (IIF). This year the October 18 event was pared down to its essentials: the double act of JPMorgan’s Jamie Dimon and Morgan Stanley’s James Gorman.

It started promisingly. Gorman sounded mildly startled by the opening music.

“Is that the Magnificent Seven?” he asked. “We’re a few short here!”

That was a taste of things to come.

Access intelligence that drives action

To unlock this research, enter your email to log in or enquire about access