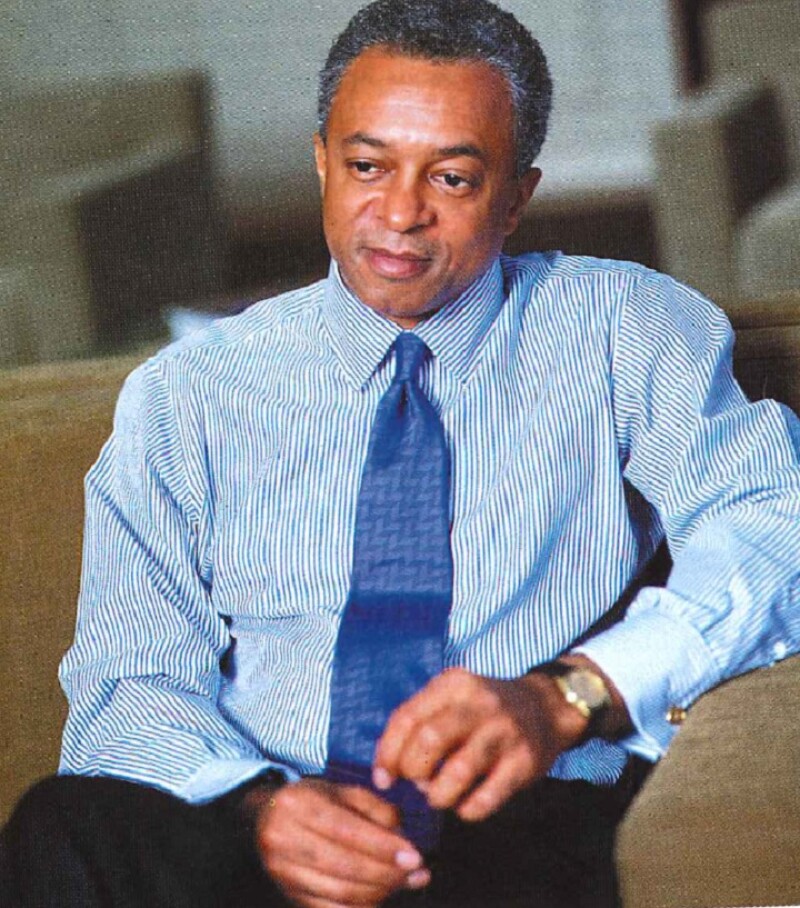

July appears to be Merrill Lynch's preferred month for addressing its CEO succession plans. On July 23 its board voted to promote Stan O'Neal from his position as president of the firm's powerful private-client group to become president and chief operating officer of the whole company, regarded as the final stop before becoming CEO.

Both roles had been left vacant since the board unceremoniously dumped Herb Allison almost two years to the day before O'Neal's appointment. Some observers were concerned back then that getting rid of Allison was yet another in a series of knee-jerk reactions from Merrill following its bond market losses of $1 billion or more in the wake of the Russian crisis in 1998.

Similar concerns are creeping through about O'Neal's appointment. Merrill is wellknown for following studied, long-winded even, succession plans, and the announcement about who would be heir apparent to Komansky, who is due to retire in April 2004, was not due until the autumn at the earliest.

So there is now a search to discover why Komansky suddenly deviated from what was taken to be a rock-solid timetable.