Well that was quick. Last month Euromoney was mulling Goldman’s poor second quarter showing in fixed income and suggesting that the firm would be looking to reprofile it pretty soon. Just weeks later comes news that none other than Harvey Schwartz, ex-CFO and current co-COO, will be speaking at Barclays’ Global Financial Services Conference in New York on September 12.

It’s the 7:30am slot – of course it is, this is Goldman. But it’s likely to be followed intensely: the rumour is that Schwartz will offer some thoughts on how the firm is hoping to sort out its FICC business.

The current CFO, Marty Chavez, has made no secret of how disturbed Goldman is at its recent performance in some areas of the FICC franchise. The division was down 40% year-on-year in the second quarter, and was down 21% in the first half (Morgan Stanley was up 36%). Its commodities business saw its worst quarter ever.

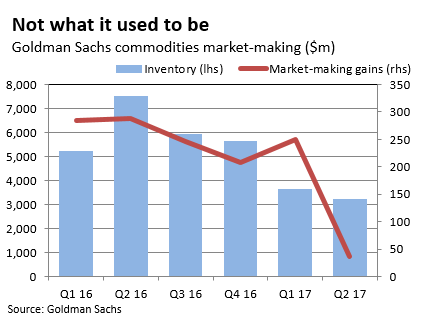

Goldman has been referencing low client activity and tough market-making conditions for a while now, particularly in commodities. A glance at the market-making figures it disclosed in its 10-Q filing in August shows the deterioration in the second quarter (see graph). Market-making gains relating to commodities typically range closely around $250m for Goldman. Last quarter they were just $37m, down 87% from the previous year.

The market-making gains or losses that Goldman reports should not be seen as equivalent to the actual revenues for a particular business line on a managed basis, because they ignore the impact of hedges elsewhere in the division that may offset them.

But they still illustrate the tough conditions, and the extent to which they have hurt Goldman. And taking the actual market-making revenues as booked by the FICC business as a whole (Goldman doesn’t break that out by product) hardly makes life look much better. They were down 46% year-on-year in the second quarter.

Reporting Goldman’s second quarter results, Chavez had spoken more frankly about the business than the firm usually does, conceding that it had not navigated the market as well as it should have done. His comments to analysts hinted that the firm would do well to spend more time courting corporate clients.

Since then he’s held another call with fixed income investors, at which he offered more glimpses of the firm’s thinking – and hints at the kinds of changes to come.

“We know we have coverage gaps and have clients that we are not covering enough,” he said. Filling those gaps was the first order of business, he added. He envisaged an emphasis on asset managers and corporate clients, opportunities to build software platforms for cash services, as well as supporting clients with more financing and more cross-selling into the investment banking business lines.

If that sounds familiar, it could be because the firm has taken a similar approach to other areas of its business before. As Chavez noted, the questions being raised about its FICC franchise now have been asked of its debt capital markets and equities businesses in the past – and have been addressed. Goldman’s increasing willingness to commit capital in intriguing ways was a key factor in Euromoney’s decision to name the firm as the World’s Best Bank for Financing in our Awards for Excellence 2017.

Assuming Schwartz is set to give more concrete details on the strategy beyond reiterating what Chavez has already said, what might those be? It’s widely assumed that the firm has been engaged in some sort of evaluation of the business in the wake of two weak quarters. The result of that might involve taking a different approach to the kinds of bets it is making, particularly in commodities, but one would hardly expect disclosure of any detail on that.

It seems plausible that an effort to broaden the client base will be central to any reprofiling of the business, too. Morgan Stanley turned around its FICC business by slashing headcount by 25%. But there’s little indication that Goldman has the appetite to drastically cut back, even in its commodities business, which continues to be bigger than peers. Quite the opposite: if a reinvigorated client effort is going to be at the heart of any change, hiring might be part of the answer.

What’s clear is that the recent trend of a falling dollar and rising commodity prices isn’t going to be enough to resolve the issue – as Chavez told fixed income investors, outright commodities levels are by no means the only driver of the success of that business at Goldman, and are often not even the major driver. And it’s also true that while prices might be rallying, the general backdrop of low volatility is persisting into the third quarter.

It’ll be good to hear from Schwartz, after Chavez. But it would be good to hear from the man at the top too. Lloyd Blankfein rose to the top of the firm as the FICC business he grew up in, and then ran, became its most profitable franchise. He knows the business intimately. He’s presumably closely involved in fixing FICC. Shouldn’t he also be seen to be fixing it?