“For the ordinary African, Brexit is pretty much irrelevant,” says Diane Karusisi, chief executive of Bank of Kigali in an interview with Euromoney Africa.

|

|

|

Diane Karusisi, |

But bankers and people in business across the continent have been thinking hard about Brexit in the year or so since the referendum and while they may disagree over what form Brexit is likely to take, many expect the UK’s split from the European Union to create business opportunities.

Once Britain leaves the union, it will have no trade agreements either with individual African countries or with regional African blocs, as British trade had been governed by EU law. That gives Africa an opportunity to renegotiate the terms of its partnership with the UK. Brexit may also, some say, embolden Africa to negotiate fairer trade terms with what remains of the EU.

Criticism

Trade terms struck between Africa and foreign parties, including Europe, have come in for criticism. Hippolyte Fofack, chief economist at Afreximbank, says he is no fan of the Economic Partnership Agreements (EPAs) that the EU wants to sign with regional groups in Africa. “The moment Brexit happened, I felt that actually it would provide an entry point to renegotiate the EPAs,” he says.

The EPAs require both parties to open their markets: while this may benefit African economies to some extent, European exporters are likely to be the biggest winners as they could stifle or crush young industries on the continent. The EU has already signed such a deal with six countries of the Southern African Development Community; another, with the East African Community, is in the doldrums.

Many in Africa hope that countries in the region will be able to strike new, more advantageous deals after the clean slate for trade terms with the UK and an EU weakened by the loss of one of its largest economies.

We have to understand the ideology behind Brexit. This is happening under a very conservative government. The Labour party is more liberal towards Africa, historically – Osita Ogbu, University of Nigeria

All of those Euromoney Africa interviewed agree that such a development would require Africans to speak as one. Fofack believes that can be achieved thanks to the African Free Trade Zone, which is an agreement to create a single continental market for goods and services, with free movement of businesspeople and investment, by the end of this year. That could, at least in theory, unify Africa’s disparate parties into one body for negotiations with the EU and the UK.

But not everyone agrees with that strategy. At a panel on Brexit and Africa put together by Afreximbank at its annual general meeting in June and July, Kiprono Kittony, Kenya’s representative at the East African Chamber of Commerce, Industry and Agriculture, argued that bilateral negotiations could yield better results for certain countries. In his view, Kenya would be better placed to negotiate on its own or as part of an east African bloc because of its close ties to the UK, than if it were a small part of a pan-African endeavour. Still, he agrees with the basic premise that trade renegotiations will take place and will deliver positive results for African economies and banks.

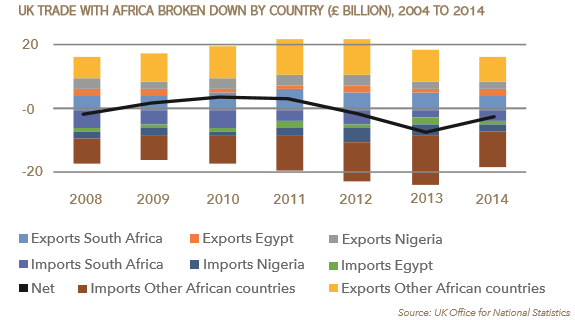

UK trade with Africa in recent years has amounted to between £35 billion and £45 billion ($45 billion to $58 billion) each year, often with a trade surplus for the continent. Egypt, Nigeria and South Africa are the UK’s main trading partners.

Negotiations

Osita Ogbu, professor of economics at the University of Nigeria, says Africa should strike deals as widely as possible and conduct simultaneous negotiations with the EU, China and India.

But Brexit has risks too. According to Ogbu, the effects on Africa will depend on what ideas end up driving the implementation of Brexit, since a ‘Britain first’ approach would leave little room for a good trade deal.

|

“We have to understand the ideology behind Brexit,” he says. “This is happening under a very conservative government. The Labour party is more liberal towards Africa, historically.”

If Brexit leads to curbs on immigration from Africa, remittances flows – an important source of revenue for many economies in Africa – could decline.

Fofack says he is disappointed that, with Britain’s departure from the EU, the country will no longer be able to promote its foreign aid philosophy in the union. “Britain had the capacity to lead the EU in the space of raising foreign aid to 0.7% of GDP,” he says. “They actually enshrined that in the parliament under David Cameron.”

Other EU countries – among them Denmark and the Netherlands – have hit the UN target of spending 0.7% of their GDP on foreign aid, but the UK is by far the biggest economy to have done so, and the first G7 nation to have passed a bill to honour that pledge. “It was a credible champion of that agenda,” Fofack says. Africa is one of the main recipients of foreign aid.

Still, many think that Africa has relied on such aid for too long, as well as on trade with countries outside the continent. Intra-African trade represents just 15% of Africa’s total trade, minuscule in comparison with Europe, where intra-European trade accounts for 60% of the total. Africa’s economies will eventually aim to become more intertwined, rather than continue to depend on the custom of Europe, the US and Asia.

Might the City lose out on African business in future to other financial centres such as Frankfurt as a result of Brexit? “I don’t think so,” says Ogbu. Bank of Kigali’s Karusisi agrees that the UK’s prime position in international finance is unlikely to end any time soon. Her bank is even considering listing in London.