In an unusual twist, we came across two reports last week that are positive on European banks – particularly surprising is that HSBC notes that international investors are becoming less negative towards Italy and Spain (Not that that says much since it''s coming from a low base...)

| Less negative on Italy and Spain |

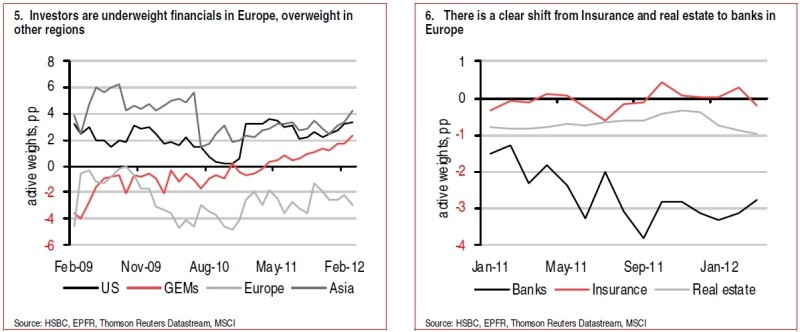

What''''s more, HSBC also notes that while, in aggregate, investors are resolutely underweight European financials, within that sector they are starting to show a trend of favouring banks over other institutions. No, really:

| Positive signals for banks |

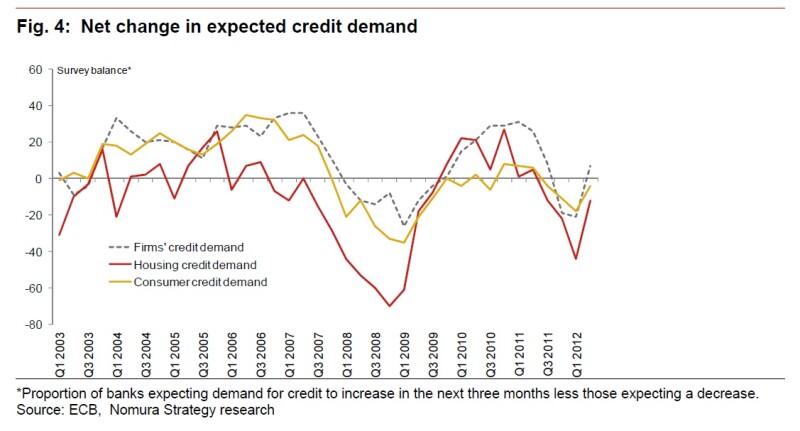

Believe it not, investors may begin to make a slow creep back towards European banks. Adding to the surprising conclusion, Nomura has put out some research suggesting that while lending from banks remains weak, this is due to a lack of credit demand from solvent borrowers that want leverage rather than banks' inability to supply.

| This was the first survey conducted since the LTROs, and is thus important because it shows some evidence of the operations having their desired effect in freeing up the ability of banks to lend. |

But the tide might be turning:

| The other bullish conclusion that could be drawn from the survey is that a majority of loan officers now expect to see an increase in the demand for loans from corporates over the next quarter, a significant change from the contraction expected over the prior two quarters (Figure 4), they do however expect to see further contraction in loan demand from households, albeit at a lower rate. |

At this stage, any crumbs of comfort with respect to European banks are worthy of note.