The CEOs and global heads of private banking at some of the world’s largest institutions have revealed to Euromoney they are looking at developed markets, such as the US, UK and some parts of Europe, for growth and expansion.

In a exclusive private-banking debate held by Euromoney, leaders of the industry said that while the exponential growth of emerging markets still hold a key position in their portfolios, many regard developed markets as having potential for growth and opportunities.

“There is no question that emerging markets will have higher growth rates than the developed markets, but the US is still the largest economy in the world and we are optimistic in terms of US growth,” says Tom Kalaris, chief executive at Barclays Wealth. “Whether in investment strategy or business strategy, one needs to have a balance between developed and emerging economies. As far as growth is concerned in the developed economies, we would put the US and then the UK before Europe.”

Furthermore, Pierre de Weck, head of private wealth management at Deutsche Bank, says that while Asia and the Middle East are still essential to their strategy, the bank has continued to expand in the developed markets, despite the eurozone sovereign debt woes.

“Emerging Asia and the Middle East are still key for us,” he says. “But we are also growing strongly in mature markets like Germany, where we have a good market position. We are expanding in the US as well, where we are establishing ourselves as an alternative to the domestic players.”

This week, the International Monetary Fund (IMF) unveiled its World Economic Outlook (WEO) 2012 report, which stated that global growth prospects dimmed and risks sharply escalated during the fourth quarter of 2011, as the "euro-area crisis entered a perilous new phase", which has led them to downwardly revise the global output by 0.75 of a percentage point, relative to the September 2011 WEO. Global output is projected to expand by 3.25% in 2012.

Furthermore, emerging and developing markets have not remained unscathed. According to the IMF's WEO report, "growth in emerging and developing economies slowed more than forecast, possibly due to a greater-than-expected effect of macroeconomic policy tightening or weaker underlying growth".

| (Figure 1) |

|

| Source: IMF and EPFR Global |

"In emerging and developing economies, the near-term focus should be on responding to moderating domestic demand and slowing external demand from advanced economies, while dealing with volatile capital flows," says the IMF in the 2012 WEO report. "The specific conditions facing these economies and the policy room available to them vary widely, and so will the appropriate policy response. In general, inflation pressures have eased, credit growth has peaked, and capital inflows have diminished (Figure 1)."

Furthermore, more private banking CEOs told Euromoney that despite large growth in Asia and emerging economiesduring the past few years, this will slow down, and understanding where the wealth originates from will mean that developed markets need to be core to portfolios.

“Our experts forecast developing economies to grow by 4.7% in 2012, spurred by 8.0% growth in China,” says Juerg Zeltner, chief executive, UBS Wealth Management. “Meanwhile, we expect developed markets to grow by just 1.2%. However, it is important to remember that 60% of global GDP remains in developed markets, and many emerging economies are heavily reliant on global capital and trade flows. This leaves a number of emerging economies and asset markets vulnerable if significant disruption in the developed world sparks capital flight – emerging market foreign exchange was the worst-performing asset class in the third quarter as eurozone worries escalated, for example.”

George Lewis, group head at Royal Bank of Canada Wealth Management, adds: “We are continuing our push in emerging markets, particularly in Asia. That is driven by the growth in wealth there. But developed markets are also key. Retirement opportunities driven by an ageing population in Europe, the US and Canada is a powerful long-term trend.”

Furthermore, the largest amount of emerging market capital outflows since the Lehman Brothers crisis was clocked in the past four months, since September 2011.

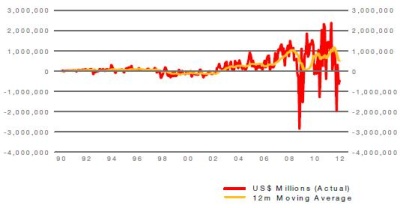

Only last week, CrossBorder Capitalrevealed that $2.75 trillion of cross-border capital (bonds, equities and banking flows) exited emerging markets, in the “biggest concentrated net outflow since the 2007/09 crisis, but without the same disastrous economic outlook (Figure 2)”.

| (Figure 2) |

|

| Source: CrossBorder Capital |

Figure 2 details the net movements of capital flows into emerging markets and are represented by monthly numbers, converted into current US dollars and aggregated from databases covering some 80 economies worldwide.

Eric Lane, global co-head of investment management at Goldman Sachs warns that while the allure growth potential in emerging markets is tantalising for investors, there still needs to be a balance in developed market exposure, which could lead to a plethora of opportunities.

“For investors, it is essential to have exposure to the growth potential of emerging markets,” says Eric Lane, global co-head of investment management at Goldman Sachs. “However, as in anything, over-exuberance can lead to grief, as we have seen in last year’s 20% drop in EM equities in dollar terms. Right now, we believe EM equities are worth looking at as we think they are somewhat undervalued. From the perspective of our business, we have made long-term commitments in growth markets. However, we also see tremendous opportunity in markets such as the US and the UK. It is important to make strategic investments and not be overly sensitive to the kinds of cyclical stresses we are experiencing now. It can cost more to re-enter a market than to stay in.

For more on whether emerging markets are still key for growth, how private banks are dealing with the increased costs/decreased revenues from regulations and many other issues, don’t forget to check the full version of Euromoney’s private-banking debate in the February issue of the magazine.